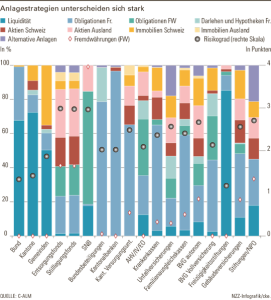

In the NZZ, Michael Schaefer reports about a study that analyzes the portfolio composition of public sector entities and social security institutions. Cantons and the Federation mostly hold cash. The SNB’s portfolio is among the riskiest.

Topics:

Dirk Niepelt considers the following as important: Canton, Investment, Notes, Portfolio, Public sector, Social security, Swiss Federation, Swiss National Bank, Switzerland

This could be interesting, too:

Fintechnews Switzerland writes Top 12 Fintech Courses and Certifications in Switzerland in 2025

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Dirk Niepelt writes Does the US Administration Prohibit the Use of Reserves?

Dirk Niepelt writes “Pricing Liquidity Support: A PLB for Switzerland” (with Cyril Monnet and Remo Taudien), UniBe DP, 2025

In the NZZ, Michael Schaefer reports about a study that analyzes the portfolio composition of public sector entities and social security institutions. Cantons and the Federation mostly hold cash. The SNB’s portfolio is among the riskiest.