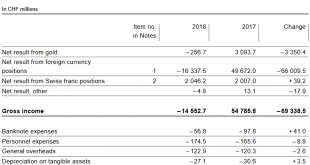

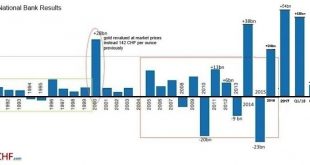

Overview The SNB earned 2 billion on negative interest rates, but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, the results have huge swings that depends on the FX rate. But the SNB may lose 50 billion in one year and win 60...

Read More »Folgt nun der umgekehrte Frankenschock?

An ihrer ersten Sitzung im neuen Jahr hat die Europäische Zentralbank (EZB) ihren Kurs bestätigt. Das Wertschriftenkaufprogramm ist definitiv beendet. Fortan kauft sie netto keine zusätzlichen Anleihen mehr zu. Sondern sie ersetzt nur noch die bestehenden Papiere, die sie in ihrem Portefeuille hält. Läuft eine Anleihe aus, erwirbt sie mit den Mitteln vergleichbare Anleihen, mehr nicht. Der Unterschied: Bisher druckte...

Read More »SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks. Entities with fintech licences whose business model makes them significant participants in the area of Swiss franc payment transactions will therefore be granted access to the SIC system and to...

Read More »SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks. Entities with fintech licences whose business model makes them significant participants in the area of Swiss franc payment transactions will therefore be granted access to the SIC system and to sight deposit accounts. The Swiss Financial Market Supervisory...

Read More »SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks. Entities with fintech licences whose business model makes them significant participants in the area of Swiss franc payment transactions will therefore be granted access to the SIC system and to sight deposit accounts. The Swiss Financial Market Supervisory...

Read More »Lenders pay to lend money to Switzerland

On 28 December 2018, Italy issued government bonds maturing in 2028 at an effective interest rate of 2.7%1. Interest rates like this combined with the scale of Italian public debt (157% of GDP) mean Italian taxpayers spend more on public debt interest than they do on education. In 2015, Italy spent 4.1% of GDP on public debt interest and only 2.8% of GDP on education. © Byvalet | Dreamstime.com This week, Switzerland issued bonds maturing in 2030 at an effective interest rate of -0.041%2....

Read More »Swiss National Bank Suffers $15 Billion Loss On 2018 Market Rout

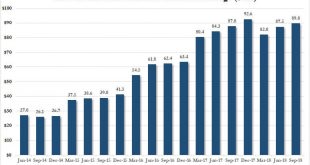

SNB US Stock Holdings In the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB’s US listed long holdings rose by over $2 billion to $90 billion, but all of this was due to the price appreciation as the central bank sold around $7bn of equities in Q3. This compares to purchases during 1H18...

Read More »SNB reports a loss of CHF 7.8 billion for third quarter of 2018

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in...

Read More »Rückenwind für die SNB

Die Nationalbank hat die Schweizer Zahlungsbilanz für das zweite Quartal veröffentlicht. Damit bietet sich erstmals die Gelegenheit, nachzuprüfen, ob die viel zitierten Europaängste Fluchtkapital ins Land gespült haben. Auch ohne Intervention läuft alles in ihrem Sinne: Schweizer Nationalbank in Bern. Foto: Getty Images Zur Erinnerung: Im März wurde in Italien ein neues Parlament gewählt, die den beiden Europagegnern...

Read More »Der Nationalbank sind die Hände gebunden

Das latente Aufwertungsrisiko des Frankens beschränkt ihren Handlungsspielraum: SNB in Bern. (Foto: Keystone/Gaetan Bally) - Click to enlarge EZB-Präsident Mario Draghi konstatierte letzte Woche zufrieden, dass die aktuellen Turbulenzen in einzelnen Staaten auch dort bleiben und nicht andere Länder anstecken. Seine Kollegen in der Nationalbank, die diese Woche ihren geldpolitischen Entscheid fällen, dürften das etwas...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org