Summary:

Swiss balance of payments and international investment position: Q3 2017

Current Account

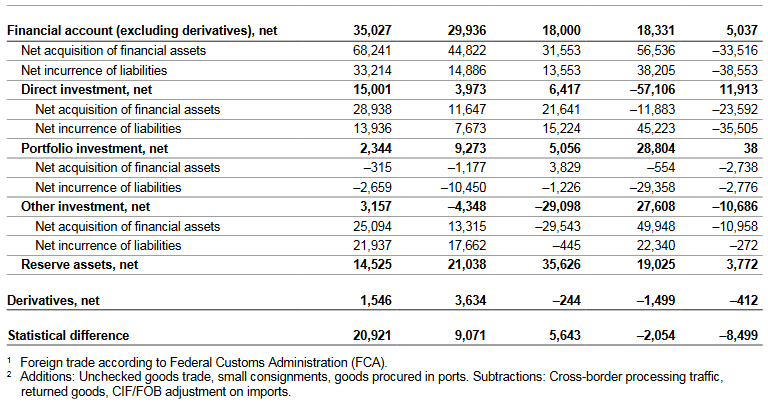

The Swiss current account surplus went down by 15% against the same quarter in 2016. In the third quarter of 2015. The current account surplus was still at 22 bn. CHF.

It seems to be a change in the usual movement that sees higher Q3 surpluses compared to the other quarters.

The surplus in Q2/2017 was similar to the one in Q2/2016, while the Q1/2017 was 25% higher than the one of Q1/2016 (see last year’s results)

There

Key figures:

Current Account: -15% against Q3/2016 to 13,030 bn. CHF

of which Trade Balance: -41% to 8,323 bn.

of which Services Balance: -4% to 4,573 bn.

of which Investment Income: +128% to 10,548 bn.

Topics:

George Dorgan considers the following as important:

Current Account-Target2,

Featured,

newsletter,

Swiss and European Macro

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss balance of payments and international investment position: Q3 2017

Current Account

The Swiss current account surplus went down by 15% against the same quarter in 2016. In the third quarter of 2015. The current account surplus was still at 22 bn. CHF.

It seems to be a change in the usual movement that sees higher Q3 surpluses compared to the other quarters.

The surplus in Q2/2017 was similar to the one in Q2/2016, while the Q1/2017 was 25% higher than the one of Q1/2016 (see last year’s results)

There

Key figures:

Current Account: -15% against Q3/2016 to 13,030 bn. CHF

- of which Trade Balance: -41% to 8,323 bn.

- of which Services Balance: -4% to 4,573 bn.

- of which Investment Income: +128% to 10,548 bn.

|

Swiss Current Account, Q3 2017(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) - Click to enlarge |

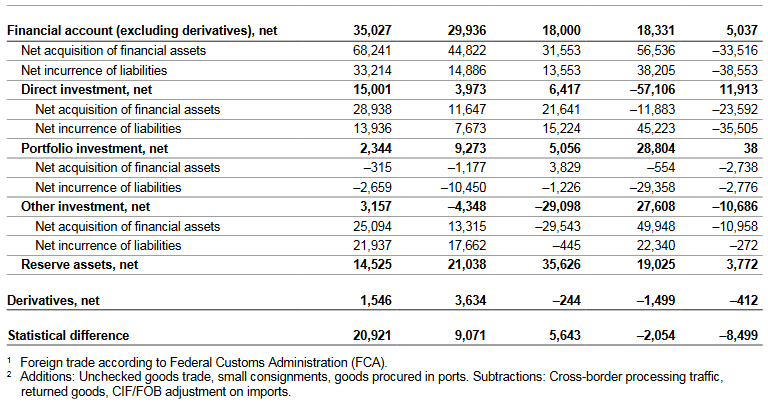

Financial Аccount

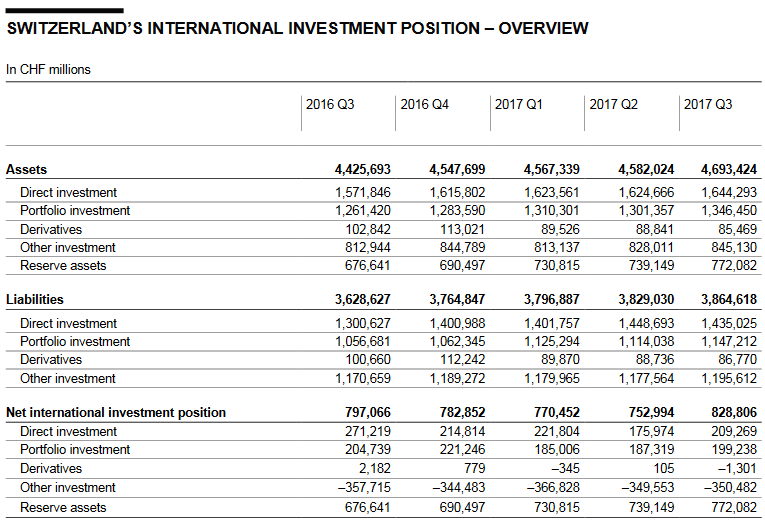

Net acquisition of financial assets

Overall, the assets side of the financial account registered a net reduction of CHF 34 billion (Q3 2016: net acquisition of CHF 68 billion), with direct investment accounting for the largest net reduction, i.e. CHF 24 billion (Q3 2016: net acquisition of CHF 29 billion). This was due to foreign-controlled finance and holding companies selling subsidiaries abroad. Other investment also saw a net reduction, of CHF 11 billion (Q3 2016: net acquisition of CHF 25 billion), primarily as a result of commercial banks in Switzerland scaling back their claims against non-resident banks. Portfolio investment recorded a net reduction of CHF 3 billion, as resident investors sold shares and short-term debt securities issued by non-residents. In the year-back quarter, purchases and sales had been on a par. Reserve assets recorded a net acquisition of CHF 4 billion (Q3 2016: net acquisition of CHF 15 billion).

Net incurrence of liabilities

Overall, the liabilities side of the financial account saw a net reduction of CHF 39 billion (Q3 2016: net incurrence of CHF 33 billion). Direct investment recorded a net reduction of CHF 36 billion (Q3 2016: net incurrence of CHF 14 billion), since non-resident investors withdrew capital from finance and holding companies. As in the year-back quarter, portfolio investment registered a net reduction of CHF 3 billion, with non-resident investors selling mainly shares. Transactions in other investment were largely balanced (Q3 2016: net incurrence of CHF 22 billion): While commercial banks reduced their liabilities towards non-resident banks and customers, the SNB’s liabilities abroad increased.

Net

The financial account balance came to CHF 5 billion (Q3 2016: CHF

37 billion). This is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrence of liabilities plus the balance from derivatives transactions. This positive financial account balance corresponds to the increase in the net international investment position resulting from cross-border investment.

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

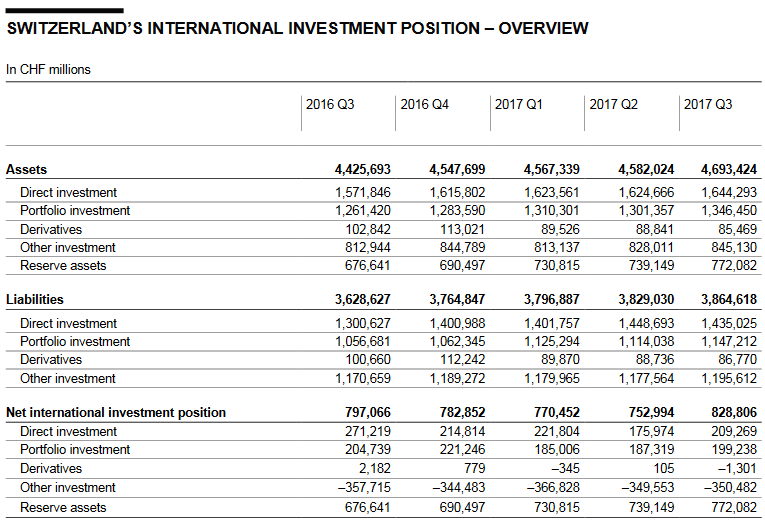

Switzerland’s International Investment Position

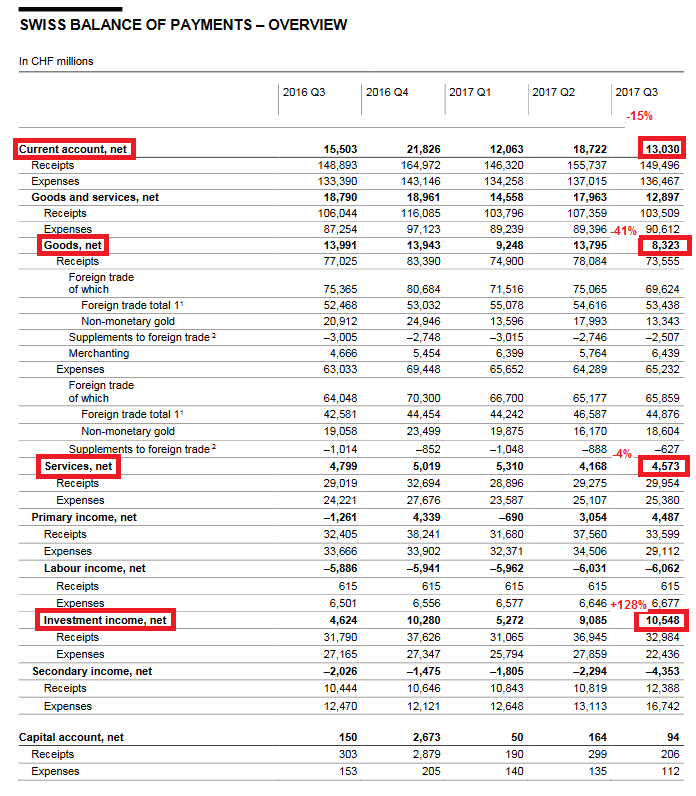

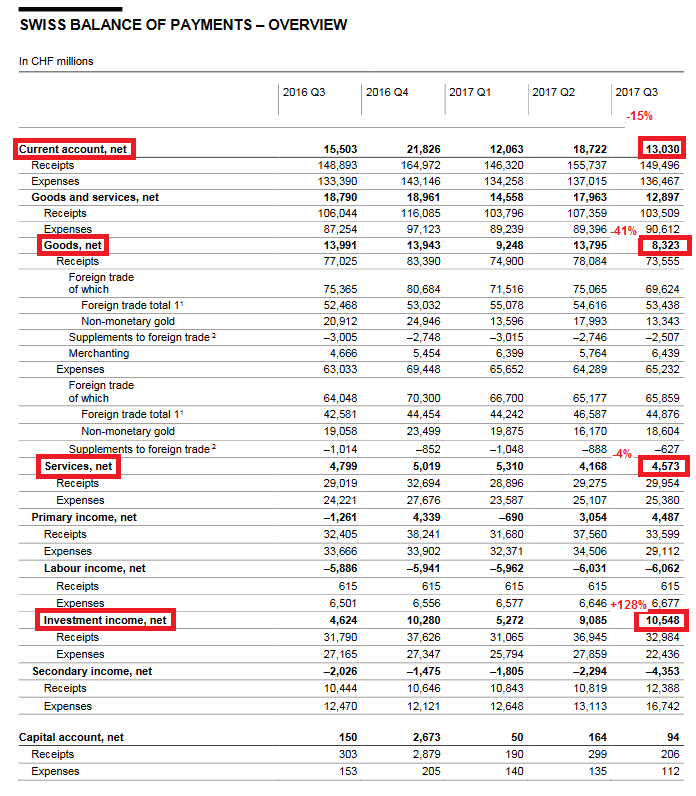

Foreign assets

Stocks of foreign assets were up CHF 111 billion on the previous quarter to CHF 4,693 billion, owing to substantial valuation changes. As the bulk of the assets is held in foreign currency, the appreciation of the euro and the US dollar against the Swiss franc resulted in significant exchange rate gains. In addition, capital gains on the back of higher stock market prices abroad also contributed to the increase. Stocks of portfolio investment grew by CHF 45 billion to CHF 1,347 billion. Reserve assets registered a CHF 33 billion increase to CHF 772 billion. Stocks of direct investment and other investment rose by CHF 20 billion to CHF 1,644 billion and by CHF 17 billion to CHF 845 billion respectively. By contrast, stocks of derivatives declined by CHF 3 billion to CHF 86 billion.

Foreign liabilities

Stocks of foreign liabilities rose by CHF 36 billion to CHF 3,865 billion compared to the previous quarter. This was mainly the result of valuation changes due to higher stock market prices in Switzerland, as well as exchange rate gains on liabilities denominated in foreign currency. Stocks of portfolio investment expanded by CHF 33 billion to CHF 1,147 billion, and stocks of other investment rose by CHF 18 billion to CHF 1,196 billion. Stocks of direct investment, by contrast, declined by CHF 14 billion to CHF 1,435 billion. Stocks of derivatives were down CHF 2 billion to CHF 87 billion.

Net international investment position

The net international investment position increased by CHF 76 billion to CHF 829 billion compared with the previous quarter, since foreign assets (up CHF 111 billion) advanced more strongly than foreign liabilities (up CHF 36 billion).

|

Switzerland International Investment Position(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

Download PDF

Tags:

Featured,

newsletter