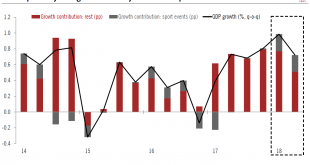

The latest headline Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ (SECO) quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2 (2.9% q-o-q annualised, 3.4% y-o-y), slightly above our 0.6% projection and consensus (0.5% q-o-q). This was the fifth consecutive quarter with an above average rate. Q1 GDP growth was significantly revised up to 1.0% q-o-q (from 0.6%). Thus,...

Read More »Switzerland Q2 growth numbers are impressive, but details are mixed

Manufacturing and sports events served as boosts to growth, while domestic consumption was a letdown.The latest Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2, slightly above our 0.6% projection and consensus. Average growth in the first half of 2018 was therefore the strongest since 2010. Nevertheless, GDP was again boosted by special factors, namely sports events, which added 0.2...

Read More »Inflation ist nicht Inflation

Das südamerikanische Land Venezuela führt gerade vor, was geschehen kann, wenn die Inflation ausser Kontrolle gerät. Der Internationale Währungsfonds rechnet bis Ende Jahr mit einer Teuerung von 1 Million Prozent. Eine solche Inflation wird etwa erreicht, wenn sich das Preisniveau rund alle vier Wochen verdoppelt. Wenn sich Geld in einem solchen Ausmass entwertet, verliert es jeden Nutzen, denn dann kann es seine...

Read More »SNB banknote app updated for new 200-franc note

The Swiss National Bank’s ‘Swiss Banknotes’ app is designed to help the public familiarise themselves with the new banknotes. The popular app, which has been downloaded some 100,000 times, now also showcases the new 200-franc note. It can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores. Anyone who has already downloaded the software can update it via the...

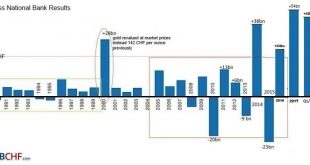

Read More »SNB reports a profit of CHF 5.1 billion for the first half of 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More »Swiss National Bank commits to FX Global Code and supports establishment of foreign exchange committee

The Swiss National Bank (SNB) has signed a Statement of Commitment to the FX Global Code (“Code”), thereby demonstrating that its internal processes are consistent with the principles of the Code. It also expects its regular counterparties to adhere to the Code and comply with the agreed rules of conduct. Published on 25 May 2017, the Code outlines principles of good practice developed by central banks and market...

Read More »Sovereign Money Referendum: A Swiss Awakening to Fractional-Reserve Banking?

On Sunday 10 June 2018, Switzerland’s electorate voted on a referendum calling for the country’s commercial banks to be banned from creating money. In a country world-famous for its banking industry, this was quite an interesting turn of events. Known as the Sovereign Money Initiative or ‘Vollgeld’, the referendum was brought to the Swiss electorate in the form of a ‘Popular Initiative‘. The Sovereign Money referendum...

Read More »Nach Vollgeld-Schlacht: Wir Schweizer dürfen nie mehr zum Spielball ausländischer Ideologen werden

Wer sich intensiv mit der fachlichen Materie „Vollgeld-Initiative“ auseinandergesetzt hat, kann aufatmen. Wäre diese Initiative angenommen worden, hätte deren Umsetzung unser Land in ein wirtschaftliches und politisches Chaos gestürzt. Es hätte nur zwei Möglichkeiten gegeben: entweder die Initiative einfach ignorieren und nicht umsetzen (wie das in unserem Land mehr und mehr in Mode kommt) oder sie nachträglich für...

Read More »SNB Statement on the outcome of the popular vote of 10 June 2018

The Swiss National Bank (SNB) has acknowledged the outcome of the popular vote on the sovereign money initiative. The SNB has a constitutional and statutory mandate to pursue a monetary policy serving the interests of the country as a whole. It is charged with ensuring price stability while taking due account of economic developments. The adoption of the sovereign money initiative would have made it considerably more...

Read More »Switzerland’s vote to change its monetary system – sensible or silly?

Sometimes Swiss voters are presented with questions that only specialists are equipped to answer. The vote on 10 June 2018 to change their monetary system appears to be one of these. © Valeriya Potapova | Dreamstime.com - Click to enlarge On the surface it appears simple. Upon closer inspection it contains much complexity and uncertainty, compounded by a widespread misunderstanding of how the financial system works –...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org