A Pleasant Surprise You can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of market history! Why is the length of the time period reviewed in the study so important? If you compare investment strategies as a practitioner, you may well look at just the past year, for a simple reason: in day-to-day business, there is pressure to quickly generate short-term profits. If your interest

Topics:

Dimitri Speck considers the following as important: 6) Gold and Austrian Economics, 6b) Austrian Economics, 7) Markets, Featured, newsletter, On Economy, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

A Pleasant SurpriseYou can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of market history! Why is the length of the time period reviewed in the study so important? If you compare investment strategies as a practitioner, you may well look at just the past year, for a simple reason: in day-to-day business, there is pressure to quickly generate short-term profits. If your interest is more academic, you will probably be inclined to consider time periods of several years. 200+ Years Study Provides Conclusive ResultsHowever, every investment strategy has its ups and downs in the short term. Even the best strategy can occasionally underperform and the worst one can take the lead. If you dismiss the objectively best strategy just because it has underperformed over the past year, your investment results are bound to suffer. That is why it is important to examine time series that are as long as possible – it is the best way to identify long-term market drivers. This is exactly what researchers Guido Baltussen and Laurens Swinkels from Erasmus University in Rotterdam together with Robeco analyst Pim van Vliet have recently done in a study (“Global Factor Premiums”, SSRN id 3325720). Some of the data they used date back as far as 1799. Not only did the data cover long time periods, the researchers also looked at a plethora of different time series: they examined 68 markets drawn from four asset classes, namely equities, bonds, currencies and commodities. |

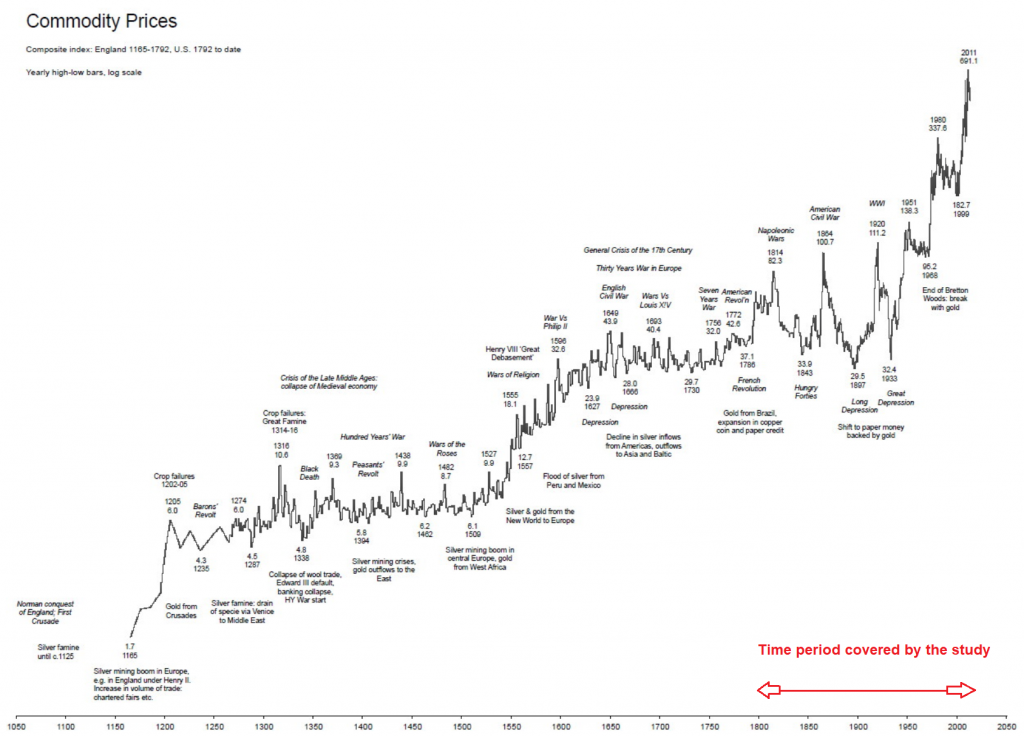

Commodity PricesA little aside to this: Estimates for some commodity prices date as far back as 3000 BC. The oldest price records permitting construction of a price index are from the time of the Babylonian empire, the Middle Kingdom of Egypt and the Minoan civilization (which blossomed during a time of global warming) from approx. 1840 BC to 1620 BC. One of the most intense periods of nominal commodity price inflation occurred in the roughly 130 years following the death of Emperor Severus Alexander in AD 235 (which marked the beginning of the Roman Empire’s “crisis of the third century”) until the reign of Julian the Apostate from 361 AD to 363 AD. Price information after Diocletian’s attempt to impose price controls in 301 AD (“edict on maximum prices”) is too spotty to permit index construction, but it is known that inflation accelerated even more after the edict failed. Rome’s history of monetary debasement started with Nero’s reign from 54 AD – 68 AD – Nero reduced the silver content of the Denarius by 10% to 90%. By the time Diocletian’s edict was promulgated in 301 AD, the silver content of the Denarius was a mere 0.02%. The worst offender among the third century emperors was Aurelian, who in the five years of his reign from 270 AD to 275 AD reduced the coin’s silver content from 50% to just 5%. Not surprisingly, he tried his hand at price controls as well (at least he won the wars he funded through debasing the realm’s coinage). It took until the 20th century and the adoption of a “scientific monetary policy” by central planning agencies for prices to increase almost as rapidly and strongly as in the chaotic third century. [PT] |

Six Popular Strategies Put to the TestIn these markets the authors of the study compare the following investment strategies:

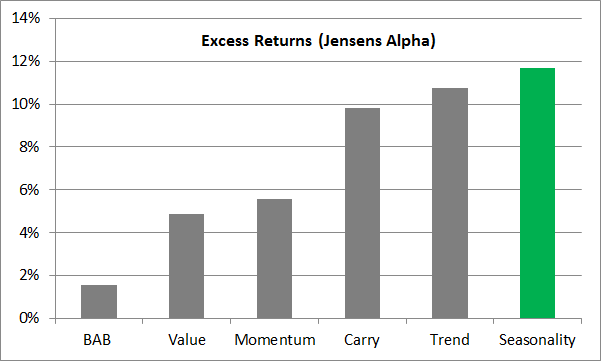

In short, the researchers included the most popular investment strategies in their comprehensive study. Seasonality is the Best Investment Strategy for a Multi-Asset PortfolioBut what was the study’s conclusion? Take a look at the following bar chart. It shows the excess returns (Jensen’s alpha) of the six strategies across all four asset classes (multi-asset) with their 68 individual markets over the entire time period examined. 200+ years study: excess returns of a multi-asset portfolio200+ years study: excess returns of a multi-asset portfolio. Sources: Guido Baltussen, Laurens Swinkels, Pim van Vliet As you can see, an investment strategy based on seasonal trends beats all other strategies! This is all the more remarkable considering that globally very little is actually invested in products that employ seasonality-based strategies. The situation is quite different in e.g. the case of the quite popular value investment strategy: hundreds of billions of US dollars are invested in this strategy – but its returns are trailing far behind. Conclusion: think for yourself rather than following the herd. Take seasonality into account! |

Excess Returns |

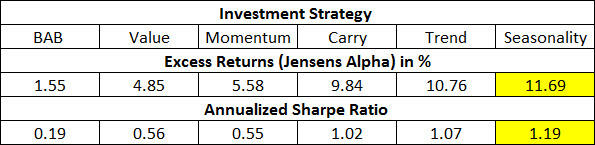

Seasonality Also Leads in Terms of Risk-Adjusted ReturnsLet me present another conclusion of the study. The table below inter alia shows the annualized Sharpe ratios[1] of the different strategies, which are a measure of the risk they entail. 200+ years study: key metrics of a multi-asset portfolio |

Key metricsSources: Guido Baltussen, Laurens Swinkels, Pim van Vliet The table underscores the excellent performance of the seasonality-based investment strategy. |

Consider Seasonality with respect to Stocks and Bonds as well!

The study furthermore puts paid to a common preconception according to which seasonality is only useful for commodities trading. It actually shows that seasonality-based strategies generate above-average returns in three of the four asset classes examined, namely in equities, bonds and commodities. It evidently pays to jettison common preconceptions!

Take Advantage of Seasonality Professionally!

The study encompassing 200+ years and 68 markets underscores that a seasonality-based investment strategy indeed works. In fact, it actually leaves far more popular strategies in the dust – what more could one want as an investor?

What’s more, there remains scope for improving the seasonal approach used in the study. For example, the particular strategy employed in the study progresses on a monthly basis. But what if e.g. the price of a specific security typically rises from the middle of one month to the middle of the next month? It would obviously make more sense to align trades in such a security with these mid-month turning points.

With the aid of the precise daily seasonal charts provided by Seasonax, seasonal trends can be identified at a glance and detailed statistics on seasonal patterns are accessible with a single mouse click. Simply navigate to www.app.seasonax.com, where numerous instruments can be examined free of charge, or call up the Seasonax app on Bloomberg or Thomson Reuters.

PS: Seasonality-based strategies are among the best – take advantage of seasonality to improve your investment returns as well!

Tags: Featured,newsletter,On Economy,The Stock Market