Finanz und Wirtschaft, April 30, 2016. PDF. Ökonomenstimme, May 6, 2016. HTML. The winners and losers of the current monetary environment are not that easy to identify. Investors holding long-term, non-indexed debt gain as unexpectedly low inflation shifts wealth from borrowers to lenders. Governments suffer from increased real debt burdens and reduced revenue due to effectively lower capital income tax rates. Policies that succeed in affecting the real exchange rate entail...

Read More »Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

The Swiss National Bank has achieved a profit of 5.7 billion CHF in Q1/2016. The total yield on assets per annum was 3.4%.The main contribution comes from gold with price change of 10% in this quarter, hence a total yield of 48%.The total yield on debt was positive with +0.2% thanks to negative interest rates.The deflationary environment let to rising bond prices. Bonds, make up 74% of the SNB portfolio. Here the details of our calculation: Position Total Positionin bn CHF % of Total...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

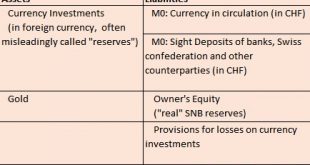

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More »With Tech Tanking, Can Anything Save The System?

Nice sentence: Tears won’t be confined to Wall Street however: let’s not forget that none other than the Swiss National Bank is also long some 10.4 million shares of AAPL. First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing to explain. The FAANGs (Facebook, Apple, Amazon, Netflix and Google) own their niches and not so long ago were expected to...

Read More »Wall Street In Pain: 163 Hedge Funds Are Long AAPL Stock

First it was the blow up of hedge fund darling Valeant that crushed countless funds who were long the name. Then, one month ago after the collapse of the Allergan-Pfizer deal, we showed (one of the reasons) why the hedge fund world continued to underperform the broader market: Allergan was one of the most widely held hedge fund stocks. And now, following the biggest Apple debacle in years, here is the reason why the hedge fund community is about to see even more redemption requests and...

Read More »In Switzerland, New Bank Notes Render Old Notes Invalid

In the NZZ, Thomas Fuster reports about a consequence of the introduction of new banknotes in Switzerland: Old notes become invalid after a transition period of 20 years. Nach der Emission des letzten Notenwerts einer neuen Serie kündigt die Schweizerische Nationalbank (SNB) jeweils den Rückruf der alten Serie an. Danach können die Banknoten zwar noch während zwanzig Jahren bei den Kassenstellen oder Agenturen der Nationalbank zum Nennwert umgetauscht werden. In der Folge sind die Noten...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world’s savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published “Negative Rates: How One Swiss Bank Learned to Live in a Subzero World“: Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More »A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swiss Bank Learned to Live in a Subzero World": Alternative Bank Schweiz AG late last year became Switzerland’s first bank to comprehensively pass along negative rates to all of its customers. Violating an almost religious precept in the financial...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!". Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org