Despite the deeply negative inflation rate, the SNB has become somewhat less sensitive to persistent undershoots of its inflation target. According to Swiss Federal Statistical Office, consumer prices in Switzerland remained broadly stable at -1.3% y-o-y in January, in line with consensus expectations and thus marking the seventeenth consecutive month in negative territory. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) was stable at -0.9% y-o-y in January. The breakdown by main group indices showed that year on year, transport prices (-4.6% y-o-y) recorded the biggest drop. The price index of housing and energy decreased as well, mainly driven down by the sharp fall in oil prices (-10.8% y-o-y). Longest period of low inflation Since the financial crisis in 2008, year-on-year Swiss consumer price readings have been negative on three occasions (see the grey areas in the chart below). In terms of magnitude, Swiss headline inflation (-1.4% y-o-y) reached its lowest point since 1959 in November 2015, before rebounding slightly. Several factors explain the weak performance of Swiss inflation. In the latest phase which started in September 2014, inflation fell back into negative territory triggered by the sharp fall in oil prices.

Topics:

Nadia Gharbi considers the following as important: inflation, Macroview, SNB, Switzerland

This could be interesting, too:

investrends.ch writes Schweizer Inflation fällt etwas stärker als gedacht

investrends.ch writes SNB erzielt nach 9 Monaten einen Gewinn von 12,6 Milliarden Franken

investrends.ch writes SNB hat im zweiten Quartal Devisen für 5,1 Milliarden Franken gekauft

investrends.ch writes SNB belässt den Leitzins bei null Prozent

Despite the deeply negative inflation rate, the SNB has become somewhat less sensitive to persistent undershoots of its inflation target.

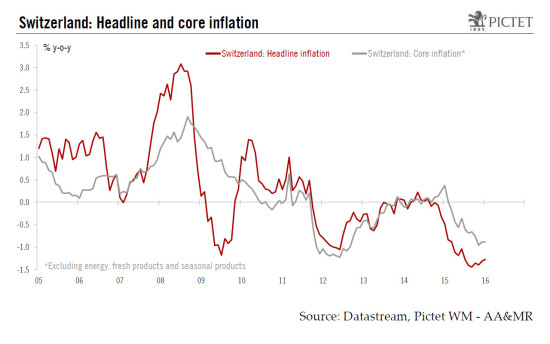

According to Swiss Federal Statistical Office, consumer prices in Switzerland remained broadly stable at -1.3% y-o-y in January, in line with consensus expectations and thus marking the seventeenth consecutive month in negative territory. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) was stable at -0.9% y-o-y in January.

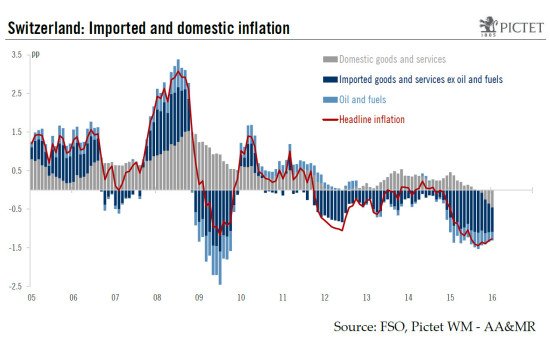

The breakdown by main group indices showed that year on year, transport prices (-4.6% y-o-y) recorded the biggest drop. The price index of housing and energy decreased as well, mainly driven down by the sharp fall in oil prices (-10.8% y-o-y).

Longest period of low inflation

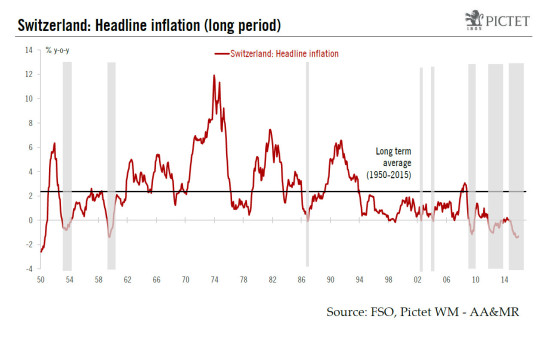

Since the financial crisis in 2008, year-on-year Swiss consumer price readings have been negative on three occasions (see the grey areas in the chart below). In terms of magnitude, Swiss headline inflation (-1.4% y-o-y) reached its lowest point since 1959 in November 2015, before rebounding slightly.

Several factors explain the weak performance of Swiss inflation. In the latest phase which started in September 2014, inflation fell back into negative territory triggered by the sharp fall in oil prices. Thereafter, the SNB’s decision to abandon its currency floor on 15 January 2015 and the subsequent abrupt appreciation of Swiss franc added to the downward pressure.

Heightened pressure on corporate margins

On top of direct disinflationary influence of imported goods, in particular oil prices, more indirect effects have started to emerge in recent months. The contribution of domestic goods and services to the annual CPI inflation rate has declined steadily over the course of the year and has been negative since September 2015. Part of the decline might be explained by price-competitiveness adjustment due to Swiss franc appreciation. In this regard, Swiss firms have reported heightened pressure on corporate margins, notably in export-oriented sectors.

Looking ahead, the renewed weakness in oil prices (-28% since October 2015 in CHF terms) has destroyed most of the favourable base effects, with headline HICP inflation now expected to remain in negative territory for the rest of the year. As a result, we have lowered our forecast for headline inflation from -0.2% to -0.6% for 2016, assuming a gradual rise in oil prices to USD 38 a barrel by the end of 2016 and a broadly stable currency (CHF 1.10 to the euro and CHF 1.00 to the USD).

No signs of a deflationary spiral at this stage

The danger of long period of negative inflation is that the economy might fall into a deflationary spiral. By deflationary spiral we mean “a vicious cycle caused by the interaction of falling prices and wages, widespread reluctance of consumer in the expectation of further price declines (i.e. households postponing their purchases) and ultimately regressive trends affecting the real economy” (SECO definition). At this stage, we see no sign of a deflationary spiral in Switzerland.

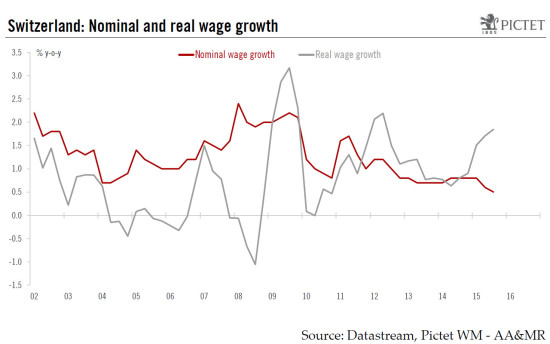

Although wage growth has been slowing since 2011, it is still positive. Latest data showed that nominal wages expanded by 0.5% y-o-y in Q3 2015 after the 0.6% y-o-y posted in Q2 (see the chart below). Positive wage growth combined with falling prices means strong real pay gains which boost spending power. In this regard, household spending was quite resilient in 2015 and is likely to remain so even though its contribution to growth is likely to be weaker in 2016 due to the deterioration expected in the labour market.

Regarding inflation expectations, short-term expectations have worsened slightly, whereas medium to long-term inflation expectations have remained pretty stable.

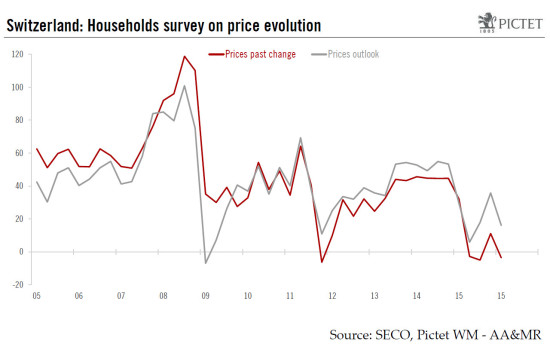

In more detail, according to the survey of households conducted by the Swiss State Secretariat of Economic Affairs (SECO) (see the chart below), households’ views on past and particularly future price trends were revised downwards. The assessment of price trends over the past twelve months deteriorated from +11 points in October to -4 points in January, close to the record low (-6 points reached in October 2011). Looking at price expectations over the next twelve months, the index also lost ground dropping from +36 points in October to +16 in January. Part of this decline can be explained by the recent decrease in oil prices.

As for medium to long-term inflation expectations, indicators are not available for Switzerland. Nevertheless, based on comments made by the SNB in its most recent bulletin (December 2015), “surveys on long-term inflation expectations continue to show that the discontinuation of the minimum exchange rate has had little impact and that expectations remain well anchored”.

Overall, nominal wage development will be a key factor to assess whether we are faced with a temporary or a persistent shock in price dynamics. Moreover, it remains to be seen whether negative second-round effects will take hold in the future.

SNB: keeping a close eye on ECB

Despite a deeply negative inflation rate, the Swiss National Bank (SNB) has become somewhat less sensitive to persistent undershoots of its inflation target of “less than 2% per year”. In a recent speech, Thomas Jordan said that “in the context of major international spillovers, small open economies must sometimes live with temporary suboptimal inflation”.

Nevertheless, the SNB remains sensitive to any new significant appreciation of the Swiss franc, as this would have a serious negative impact on inflation and growth perspectives. As the euro area is the largest market for Switzerland, fluctuations against the euro will remain a key determining factor for the SNB. For this reason, future SNB decisions will remain dependent on the ECB’s monetary policy. Due to the new easing package likely to be announced by the ECB on 10 March, pressure on the SNB will increase.

As a result, in the event of Swiss franc appreciation, a new decrease of the target rate (CHF 3-month Libor) further into negative territory is becoming increasingly likely at the next meeting on 17 March.