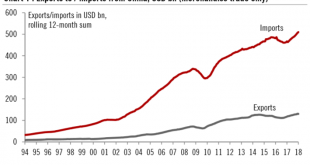

The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD506bn of total Chinese merchandise imports). The list of products targeted, still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn. But President Trump also sees the...

Read More »British pound – Smoother transition, stronger sterling

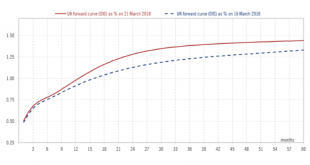

Recent positive developments in the United Kingdom (UK), namely the transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March, call for a more positive short-term outlook for the sterling than previously thought. We therefore revise our projections upward for the sterling on the entire time horizon. Our new projection for the GBP/USD rate in the next 12...

Read More »London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

– London house prices falling at fastest pace since 2009 – Values fell by 2.6% in year through January – London house prices likely to be weakest in UK over next five years – Inflated prices make London property more exposed to economic and political shocks – Worries over house prices are having a knock-on effect in wider economy– Physical gold to act as much needed hedge against falling property prices A new study by...

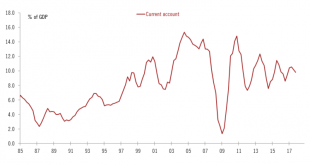

Read More »Disentangling the Swiss current account

Following the Swiss National Bank’s (SNB) publication of Switzerland’s balance of payments data for Q4 2017, in this note we look deeper into the Swiss current account to try to find out why Switzerland persistently runs a surplus and whether or not the current account balance can be used to assess the fair value of the Swiss franc. In 2017, the current account surplus stood at around 9.8% of GDP or CHF66bn. This was...

Read More »Euro area Flash PMIs: “Growing pains” but no reason to panic

Today’s first batch of euro area March business surveys looks worrying at first sight. The drop in the euro area composite PMI index, from 57.1 to 55.3 in March (consensus: 56.8), was the second one in a row and the largest monthly decline in six years. New orders fell to a 14-month low. The correction in business sentiment was predominantly driven by the manufacturing sector, which could reflect broader concerns of a...

Read More »Europe chart of the week – monetary policy

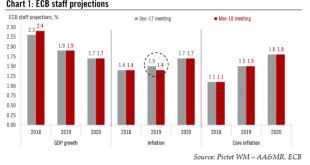

Much of recent ECB dovish rhetoric has been building around the (not-sonew) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good...

Read More »Swiss Trade Balance February 2018: Foreign Trade at a High Level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Europe chart of the week – Employment

Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level. The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total amount of labour input used by...

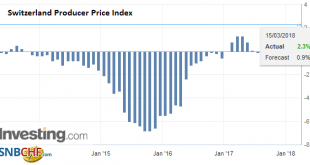

Read More »Swiss Producer and Import Price Index in February 2018: +2.3 percent YoY, +0.3 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More »ECB begins to rotate forward guidance

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org