Summary The Reserve Bank of India is tilting more hawkish. Tensions on the Korean peninsula are easing. The Trump administration reversed course on Russia sanctions. Turkey is heading for early elections. Raul Castro stepped down as president of Cuba. Mexico polls show continued gains for Andres Manuel Lopez Obrador. Stock Markets In the EM equity space as measured by MSCI, Qatar (+4.8%), Russia (+3.3%), and Singapore (+2.9%) have outperformed this week, while Mexico (-3.1%), Taiwan (-2.4%), and the Philippines (-2.2%) have underperformed. To put this in better context, MSCI EM fell 0.3% this week while MSCI DM rose 0.8%. In the EM local currency bond space, Turkey (10-year yield -47 bp), China (-19 bp), and Brazil

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

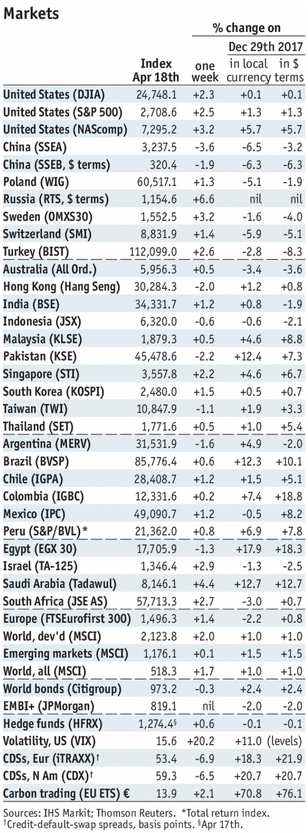

Stock MarketsIn the EM equity space as measured by MSCI, Qatar (+4.8%), Russia (+3.3%), and Singapore (+2.9%) have outperformed this week, while Mexico (-3.1%), Taiwan (-2.4%), and the Philippines (-2.2%) have underperformed. To put this in better context, MSCI EM fell 0.3% this week while MSCI DM rose 0.8%. In the EM local currency bond space, Turkey (10-year yield -47 bp), China (-19 bp), and Brazil (-16 bp) have outperformed this week, while India (10-year yield +29 bp), Indonesia (+23 bp), and Hong Kong (+19 bp) have underperformed. To put this in better context, the 10-year UST yield rose 9 bp to 2.93%. In the EM FX space, RUB (+1.1% vs. USD), TRY (+1.0% vs. USD), and BRL (+0.5% vs. USD) have outperformed this week, while MXN (-3.0% vs. USD), COP (-1.7% vs. USD), and INR (-1.4% vs. USD) have underperformed. To put this in better context, MSCI EM FX fell -0.3% this week. |

Stock Markets Emerging Markets, April 18 |

IndiaThe Reserve Bank of India is tilting more hawkish. Minutes from the last meeting showed Deputy Governor Acharya switching from a neutral stance to “decisively to vote for a beginning of ‘withdrawal of accommodation’ in the next monetary policy meeting in June.” This will bring the number of MPC members voting for a hike up to two. KoreaTensions on the Korean peninsula are easing. After the secret visit by Secretary of State-designate Pompeo, direct talks between the North and the US appear likely. North Korea has reportedly removed a key obstacle to negotiations with the US. According to South Korean President Moon, Pyongyang is no longer demanding that US troops be removed from South Korea as a condition for denuclearizing. RussiaThe Trump administration reversed course on Russia sanctions. Last weekend, UN Ambassador Haley said another round was coming that would target Russian companies that were involved in Syria’s chemical weapons program. However, US officials said this week that there would be no further sanctions without a “triggering event.” TurkeyTurkey is heading for early elections. An election wasn’t due until November 2019. Due to the controversial constitutional referendum, Erdogan can run for two more 5-year terms, which could theoretically see him rule the country until 2028. The timing itself of the election is not that important. What matters is that Erdogan continues to consolidate power even as the opposition is being further marginalized. CubaRaul Castro stepped down as president of Cuba. He was replaced by Miguel Diaz-Canel, but Castro will still wield power as he remains head of the Communist Party until his term ends in 2021. Castro said he hoped Diaz-Canel would assume that post then. Note Raul took over the presidency from his brother Fidel back in 2008. MexicoMexico polls show continued gains for Andres Manuel Lopez Obrador. The latest Consulta Mitofsky poll showed AMLO’s support rising to 31.9% from 29.5% in March. PAN candidate Ricardo Anaya was in second place with 20.8%, dropping from 21.2% in March. We expect nervousness about the political outlook to pick up as the July election approaches. |

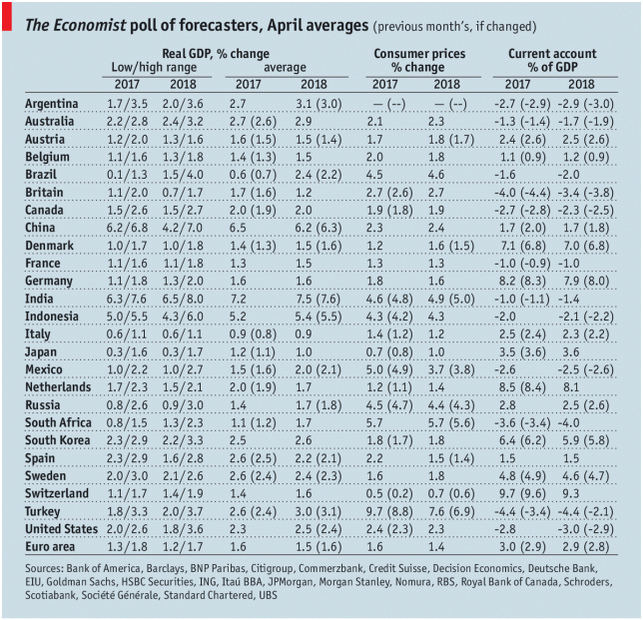

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin