During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European sovereign debt crisis) as well as Bear Stearns and Lehman Brothers (Is this the Breaking of the Bear? January 2008). Today, Reuters released news vindicating our position in spades, leading any institution that took a position via our blockchain-based Veritaseum trading platform or today's legacy system with 14% cash gains or 50% to 100+% leveraged gains in the short time period in question, to wit: Tumbling Banco Popolare leads Italian bank shares lower Banco Popolare shares fall 14 pct to record low Bank booked writedowns ahead of merger with Popolare Milano Italian banking shares dogged by concerns over bad loans (Recasts with details) MILAN, May 11 Shares in Banco Popolare plunged 14 percent on Wednesday after a surprise first-quarter loss driven by loan writedowns -- the main focus of investor concerns over Italian banks.

Topics:

Reggie Middleton considers the following as important: Bear Stearns, Capital Markets, Central Banks, Counterparties, default, European Central Bank, goldman sachs, Investment Grade, Italy, Lehman, Lehman Brothers, Monetary Policy, Mortgage Loans, OTC, OTC Derivatives, Rating Agencies, Rating Agency, ratings, ratings agencies, Real estate, Recession, Reggie Middleton, Reuters, Sovereign Debt, Swiss Banks, Swiss National Bank, Unemployment

This could be interesting, too:

investrends.ch writes Neuer Vertriebsleiter bei Goldman Sachs kommt von Invesco

investrends.ch writes Goldman Sachs lanciert aktiven ETF auf grüne und soziale Anleihen aus Schwellenländern

investrends.ch writes Goldman Sachs verdient mehr als erwartet

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

During the months of March and April of 2016 we released a series of proprietary research reports indicating signficant weakneses that we found in the European banking system and released it for sale through the blockchain (reference The First Bank Likely to Fall in the Great European Banking Crisis). This was performed by the same macro forensic and fundamental analysis team that first warned about the pan-European sovereign debt crisis in 2009 and 2010 (reference Pan-European sovereign debt crisis) as well as Bear Stearns and Lehman Brothers (Is this the Breaking of the Bear? January 2008).

Today, Reuters released news vindicating our position in spades, leading any institution that took a position via our blockchain-based Veritaseum trading platform or today's legacy system with 14% cash gains or 50% to 100+% leveraged gains in the short time period in question, to wit: Tumbling Banco Popolare leads Italian bank shares lower

- Banco Popolare shares fall 14 pct to record low

- Bank booked writedowns ahead of merger with Popolare Milano

- Italian banking shares dogged by concerns over bad loans (Recasts with details)

MILAN, May 11 Shares in Banco Popolare plunged 14 percent on Wednesday after a surprise first-quarter loss driven by loan writedowns -- the main focus of investor concerns over Italian banks.

Banco Popolare booked loan writedowns requested by the European Central Bank as a condition for approving a planned merger with Banca Popolare di Milano that will create Italy's third-biggest banking group.

To improve its loan loss provisions Banco Popolare must raise 1 billion euros in a share issue slated for early June.

Investors are expected to be more supportive of the move than was the case when Banca Popolare di Vicenza IPO-BPVS.MI tried to raise cash last month and had to be supported by a new bank rescue fund.

Shares in Banco Popolare lost 14 percent by 1040 GMT, hitting a record low of 4.14 euros.

Popolare Milano lost 10 percent to 0.50 euros, against a 3 percent drop in Italy's banking index.

Italian banks have lost nearly 40 percent of their market value so far this year, weighed down by concerns they could need additional capital to shoulder losses from sales of bad loans that rose to 360 billion euros ($410 billion) during a long recession.

A share rebound triggered by the hasty creation last month of the fund intended to inject capital into weaker lenders and buy their bad loans proved short-lived.

Banco Popolare said late on Tuesday that it had written down loans for 684 million euros in the first quarter, nearly four times more than in the same period of 2015, posting a net loss of 314 million euros for the first three months.

CEO Pierfrancesco Saviotti told an analyst call that the loan writedowns were the first step towards selling chunks of bad loans and that it would book further provisions this year."

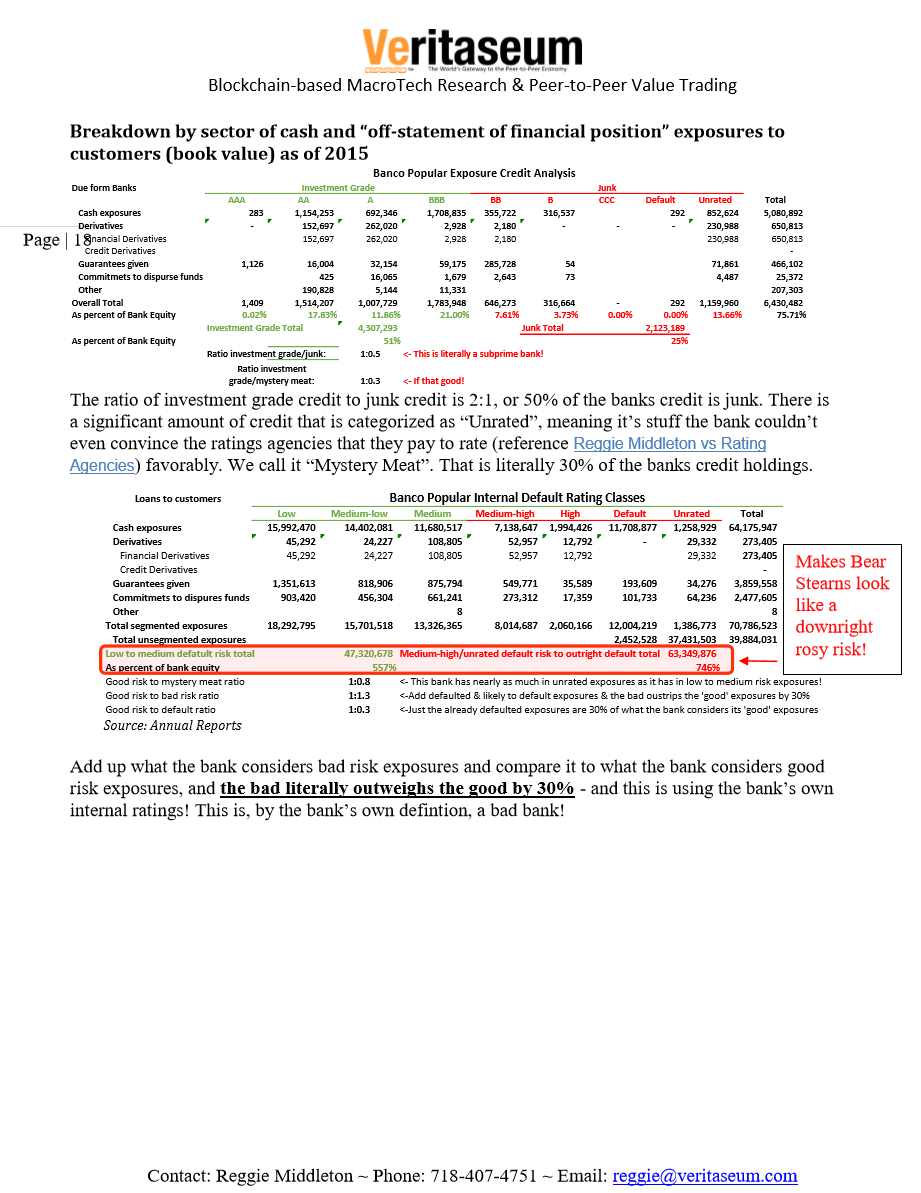

Let's take a look at what the Macrotechnology, fintech and blockchain research experts at Veritaseum had to say about Banco Popular. Keep in mind that although we are now a technology firm, we specialize in Fintech and Macrotech, hence keeping our finger on the pulse of the global banking system is paramount. We mush be aware of what it is that we are disintermediating! On that note, we will happily create a distributed blockchain solution using our realistic approach to isolate these risks in a zero trust confine, essentially bullet proofing parts of this bank or any other from catastrophic loss. Ping me for more.

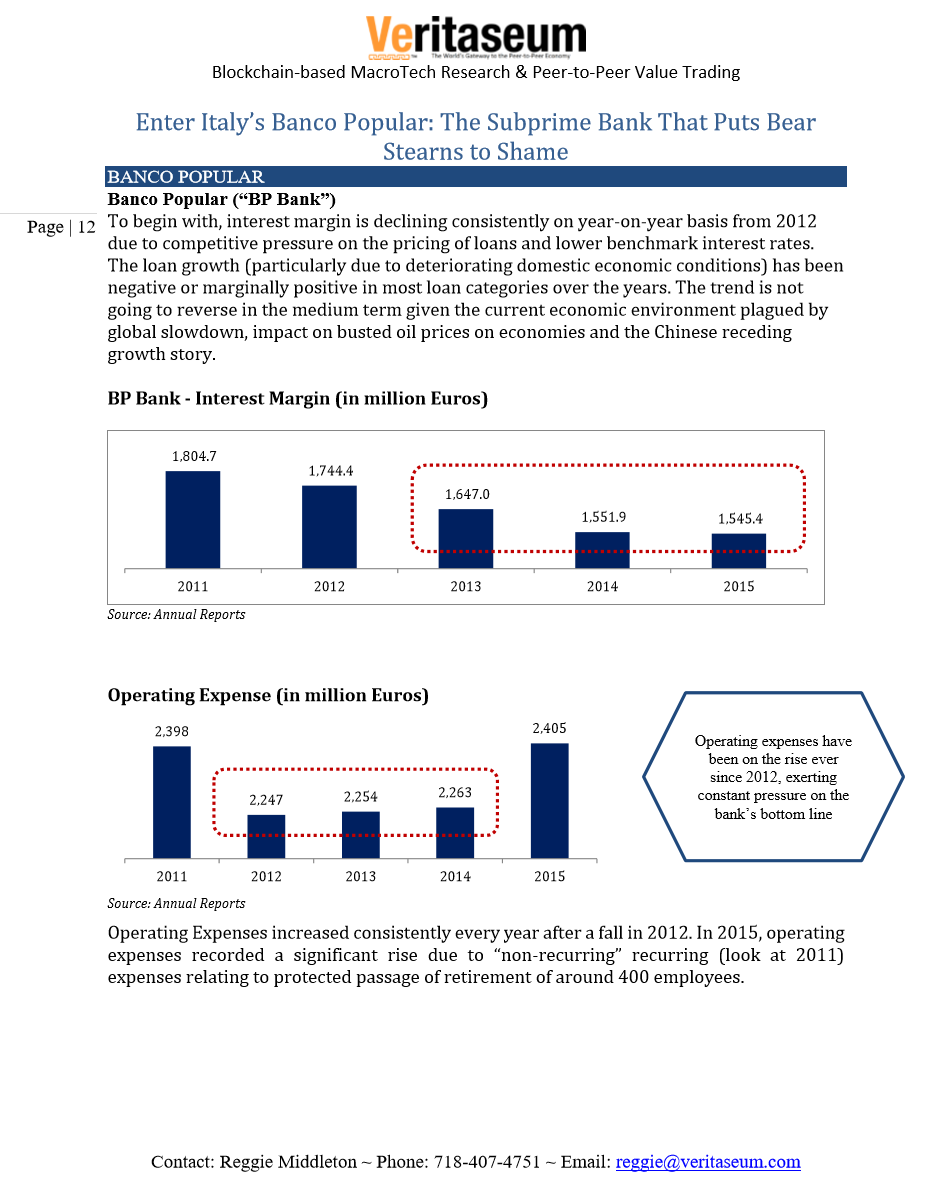

Income from operations declined every year from 2011 due to lower interest margin and higher operating expense. The declining trend was stopped in 2015 as the bank recorded a rise of 13% in income from operations. The pop was due to sale of equity investments held in ICBPI (13.88%) and Arca SGR (19.9%) amounting to Euro172.6 and Euro68.7 million, respectively, and higher other operating income including fees and commission earned. However, the notable aspect is the core income from operations has been on constant decline (even in 2015) over the last few years

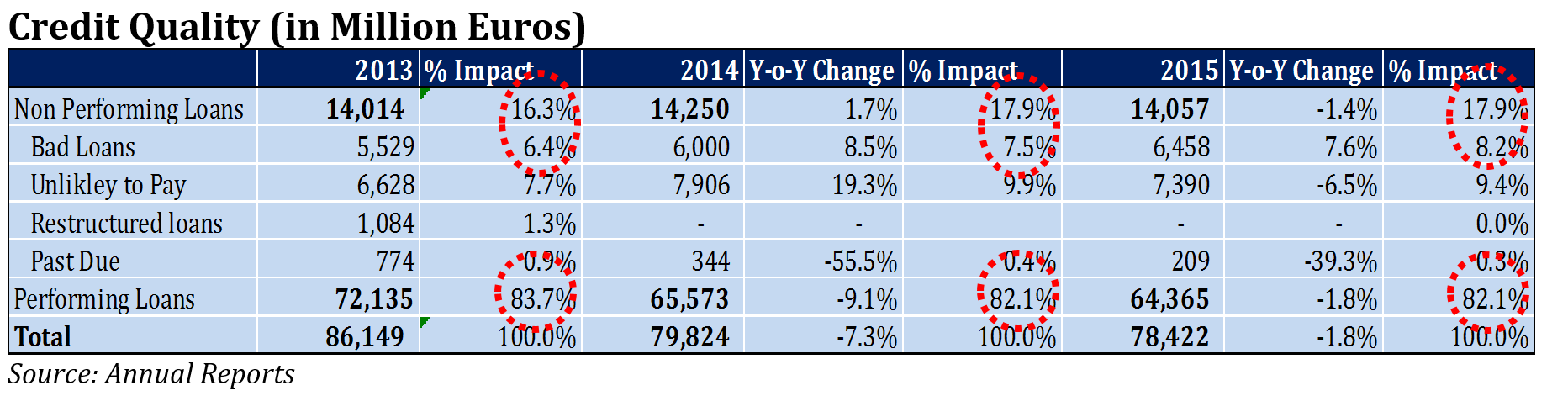

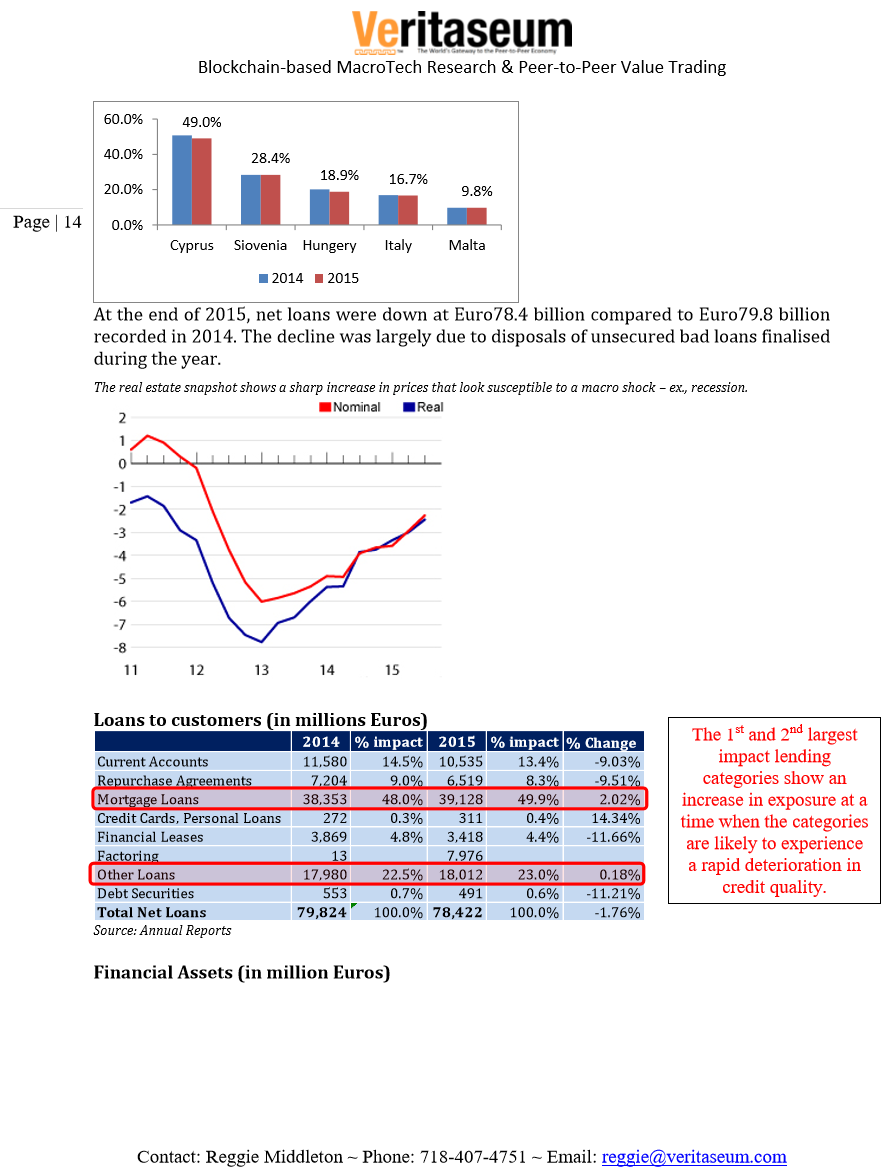

The quality of loans has been deteriorating with percentage of non-performing and bad loans showing signs of increase due to adverse macro-economic environment. Of the total loan portfolio, the bank’s performing loans decreased to 82.1% in 2015 from 83.7% in 2013. Furthermore, BP stopped reporting restructured loans for at least two years. That looks quite suspicious given that loan credit quality has been tumbling. The numbers offered add up, but they shouldn't unless the restructured loans have been somehow reclassified as performing loans (quite possibly). If so, that's quite misleading and should be duly noted.

A significant percentage of the loan portfolio comprises mortgage loans and loans on current accounts. Distressed residential real estate sector and subdued business environment are likely to take toll on % of performing loans in these categories. As can be seen below, Italy as a nation, has high NPLs and it is not materially improving, YoY.

Since the hyperlinks are not active in these report jpg snapshots, I'll past the text here so you can access the live links, reference Reggie Middleton vs Rating Agencies.

Parallels to Bear Stearns Before it Popped

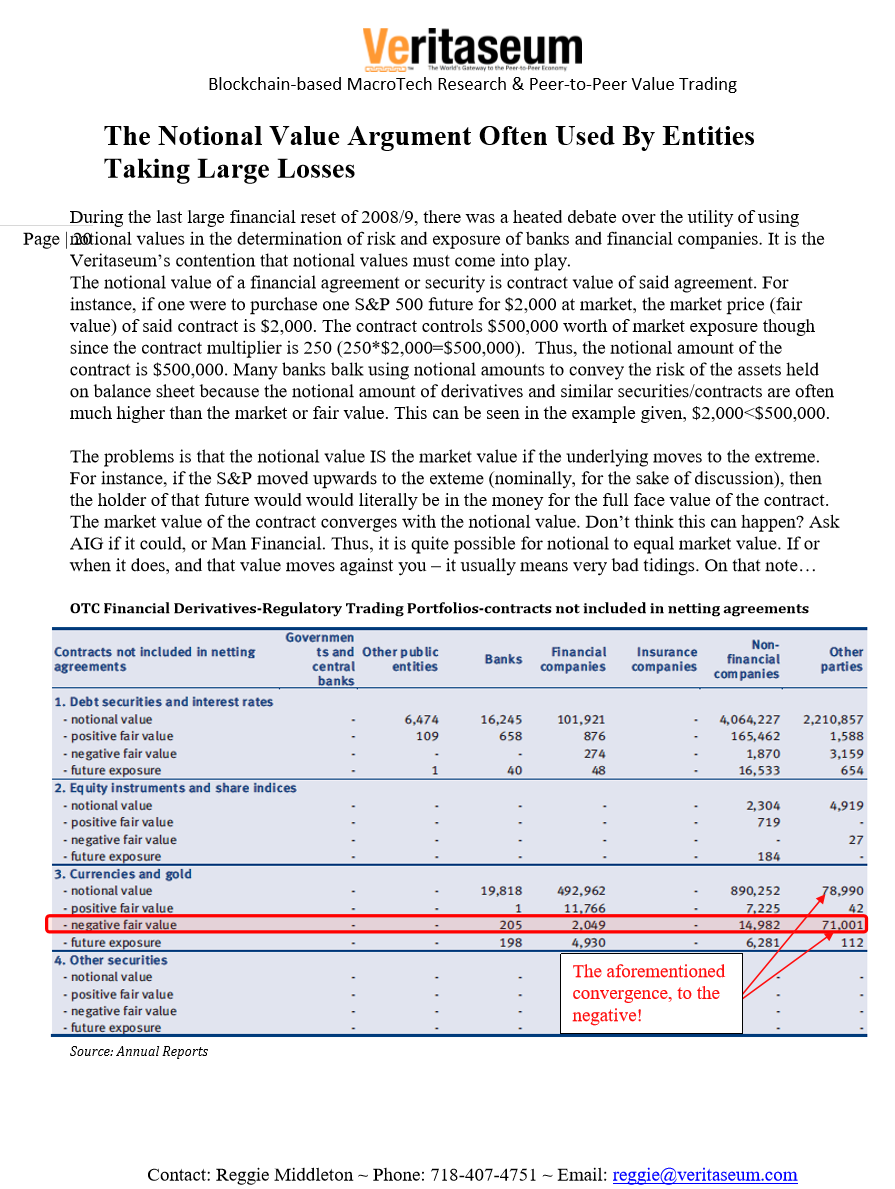

In January of 2008, we warned (in exquisite detail) of the collapse of Bear Stearns. It was 2 months before Bear Stearns actually fell, while it was trading in the $100s and still had buy ratings and investment grade AA or better from the ratings agencies. See for yourself: Is this the Breaking of the Bear? As part of the analysis, we did a counterparty risk profile, see below:

Counterparty Risk

| In $million | OTC Derivative credit exposure ($ million) | ||||||

| TThe table summarizes the counterparty credit quality of the company's exposure with respect to OTC derivatives | |||||||

| Rating(2) | Exposure | Collateral (3) | Exposure, Net of Collateral (4) | Percentage of Exposure, Net of Collateral | Total exposure a % of Total assets | Net exposure as a % of Total assets | Net exposure as a % of equity |

| AAA | 3,369 | 56 | 3,333 | 42% | 0.8% | 0.8% | 25.6% |

| AA | 6,981 | 4,939 | 2,153 | 27% | 1.8% | 0.5% | 16.6% |

| A | 3,869 | 2,230 | 1,784 | 23% | 1.0% | 0.4% | 13.7% |

| BBB | 354 | 239 | 203 | 3% | 0.1% | 0.1% | 1.6% |

| BB and lower | 1,571 | 3,162 | 322 | 4% | 0.4% | 0.1% | 2.5% |

| Non-rated | 152 | 223 | 94 | 1% | 0.0% | 0.0% | 0.7% |

| 16,296 | 10,849 | 7,889 | 100% | 4.1% | 2.0% | 60.7% | |

| (1) Excluded are covered transactions structured to ensure that the market values of collateral will at all times equal or exceed the | |||||||

| related exposures. The net exposure for these transactions will, under all circumstances, be zero. How this is accomplished is beyond our ken, and likely not at true in the event of a liquidity crisis. | |||||||

| (2) Internal counterparty credit ratings, as assigned by the Company’s Credit Department, converted to rating agency equivalents. (3) Includes foreign exchange and forward-settling mortgage transactions) as of August 31, 2007 | |||||||

Banco Popuar is slated to merge with Banco Popular Milano. We have performed a deep dive analysis on this bank as a standalone entity and assessed the synergistic benefits of a newly formed combined entity. Anyone wishing access to that report can purchase it from us by contacting me, reggie AT Veritaseum dot com.

We are anxious to provide macro analysis, deep dive fundamental analysis, and blockchain consulting for banks, buyside institutions and particularly investors (the clients of the money center banks). We were the first entitiy to apply for patent protection for the capital markets application of blockchain tech. We were the first entity to launch and clear blochchain based securities, and we were the guys that called the banking, real estate, European sovereign debt, and mobile tech moves of the last ten years. We know what we're doing, and we know how to apply this blochchain tech correctly - the first time around.

The aforementioned report also states the likelihood of a currency war of competitive devaluations if more central banks use negative rates to pace up their economy. We have declared a currency war among macro-economically warring nations over a year ago. Reference:

- Despite What You Don't Hear In The Media, It's ALL OUT (Currency) WAR! Pt. 1 - ...er, as excerpted from Wikipedia: Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relati ... Created on 25 January 2015

- Stab, er... I Mean... Beggar Thy Neighbor - It's ALL OUT (Currency) WAR! Pt 2 - Here Comes The Boom! By now, everybody who cares knows about the Swiss National Bank's removal of its EUR floor, and the havoc that it caused to FX brokerages around the world (Currency Brokers Fightin ... Created on 26 January 2015

- As US Companies Report, Signs of Imported Unemployment/Deflation Appear: It's ALL OUT (Currency) WAR! Pt. 2.5 - In "Despite What You Don't Hear In The Media, It's ALL OUT (Currency) WAR! Pt. 1" I detailed what happened the only other time in modern history we've had a global currency war: ... currency ... Created on 27 January 2015

- It's All Out War, Pt 3: Is the Danish Krone Peg to Euro More Fragile Than Glass Beads? The Danish National Bank Infers So!- ... t it is highly unlikely that the Swiss will be the only nation that realizes it can't run lockstep with the behemoth that is the ECB in devaluing its currency. Expect to see practically all of the nor ... Created on 10 February 2015

- Translating Goldman Sachs 2015 Recommendations As UltraCoin Trade Setups pt 2- ... 50 long ETF (speculating that the top 50 EZ equities will rise from currency wars & QE) and pay exposure to the ProShares Ultra Euro ETF (ULE) (with minimum of 2x leverage set in UltraCoin client, ...

- Monetizing The Spear That The Swiss National Bank Hurled At Swiss Banks and Insurers

- "Fu$k the Fundamentals!": Negative Rates In EU Will Absolutely Wreck the Very System the ECB Sought to Save - ... t's not as if there's that much equity in the system. Once two or three counterparties "legally" default, the system comes tumbling down! Take your own high leverage positions on every soveriegn, cur ...

- How to Blow a Trillion Dollars and Look Like You (Don't) Know What You're Doing While Blowing It- ... I declared that it was not going to work as planned. As a matter of fact, I made it clear that there is clear evidence of diminishing returns in QE currency wars as a form of monetary policy, reference: ...

For those who want to know where all of this came from, read...

The Central Banker's Definition of Money is Obviously Wrong, And That's Not Taking Into Consideration Veritaseum Technology and also The Real Definition of Money in a Modern Economy and The Global Currency War - USA Edition.

Starting the 3rd quarter of 2016, Veritaseum will embed links throughout all of its research to allow users to easily (with the click of a link) trade on the research with over 45,000 tickers in all asset classes and major and exotic currency pairs – on a peer-to-peer basis with:

- No credit risk

- No counterparty risk

- No broker

- No centralized brokerage or exchange account

- And no excessive costs.

Play with the prototype Veritaseum client here. Learn more about pathogenic finance here (video) and here (research report), and how we’re ushering in the peer-to-peer economy here – or learn more about Veritaseum here (presentation).