Over four years our association of supporters of Austrian Economics from Switzerland, Germany and Austria and helpful hands from all over the world expressed opposition against the CHF cap in in-numerous pages. Finally the SNB agreed to the wishes of Swiss consumers and gave up the cap that effectively represented a tax on consumption and extra-profits for companies and close friends of the central bank. Swiss Inflation Watch: Swiss inflation As monetarists & Austrians we expect Swiss...

Read More »The 2015 Update: Risks on the Rising SNB Money Supply

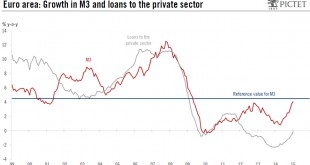

Since the financial crisis central banks in developed nations increased their balance sheets. The leading one was the American Federal Reserve that increased the monetary base (M0, often called “narrow money”), followed by the Bank of Japan and recently the ECB. In most cases the extension of narrow money did neither have an effect on banks’ money supply, the so called “broad money” (M1-M3), nor on price inflation. For the Swiss, however, the rising money supply concerned both narrow and...

Read More »SNB

Swiss National Bank, the Most Relevant Pages Click here for the multi-media version of this page on the social media site Scoop It. The chapter on the SNB has the following sections (click open): Recent articles and updates: Older posts about the SNB balance sheet risks On the SNB balance sheet and sight deposits, the means of financing currency interventions: SNB Reserves vs. EUR/CHF On SNB results and its future profitability, from 2014 and 2013 that predicted the end of the...

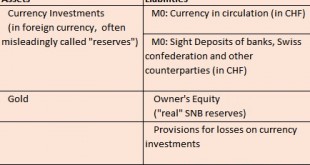

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

We regularly publish the SNB asset structure by currency, rating & duration and the investment strategy. They shall be a template for the tactical asset allocation along these dimensions for other conservative asset managers – CHF holdings certainly excluded because the SNB nearly exclusively buys foreign assets. The SNB balance sheet looks as follows: In this post we will concentrate on the assets side, investment strategy and composition of “FX reserves”.See more on liabilities...

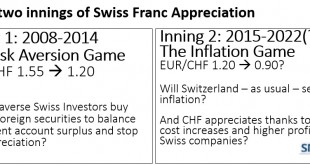

Read More »The two phases of CHF appreciation… and what is in between

We show the two phases or two innings or phases of Swiss franc appreciation: The “risk aversion game” and the “inflation game”. With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the “risk aversion game“, the first innings in a two-part match. Risk aversion is lower because the United States recovered thanks to lower oil prices.The “inflation game”...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org