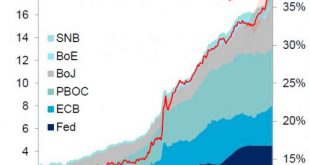

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »Weekly SNB Interventions and Speculative Positions: After French Elections

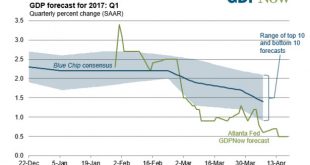

Headlines Week May 08, 2017 The centre-left politician Macron has won the French elections. He is a politician that – similar to Hollande four years ago – promises economic improvements, more investment, more jobs. As opposed to Hollande, he also advocates limitations on salaries and less social protection for workers, to restore France’s competitiveness. Mostly probably he will fail similar to his predecessor because...

Read More »Weekly SNB Interventions and Speculative Positions: Macron will Probably Win the French Elections

Headlines Week May 08, 2017 The centre-left politician Macron has won the French elections. He is a politician that – similar to Hollande four years ago – promises economic improvements, move investment, more jobs. Mostly probably he will fail similar to his predecessor because the French economic reality is simply different. His success moved the EUR/CHF up to 1.0865, mostly caused by FX speculators. But serious...

Read More »“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank’s interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the “the...

Read More »Digital Swiss Francs

The Swiss National Bank held its annual general meeting of shareholders (web TV). In response to one of the questions posed by shareholders Thomas Jordan suggested (2:58–2:59) that possibly a digital Swiss Franc might be introduced sometime in the future. Tags: Digital currency,Electronic money,Featured,M0 base...

Read More »Weekly SNB Interventions and Speculative Positions: Interventions despite Positive Outcome in France

Headlines Week May 03, 2017 The centre-left politician Macron has won the French elections. He is a politician that – similar to Hollande four years ago – promises economic improvements, move investment, more jobs. Mostly probably he will fail similar to his predecessor because the French economic reality is simply different. His success moved the EUR/CHF up to 1.0865, mostly caused by FX speculators. However serious...

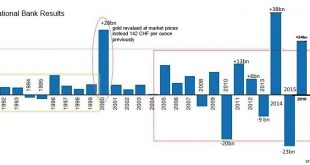

Read More »Interim results of the Swiss National Bank as at 31 March 2017

From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange...

Read More »SNB posts 7.9 billion CHF Profit in Q1

From the official news release Interim results of the Swiss National Bank as at 31 March 2017 The Swiss National Bank (SNB) reports a profit of CHF 7.9 billion for the first quarter of 2017. A valuation gain of CHF 2.2 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 5.3 billion. The SNB’s financial result depends largely on developments in the gold, foreign exchange...

Read More »Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »Switzerland at IMF and World Bank 2017 Spring Meetings in Washington, D.C.

Bern, 20.04.2017 – Federal Councillor Ueli Maurer as Head of the Swiss delegation, Federal Councillor Johann N. Schneider-Ammann and Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, will take part in the joint Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington, D.C., from 21 to 23 April 2017. Prior to these meetings, Federal Councillor Ueli Maurer...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org