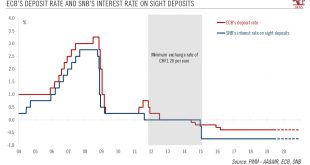

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months. How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the...

Read More »Swiss monetary policy – it’s (almost) all about the Swiss franc

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months.How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the ECB, especially in the case of a small 10 basis point deposit rate cut by the...

Read More »Das Einmaleins des neuen Leitzinses

Wie schon beim Libor teilt die Nationalbank mit dem Leitzins mit, wo sie die Kurzfristzinssätze haben will: SNB-Präsident Thomas Jordan. Foto: Anthony Anex (Keystone) Die Schweizerische Nationalbank (SNB) führt neu einen Leitzins ein. Hatte sie denn bis jetzt gar keinen? Doch, hatte sie, aber der hiess anders. Nutzen wir doch die Gelegenheit, um zu klären, was eigentlich ein Leitzins ist. Und was sich nun geändert hat....

Read More »How dovish can Swiss monetary policy go?

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have increased. Since the last SNB meeting in...

Read More »How dovish can Swiss monetary policy go?

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates. At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit,...

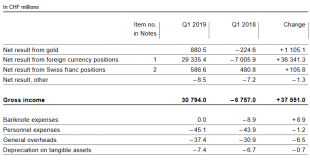

Read More »SNB Results: Big Win After Big Loss in Q4 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »Swiss Policy Mix Review

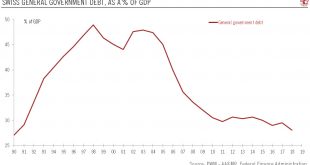

Despite a record of federal budget surpluses, don’t count on fiscal policy to relieve pressure on the SNB The Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of...

Read More »Swiss policy mix review

Despite a record of federal budget surpluses, don't count on fiscal policy to relieve pressure on the SNBThe Swiss federal budget is governed by a strict expenditure rule, which is enshrined in the Constitution. Since its introduction, the ratio of public debt-to-GDP has been significantly reduced, falling back to its early-90’s level. At the close of 2018, the Swiss federal budget registered a significant surplus of CHF 2.9 billion, compared with budget projections for a surplus of CHF 295...

Read More »“Die SNB schuldet den Pensionskassen nichts (Nothing the SNB Owes to Pension Funds),” NZZ, 2019

NZZ, March 13, 2019. PDF. Long-term real interest rates do not reflect monetary policy. In the recent past, monetary policy has contributed to lower fixed-income interest rates but also to higher returns on other asset classes. Complaining about low rates but not adjusting one’s portfolio makes little sense; there is no “financial repression.” If politicians want to subsidize pension funds they should contribute funds from the government budget rather than asking the central bank to...

Read More »“Die SNB schuldet den Pensionskassen nichts (Nothing the SNB Owes to Pension Funds),” NZZ, 2019

NZZ, March 13, 2019. PDF. Updated: Ökonomenstimme, March 22, 2019. HTML. Long-term real interest rates do not reflect monetary policy. In the recent past, monetary policy has contributed to lower fixed-income interest rates but also to higher returns on other asset classes. Complaining about low rates but not adjusting one’s portfolio makes little sense; there is no “financial repression.” If politicians want to subsidize pension funds they should contribute funds from the government...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org