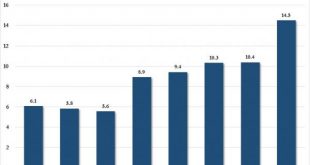

Overview In the second quarter of 2016, the current account surplus amounted to CHF 17 billion. This was CHF 3 billion less than in the year-back quarter, mainly due to a decline in the receipts surplus in primary income (labour and investment income). The receipts surplus in primary income was CHF 1 billion, compared to CHF 7 billion in the year-back quarter. By contrast, the second-quarter surplus of receipts from...

Read More »Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

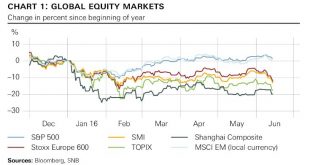

Investec Switzerland. © Vividrange | Dreamstime.com The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on...

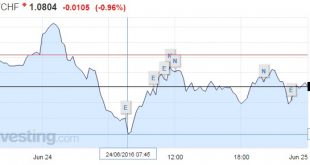

Read More »SNB Intervenes during Brexit Turmoil

SNB interventions During the Brexit turmoil on Friday, the Swiss National Bank has intervened in markets. Just after they got into the office, at 7.45 am CET, they started the interventions. Apparently the Singapore office did not have a mandate to do interventions. The central bank drove the EUR/CHF price from a low of 1.0646 towards 1.08. FX traders might have moved it higher to 1.0850. We do not think that the...

Read More »SNB’s Maechler on Negative Rates and our Critique

At the news conference of the Swiss National Bank, Andréa Maechler discusses the current situation of financial markets and the negative interest environment. She explains the recent Swiss experience with negative interest rates. Negative rates have the desired effect: It makes holding money on Swiss bank accounts less attractive. We see different issues with this explanation: Negative rates make only holding money on...

Read More »News conference Swiss National Bank 2016, Fritz Zurbrügg

Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 16.06.2016 Complete text: PDF(74 KB) Major Points: UBS and Credit Suisse: Capital Situation improved further: fully compliant with the requirements of the current Swiss ‘too big to fail’ regulations (TBTF1) for 2019.The regulation until 2019, however is only temporary. From 2020...

Read More »News conference Swiss National Bank, Thomas Jordan

Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank News conference of the Swiss National Bank, Berne, 16.06.2016 Complete text: PDF (96 KB) Major points: SNB rate remains –0.75% and the target range for the three-month Libor unchanged at between –1.25% and –0.25%. Negative interest helps to maintain the interest rate differential between the Swiss franc and other currencies, hence...

Read More »FX Weekly Preview: Four Central Bank Meetings and More

A couple of weeks ago, the four central banks that meet in the coming days were thought to be a big deal. Numerous Federal Reserve officials were preparing the market for a summer hike. Risks of a new downturn in Japan spurred speculation that BOJ would ease policy. On the other hand, the neither the Bank of England nor the Swiss National Bank were expected to move ahead of the UK referendum on June 23. Besides...

Read More »Swiss Reserves: Not what They Seem

This posts shows again the stupidity of the financial media, that mixes up assets and liabilities for central banks.SNB FX reserves are assets. They are in different foreign currencies and subject to the valuation effect of these currencies.Our weekly sight deposits report show the liabilities. They are measured in Swiss franc and therefore not subject to valuation effects. They are the only way to measure...

Read More »Geldreform — Weltreform

Urs Birchler Am Dienstagabend gab ich an der Uni Zürich meine Abschiedsvorlesung. Inhalt: Geldreformen, die gleichzeitig als Weltreformen gedacht waren oder sind: Corvaja’s Bankokratie, Gesell’s Freiwirtschaft, die Vollgeldinitiative, der Euro. Fazit: Der Versuch, über das Geld die Welt zu erneuern, ist zum Scheitern verurteilt. Im schlimmsten Fall gehen dabei sowohl das Geld kaputt, als auch die angestrebte neue Welt. Bestes Beispiel: der Euro. Der Versuch, Europa via Gemeinschaftswährung...

Read More »As Carl Icahn Was Selling Apple, This Central Bank Was Furiously Buying

On April 28, the catalyst the sent the stock price of AAPL to its post-August 25 frash crash lows, and launched a tremor not only within the Nasdaq but the broader market, was news that after several years of being AAPL’s biggest cheerleader, even coming up with price targets north of $200, Carl Icahn had suddenly cooled on the China-focused growth company, and had liquidated his entire stake. But as Icahn was selling, or just before as we don’t know precisely when Icahn, who has since...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org