On April 28, the catalyst the sent the stock price of AAPL to its post-August 25 frash crash lows, and launched a tremor not only within the Nasdaq but the broader market, was news that after several years of being AAPL’s biggest cheerleader, even coming up with price targets north of $200, Carl Icahn had suddenly cooled on the China-focused growth company, and had liquidated his entire stake. But as Icahn was selling, or just before as we don’t know precisely when Icahn, who has since...

Read More »The Twilight Of The Gods (aka Central Bankers)

The current financial market volatility increasingly reflects loss of faith in policy makers. Celebrity central bankers are learning that they must constantly produce new miracles for their followers. First, the measures implemented since 2009 created an artificial stability and an asset price boom in many markets. But the absolute rate of GDP expansion and level of price changes is inadequate to solve global debt problems. Second, new initiatives seem the risky response of clever...

Read More »SNB Increased Equities Share from 18 to 20% with Purchases

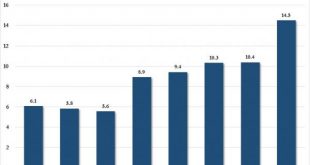

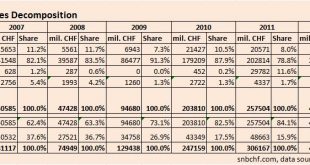

The SNB increased the equities share from 18% to 20% in Q1/2016. Purchases focused on US equities.It raised holdings in U.S. Equities 32 percent in the first Q1 2016, from $41.3 billion at the end of last year. The S&P 500 rose 0.8 percent over that period. This makes obvious that the central bank goes higher risk. The first risk is the risk on equities, the second one is the dollar that is currently quite expensive. Main Positions: Swiss National Bank, 2007-2013 Still in 2009, the...

Read More »Gold, Bonds and Negative Interest Rates Give SNB a Q1 profit

The Swiss National Bank has achieved a profit of 5.7 billion CHF in Q1/2016. The total yield on assets per annum was 3.4%.The main contribution comes from gold with price change of 10% in this quarter, hence a total yield of 48%.The total yield on debt was positive with +0.2% thanks to negative interest rates.The deflationary environment let to rising bond prices. Bonds, make up 74% of the SNB portfolio. Here the details of our calculation: Position Total Positionin bn CHF % of Total...

Read More »Swiss National Bank: Composition of Reserves and Investment Strategy

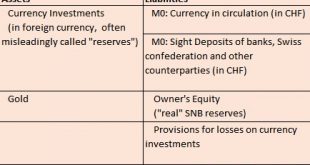

The Q1/2016 update on the SNB investment strategy and its assets. The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.The SNB balance sheet looks as follows: In this post we will...

Read More »Geldreform — Weltreform

Urs Birchler Hier ein Veranstaltungshinweis in eigener Sache: Abschiedsvorlesung von Prof. Dr. Urs BirchlerProfessor of Banking am Institut für Banking und Finance. Das Geldwesen ist aus den Fugen, Reformvorschläge blühen. Freigeld, Vollgeld, Bit-Geld, Negativzins, Bargeldverbot: Was gestern als Wahn erschien, ist heute Wirklichkeit — und umgekehrt. Ein Blick durch’s monetäre Kaleidoskop in die Zukunft… Dienstag, 24. Mai 2016, 18.30Universität Zürich, Aula KOL-G-201, Rämistrasse 71, 8006...

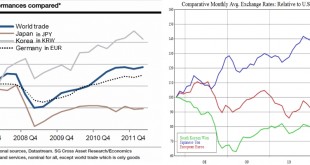

Read More »History of Bank of Japan Interventions

We show the history of Japanese FX interventions. The Japanese only intervened when the USD/JPY was under 80. Therefore the 2016 FX intervention threads at 108 are ridiculous.As opposed to the Swiss National Bank, the Japanese only talk, they do not fight. 2016 Japanese interventions thread Once the Fed finally reduced rate expections, the USD/JPY depreciated from 120 to 108 in a single quarter. (via Reuters and investing.com) Gains for stock markets and a warning of the chances of...

Read More »Investment policy in times of high foreign exchange reserves

The Money Market Event is the biggest feast of the Swiss National Bank and a selected list of money managers that work together with the central bank. It is initiated by important speeches and ended with a generous buffet dinner. In the first speech, Andrea Mächler addressed three points: The expansion of the SNB balances sheet as measure against the so-called “strong franc” in a historic perspective. How the SNB takes over currency risks from the private sector. Details on the balance...

Read More »Despite risks a more negative Swiss interest rate possible says SNB’s Maechler

Investec Switzerland. The Swiss National Bank won’t rule out another interest rate cut, though any measure must be weighed with a view to its potential side effects, Governing Board Member Andrea Maechler said. © Yulan | Dreamstime.com “We’re always looking into other options, if needed — we’re looking into all of them,” Maechler said at an event for financial professionals in Zurich on Thursday. “We’re not excluding any of them, including a possible further reduction in...

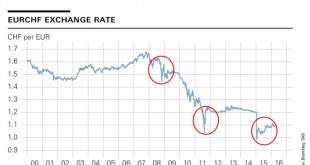

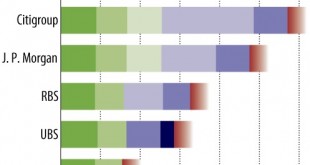

Read More »The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it’s economic data. That’s because the vast majority don’t understand how the Forex markets work. It’s not insulting – it’s a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions – but none against a central bank....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org