Financial assets and liabilities of the institutional sectors The financial accounts form part of Switzerland’s system of national accounts. They show the financial assets and liabilities of the economy’s institutional sectors, which are non-financial and financial corporations, general government and households. The major developments in the financial accounts are outlined below. Households In 2016, household financial assets increased by CHF 91 billion to CHF 2,445 billion. This increase was greater than in 2015 and was due to higher deposits at banks and a rise in the insurance and pension schemes item. The latter item accounts for over 40% of total household financial assets. Household liabilities, which

Topics:

Swiss National Bank considers the following as important: Featured, newsletter, SNB, SNB Press Releases

This could be interesting, too:

Eamonn Sheridan writes CHF traders note – Two Swiss National Bank speakers due Thursday, November 21

Charles Hugh Smith writes How Do We Fix the Collapse of Quality?

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Michael Lebowitz writes Trump Tariffs Are Inflationary Claim The Experts

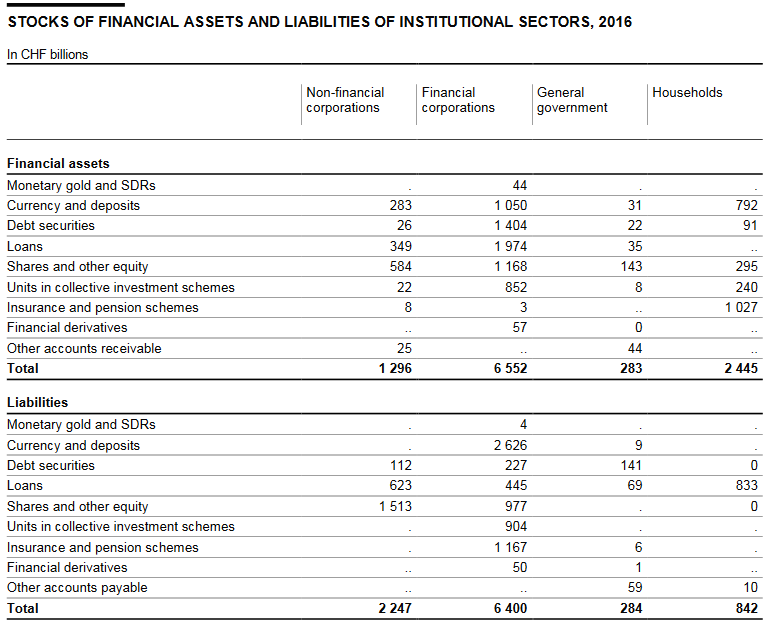

Financial assets and liabilities of the institutional sectorsThe financial accounts form part of Switzerland’s system of national accounts. They show the financial assets and liabilities of the economy’s institutional sectors, which are non-financial and financial corporations, general government and households. The major developments in the financial accounts are outlined below. HouseholdsIn 2016, household financial assets increased by CHF 91 billion to CHF 2,445 billion. This increase was greater than in 2015 and was due to higher deposits at banks and a rise in the insurance and pension schemes item. The latter item accounts for over 40% of total household financial assets. Non-financial corporationsHalf of the financial assets of non-financial corporations are shares and other equity and a quarter are loans. Overall, in 2016, the total rose by CHF 48 billion to CHF 1,296 billion, principally as a result of corporate acquisitions abroad and loans made in the context of group reorganisations. The liabilities of non-financial corporations also consist, to a large extent, of shares and other equity as well as loans. Total liabilities rose by CHF 24 billion to CHF 2,247 billion. While loans increased, the shares and other equity item declined as a result of lower share prices in Switzerland. Financial corporationsThe financial assets and liabilities of financial corporations greatly exceed those of the other sectors. This is because the institutions combined in this sector (central bank, commercial banks, investment funds, other financial intermediaries, as well as insurance corporations and pension funds) act as financial intermediaries. On the financial assets side, the split between claims on domestic and foreign borrowers is almost equal. At the end of 2016, the largest components of domestic financial assets were commercial bank loans to households and non-financial corporations, commercial bank deposits with the SNB and units in domestic investment funds held by insurance corporations and pension funds. The most significant foreign financial assets were securities issued by foreign borrowers which were mainly held by the SNB, investment funds, and insurance corporations and pension funds. Two further important components under foreign financial assets were commercial banks’ foreign deposits and the foreign financial assets of other financial intermediaries, which took the form of participating interests and loans. Overall, financial assets of financial corporations increased by CHF 434 billion to CHF 6,552 billion in 2016. This increase was attributable to SNB purchases of debt securities and shares,higher commercial bank deposits with the SNB, commercial bank lending , and the acquisition of units in collective investment schemes by insurance corporations and pension funds. At insurance corporations and pension funds, the shift from direct investments in securities to collective investments continued. In 2016, financial corporations’ total liabilities rose by CHF 390 billion to CHF 6,400 billion. The largest components were deposits with the SNB and commercial banks as well as the entitlements of insureds vis-à-vis insurance corporations and pension funds. Deposits increased by CHF 127 billion to CHF 2,626 billion, and insurance and pension schemes by CHF 43 billion to CHF 1,167 billion. |

Stocks of Financial Assets and Liabilities of Institutional Sector in 2016 Source: snb.ch - Click to enlarge |

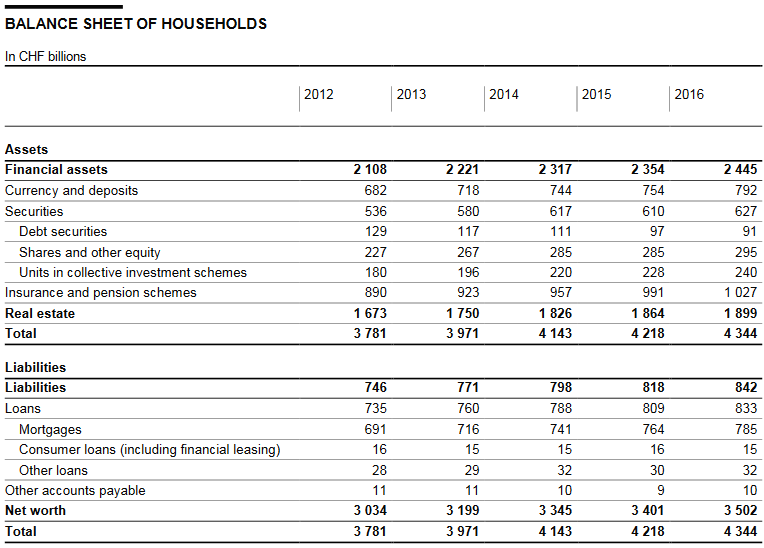

Balance sheet of householdsThe balance sheet of households combines households’ financial assets and liabilities as per the financial accounts and household real estate assets. The assets side of the balance sheet covers financial assets and real estate at market value, while the liabilities side covers liabilities and net worth. In 2016, the market value of real estate owned by households grew by CHF 35 billion to CHF 1,899 billion. Around half of this increase was due to the steady, albeit weak, rise in real estate prices. Together with the financial assets, which grew by CHF 91 billion to CHF 2,445 billion, this resulted in an increase in assets of CHF 126 billion to CHF 4,344 billion. With household liabilities up CHF 25 billion to CHF 842 billion, the net worth of households rose by CHF 101 billion to CHF 3,502 billion. In 2016, the increase in net worth was slightly higher than in 2015, but significantly lower than between 2012 and 2014, when real estate prices had climbed more sharply and substantial capital gains were recorded on financial assets. |

Balance Sheet of Households |

Notes

The Swiss National Bank (SNB) compiles the financial accounts in collaboration with the Swiss Federal Statistical Office.

The Swiss Financial Accounts 2016 report is available on the SNB website, www.snb.ch, Publications, Statistical Publications. The printed version may be obtained from the SNB from 30 November 2017.

For comprehensive tables covering the Swiss financial accounts, cf. the SNB’s data portal, data.snb.ch, Table selection, Other areas of the economy, Swiss Financial Accounts. The data can be accessed there in the form of configurable tables. The data are currently available for 1999 to 2016. Detailed notes on the methods for the financial accounts, and information on revision of data and breaks in series, can also be found on the data portal.

Tags: Featured,newsletter