The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »Ein rationaler Erklärungsansatz für negative Zinsen

In einem Beitrag auf LinkedIn am 29. Dezember 2019 wirft Prof. Erwin Heri von der Universität Basel in die Runde, dass negative (Real-)Zinsen möglicherweise vernünftig sind. Sie wären das natürliche Ergebnis der Präferenzen der Wirtschaftssubjekte – und nicht primär das Ergebnis einer Manipulation von Zentralbanken. Als Indizien werden angeführt: die über Jahrhunderte stetig sinkende Tendez der Realzinsen die Demographie der materielle Wohlstand Aus folgenden...

Read More »Is the SNB In Control of the Amount of Sight Deposits?

The current monetary environment in Switzerland is as far from ordinary as can be imagined: negative interest rates (from -0.75% in the short term to -0.25% for 50Y govt bonds) and oceans of liquidity (M0 has grown to 50% of M3 from pre-crises levels of around 8%). The Swiss National Bank faces criticism because it is seen as contributing to this state of affairs. Both the critique and the counter-arguments have many facets. Let us pick just one of them: is the SNB...

Read More »Sollen Zentralbanken Klimapolitik betreiben?

Warum die Forderung nach einer klimafreundlichen Anlagepolitik schwierig bis gar nicht umzusetzen ist. Wartet auf eine EU-gültige Definition des Begriffs «grüne Anlagen»: EZB-Präsidentin Christiane Lagarde. Foto: Reuters Aufgrund ihrer extrem expansiven Geldpolitik sind sowohl die EZB als auch andere wichtige europäische Zentralbanken wie die SNB zu Grossinvestoren auf Anleihenmärkten und teilweise auch an Börsen geworden. Sie halten riesige Portfolios...

Read More »Central Banks Zoom In on CBDC

According to a BIS press release, several leading central banks collaborate with the BIS on matters relating to the introduction of CBDC: The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home...

Read More »Central Banks Zoom In on CBDC

According to a BIS press release, several leading central banks collaborate with the BIS on matters relating to the introduction of CBDC: The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home jurisdictions. The group...

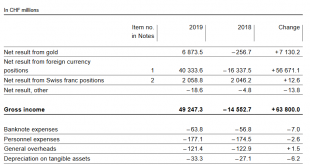

Read More »Swiss National Bank expects annual profit of 49 billion francs

SNB building in Bern According to provisional calculations, the Swiss National Bank (SNB) expects to make a profit of around CHF 49 billion in 2019. Most of this comes from the rising value of the SNB’s foreign currency positions (+CHF 40 billion) and a valuation gain on gold holdings (+CHF 6.9 billion). After adjusting reserves, the SNB will have CHF 88 billion available for distribution. Since the announcement SNB shares have risen 2% to CHF 5,600. The central bank...

Read More »Swiss National Bank expects annual profit of 49 billion francs

According to provisional calculations, the Swiss National Bank (SNB) expects to make a profit of around CHF 49 billion in 2019. SNB building in BernMost of this comes from the rising value of the SNB’s foreign currency positions (+CHF 40 billion) and a valuation gain on gold holdings (+CHF 6.9 billion). After adjusting reserves, the SNB will have CHF 88 billion available for distribution. Since the announcement SNB shares have risen 2% to CHF 5,600. The central bank plans to pay...

Read More »Negativzinsen, unser notwendiges Übel

Warum die Schweizer Negativzinspolitik trotz aller leidigen Nebenwirkungen bis auf weiteres unumgänglich ist. Muss sich der EZB und deren zementierten Negativpolitik anpassen: SNB-Präsident Thomas Jordan. Foto: Keystone/Anthony Anex Negativzinsen in der Schweiz sind ein Sonderfall. Denn die Schweiz hat keine Negativzinsen, um das Wirtschaftswachstum anzukurbeln oder um bedrohte Schuldner vor dem Zusammenbruch zu retten. Die Negativzinsen hierzulande haben nur einen...

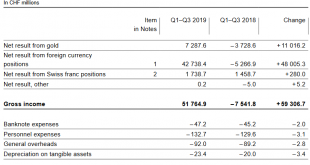

Read More »The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org