From the SNB’s press release regarding the newly established BIS Innovation Hub Centre in Switzerland: “The Swiss Centre will initially conduct research on two projects. The first of these will examine the integration of digital central bank money into a distributed ledger technology infrastructure. This new form of digital central bank money would be aimed at facilitating the settlement of tokenised assets between financial institutions. Tokens are digital assets...

Read More »BIS Innovation Hub Centre in Switzerland

From the SNB’s press release regarding the newly established BIS Innovation Hub Centre in Switzerland: The Swiss Centre will initially conduct research on two projects. The first of these will examine the integration of digital central bank money into a distributed ledger technology infrastructure. This new form of digital central bank money would be aimed at facilitating the settlement of tokenised assets between financial institutions. Tokens are digital assets that can be transferred...

Read More »How to Prevent Cash Hoarding when Interest Rates are Strongly Negative

On swissinfo.ch, Fabio Canetg explains how the Swiss National Bank prevents banks from hoarding cash rather than holding reserves at the central bank (which pay negative interest). He points to the following sentence in the SNB’s December 2014 press release (my emphasis) and he speculates that banks could, in principle, implement similar schemes to keep depositors from withdrawing cash: The threshold currently corresponds to 20 times the minimum reserve requirement for the reporting...

Read More »FX Weekly Preview: Six Things to Watch in the Week Ahead

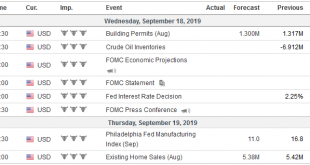

The prospect of a third trade truce between the US and China helped underpin the optimism that extended the rally in equities. Bond yields continued to back-up after dropping precipitously in August, led by a more than 30 bp increase in the US yield benchmark. The Dollar Index fell for the second consecutive week, something it had not done this quarter. United States The Federal Reserve’s meeting on September 18 is the most important calendar event in the week...

Read More »Swiss National Bank – Between a rock and a hard place

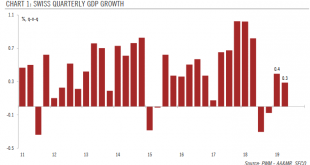

We expect the Swiss National Bank to stay on hold at its next policy meeting, but a lot will depend on ECB and Fed meetings. Uncertainties and global slowdown are weighing on business investment in Switzerland, while household consumption growth has been slowing. Swiss GDP rose by 0.3% q-o-q in Q2 (down from 0.4% in Q1), mainly due to spending in healthcare, housing and energy. Previous quarters were revised down and now show that Switzerland was in a technical...

Read More »SNB Jordan: Cannot say how long negative interest rates will last

. SNBs Jordan on the wires The Swiss national banks Jordan is on the wires saying: He cannot say how long negative interest rates will last Negative rates are necessary for now Interest rate spreads like important role for exchange rates The USDCHF is trading higher today. It currently trades at 0.9861. The 100 hour moving average stalled the rally at 0.98737 today. The 200 hour moving average at 0.98479 was rebroken to the upside earlier. That is now support....

Read More »Nationalbank – SNB-Präsident Jordan: Libra könnte Geldpolitik gefährden

Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank, in einem früheren Interview mit cash. Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten “eher den Charakter von spekulativen Anlageinstrumenten als von ‘gutem’ Geld”, sagte der SNB-Präsident in einer Rede an der Universität...

Read More »Swiss National Bank Presents New 100-Franc Note

100-Franc Note - Click to enlarge The Swiss National Bank (SNB) will begin releasing the new 100-franc note on 12 September 2019, bringing the issuance of the ninth banknote series to a close. The first denomination in the new series, the 50-franc note, entered circulation on 13 April 2016. This was followed by the 20, 10, 200 and 1000-franc notes, which were released at six or twelve-month intervals. The inspiration behind the new banknote series is ‘The many...

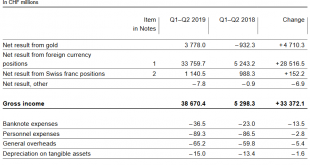

Read More »SNB reports a profit of CHF 38.5 billion for the first half of 2019.

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the...

Read More »Looking for evidence of SNB intervention

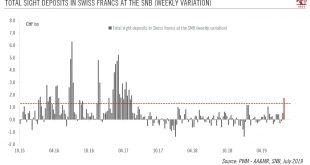

Before any rate cut, intervention in the forex market is likely to remain the Swiss National Bank’s first line of defence to counter any appreciation of the CHF.Data published on Monday revealed that commercial banks’ sight deposits at the Swiss National Bank (SNB) rose by CHF1.7bn last week (see chart), the largest weekly increase since May 2017. The amount suggests the SNB intervened in the FX market, probably ahead of the ECB’s meeting last Thursday.Weekly releases of commercial banks’...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org