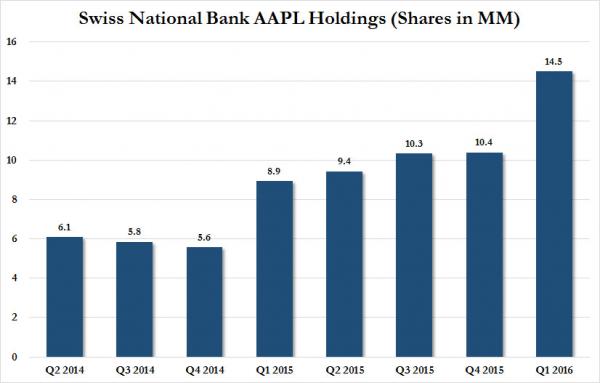

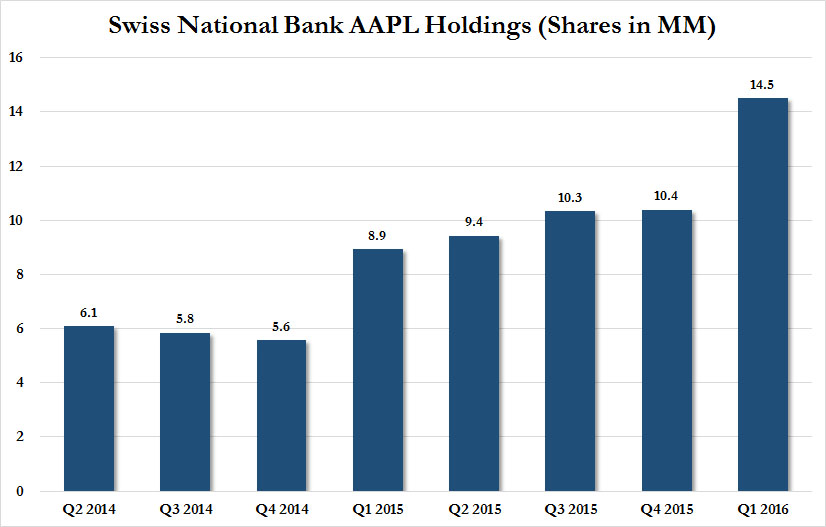

On April 28, the catalyst the sent the stock price of AAPL to its post-August 25 frash crash lows, and launched a tremor not only within the Nasdaq but the broader market, was news that after several years of being AAPL’s biggest cheerleader, even coming up with price targets north of 0, Carl Icahn had suddenly cooled on the China-focused growth company, and had liquidated his entire stake. But as Icahn was selling, or just before as we don’t know precisely when Icahn, who has since indicated he has turned massively bearish on the overall market, one entity was buying every AAPL share it could find. In fact, according to its latest 13F, everyone’s favorite central bank that openly admits it is also a wholesale buyer of stocks (with a portfolio of some 0 billion), Swiss National Bank AAPL Holdings (Sheres in MM) the Swiss National Bank reveals that in Q1 it bought another 4.1 million in AAPL shares, bringing its total to a record 14.5 milion shares. Swiss National Bank AAPL Holdings (Sheres in MM) – click to enlarge. What is bad for citizens of Switzerland is that as their central bank was aggressively bidding up AAPL stocks, its price was tumbling resulting in an immediate loss. What is more troubling is that as of March 31, 2016, the SNB had total assets of CHF 646 Billion… Assets, In CHF Millions Assets, In CHF Millions – click to enlarge. ….

Topics:

Tyler Durden considers the following as important: AAPL Holdings, Apple holdings, Assets, Carl Icahn, CHF, Equity investment, Featured, foreign currency investments, newsletter, SNB, Swiss National Bank, Zerohedge on SNB

This could be interesting, too:

investrends.ch writes SNB mit Quartals-Gewinn von 6,7 Milliarden Franken

investrends.ch writes SNB schreibt 2024 definitiven Gewinn von über 80 Milliarden Franken

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

On April 28, the catalyst the sent the stock price of AAPL to its post-August 25 frash crash lows, and launched a tremor not only within the Nasdaq but the broader market, was news that after several years of being AAPL’s biggest cheerleader, even coming up with price targets north of $200, Carl Icahn had suddenly cooled on the China-focused growth company, and had liquidated his entire stake.

But as Icahn was selling, or just before as we don’t know precisely when Icahn, who has since indicated he has turned massively bearish on the overall market, one entity was buying every AAPL share it could find. In fact, according to its latest 13F, everyone’s favorite central bank that openly admits it is also a wholesale buyer of stocks (with a portfolio of some $100 billion),

Swiss National Bank AAPL Holdings (Sheres in MM)the Swiss National Bank reveals that in Q1 it bought another 4.1 million in AAPL shares, bringing its total to a record 14.5 milion shares. |

What is bad for citizens of Switzerland is that as their central bank was aggressively bidding up AAPL stocks, its price was tumbling resulting in an immediate loss.

What is more troubling is that as of March 31, 2016, the SNB had total assets of CHF 646 Billion…

Assets, In CHF Millions |

…. of which 20% ,or CHF130 billion ($132BBN), was in the form of equities (its $54 bilion in US holdings are listed on the quarterly 13-F filing).

Foreign currency investments and Swiss franc bond investments (end of Q1 2016) |

We hope for the sake of Switzerland, and especially its residents, that equity markets never suffer a dramatic drop because with a central banks which has “invested” 20% of Swiss GDP in stocks, bad things would result to the “full faith and credit” of its central bank when its peers finally stop buying equities and/or ivory tower economists ultimately lose control of the most manipulated, centrally-planned market in history.

Swiss National Bank AAPL Holdings (Shares in MM) |