Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves. These...

Read More »Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.Our weekly sight deposits report show the liabilities. They are measured in Swiss franc and therefore not subject to valuation effects. They are the only way to measure...

Read More »Swiss growth fails to ignite, SNB likely to remain on hold

Macroview Although there were positive components in the Q1 GDP report, we are reducing our full-year growth forecast for Switzerland to 0.9% this year Read full report hereGrowth estimates from SECO (the Swiss economic affairs secretariat) released on June 1 suggest that real GDP in Switzerland expanded by 0.1% q-o-q (0.3% q-o-q annualised, 0.7% y-o-y) in Q1, lower than consensus expectations of 0.3% and Q4 2015 growth of 0.4%.But the GDP components were more encouraging than what the...

Read More »The Public Sector’s Portfolio Choice

In the NZZ, Michael Schaefer reports about a study that analyzes the portfolio composition of public sector entities and social security institutions. Cantons and the Federation mostly hold cash. The SNB’s portfolio is among the riskiest.

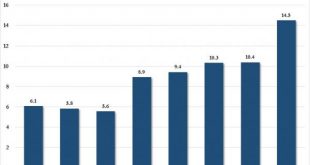

Read More »Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors’ exuberance over bouncing crude oil prices, the world’s crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss next. Having urged investors “don’t panic” last year, and seeing dollar reserves drying up rapidly earlier this year, recent “lies” about the nation’s statistics have raised fears of a looming devaluation as FX forwards have crashed to 291...

Read More »Three unintended consequences of NIRP

Submitted by Patrick Watson via MauldinEconomics.com, Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues in the exactly opposite way: Falling prices are a consequence of low interest rates and not the opposite: We see two reasons why this can be true: High, maybe excessive investment is happening in China (alas not in Europe). Cheap costs of...

Read More »Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. There was some confusion as to why the jump and then it was revealed that none other than that “other” billionaire, Warren Buffett, has decided to start building a stake in the world’s biggest cell phone company to the tune of 9.8 million shares or about $1.07 billion as of March 31. Making some more sense of the transaction, CNBC adds this...

Read More »As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

On April 28, the catalyst the sent the stock price of AAPL to its post-August 25 frash crash lows, and launched a tremor not only within the Nasdaq but the broader market, was news that after several years of being AAPL’s biggest cheerleader, even coming up with price targets north of $200, Carl Icahn had suddenly cooled on the China-focused growth company, and had liquidated his entire stake. But as Icahn was selling, or just before as we don’t know precisely when Icahn, who has since...

Read More »Veritaseum Blockchain-based Bank Research Hits Another Home Run – Banco Popular Shown to be Bear Stearns Redux!

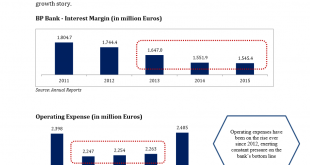

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European...

Read More »St. Louis Fed Slams Draghi, Kuroda – “Negative Rates Are Taxes In Sheep’s Clothing”

“At the end of the day, negative interest rates are taxes in sheep’s clothing. Few economists would ever claim that raising taxes on households will stimulate spending. So why would they think negative interest rates will?” Those are the shocking words of St.Louis Fed Director of Research Christopher Waller whose brief note today will be required reading for everyone at The Bank of Japan, The ECB and every other central banker on the verge of NIRP… If you pick up any principles of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org