At its quarterly policy assessment, the Swiss National Bank (SNB) decided to leave its monetary policy unchanged. The SNB could afford not to cut its reference rate after last week’s ECB stimulus failed to have much impact on the Swiss franc versus the euro. The target range for the 3-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%; and the SNB reiterated its willingness to intervene on the foreign exchange market to deal with short-term appreciation of the Swiss franc. The SNB also revised down its conditional inflation forecast owing to the decrease in the oil price. For the current year, inflation is forecast at -0.8%, a 0.3 percentage point decrease from December’s assessment. For 2017, the SNB predicts an inflation rate of 0.1% (previously 0.3%) and 0.9% for 2018. Regarding growth, the SNB expects a slower recovery, and it is predicting GDP growth between 1%-1.5%, instead of around 1.5% as previously. Overall, today’s statement contained no major surprises. The SNB could afford not to cut the reference rate after last week’s ECB package failed to have much impact on the Swiss franc versus the euro. In particular, the fact that the ECB did not signal more rate cuts reduced the downwards pressure on the euro.

Topics:

Nadia Gharbi considers the following as important: CHF, Macroview, Monetary Policy, SNB, Swiss Franc, Swiss monetary policy

This could be interesting, too:

investrends.ch writes Wechsel an der VR-Spitze von Julius Bär

investrends.ch writes WEF 2025: SNB schliesst Negativzinsen nicht aus

investrends.ch writes SNB mit Rekordgewinn – Bund und Kantone freuen sich

investrends.ch writes Volksinitiative: Nationalbank soll Bitcoins halten

At its quarterly policy assessment, the Swiss National Bank (SNB) decided to leave its monetary policy unchanged. The SNB could afford not to cut its reference rate after last week’s ECB stimulus failed to have much impact on the Swiss franc versus the euro.

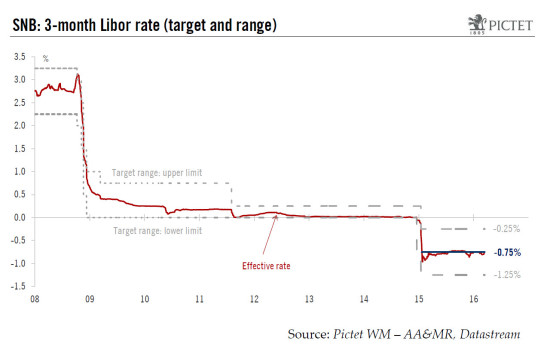

The target range for the 3-month Libor was kept between -1.25% and -0.25%; the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%; and the SNB reiterated its willingness to intervene on the foreign exchange market to deal with short-term appreciation of the Swiss franc.

The SNB also revised down its conditional inflation forecast owing to the decrease in the oil price. For the current year, inflation is forecast at -0.8%, a 0.3 percentage point decrease from December’s assessment. For 2017, the SNB predicts an inflation rate of 0.1% (previously 0.3%) and 0.9% for 2018. Regarding growth, the SNB expects a slower recovery, and it is predicting GDP growth between 1%-1.5%, instead of around 1.5% as previously.

Overall, today’s statement contained no major surprises. The SNB could afford not to cut the reference rate after last week’s ECB package failed to have much impact on the Swiss franc versus the euro. In particular, the fact that the ECB did not signal more rate cuts reduced the downwards pressure on the euro.

The SNB’s behaviour will continue to depend on the ECB’s future actions and the effect they have on the Swiss currency. We expect the SNB to remain on hold and keep rates in negative territory for the foreseeable future, with FX intervention in the event of short-term currency appreciation.

In the section below, we list possible measures in the event of further Swiss franc appreciation.

What if the Swiss franc strengthens further?

The SNB’s main objective is to ensure price stability. The SNB equates price stability “with a rise in consumer prices of less than 2% per year”. At its current level, inflation is far from the SNB’s main objective, but its mandate still remains credible given stable medium to long-term inflation expectations. Nevertheless, the Swiss economy is not shielded from falling into a deflationary spiral. As a consequence, countering Swiss franc overvaluation will remain a key element. In this regard, given the political uncertainties in Europe, aggressive monetary policy abroad and subdued global growth, an appreciation of the Swiss franc cannot be ruled out.

In this context, what type of measures could the SNB deploy? We have drawn up a list of measures, which are split into two main groups: likely measures (the ones that are possible in the light of the SNB’s recent statements) and unlikely measures (the ones that may be possible options to address currency overvaluation, and thus deflationary pressure, but are unlikely to be implemented at this stage).

Likely measures:

- Foreign currency intervention

In the event of market volatility, the SNB could intervene on the foreign exchange market to combat short-term currency appreciation. This has been one of the two main pillars (the other being negative interest rates) of the SNB’s monetary policy since January 2015.

- More rate cuts

In the event of marked appreciation of the Swiss franc, the SNB could cut its reference interest rate (3-month Libor) further into negative territory in order to re-establish an interest rate differential and thus diminish the attractiveness of Swiss franc investments. Recent comments by the SNB’s board members suggest that the central bank is comfortable with negative rates and their effectiveness in terms of policy transmission.

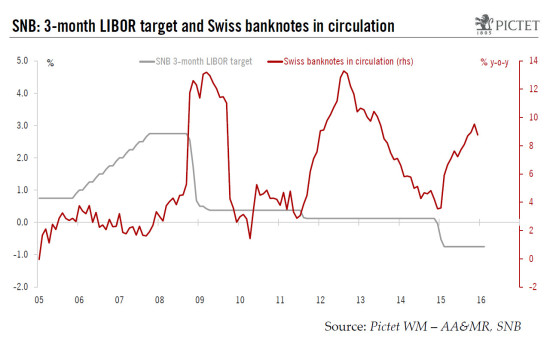

Nevertheless, lowering rates further into negative territory has two main drawbacks. First, the extent to which interest rates can go negative without precipitating cash hoarding is not unlimited. This in turn could reduce financial intermediation and weaken the monetary transmission mechanism. As shown in the chart above, a cut in reference interest rates coincides with rising Swiss franc circulation.

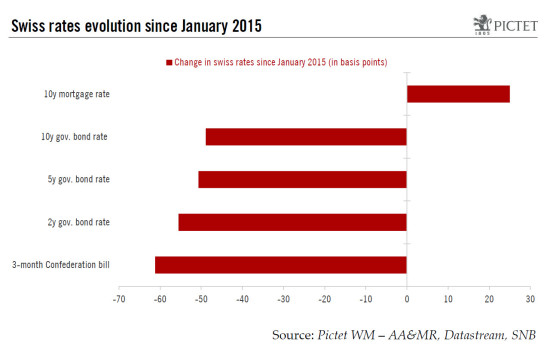

Second, negative rates dent bank profitability and are as such increasingly controversial. In Switzerland, banks have responded to pressures on liability margins by raising mortgage rates (see the chart below). Although this development could be seen as welcome given the situation on the Swiss real estate market, negative rates cannot be regarded as an appropriate tool to combat imbalances in the real estate market.

- Changing the exemption threshold on sight deposits

Adjusting the threshold for exemptions could be an alternative to a reference interest rate cut. Negative interest is charged “only” on the portion of the sight deposits held by banks and other financial market participants at the SNB that exceed a certain threshold (exemption threshold). For domestic banks, the threshold corresponds to 20 times the minimum reserve requirement minus any increase/decrease in the amount of cash held.

Nevertheless, in terms of monetary transmission, this option could be less effective. The SNB has argued several times that transmission of the negative rates to money market rates runs via the marginal rate, thus a change in the threshold without changing the marginal rate would be unlikely to help much. As a result, a more likely approach would be a change in the exemption threshold combined with a rate cut, rather than just changing the threshold. That is not our baseline scenario at this stage, but it remains a policy option, as stated recently by SNB’s chairman Thomas Jordan.

Unlikely measures:

- Exchange rate floor

A return to an exchange rate floor (against a basket of currencies or against the euro) would be introduced only under extreme circumstances. However, when we consider the multitude of problems and the criticisms in terms of communication that have surrounded its abandonment in January 2015, we think that the SNB would prefer to avoid this option.

- Pre-announced or domestic QE

Maintaining an exchange rate floor is a form of quantitative easing which exclusively requires purchases of foreign assets. However, instead of fixing a floor, the SNB could pre-announce the amount of foreign-asset purchases and adjust it if necessary, depending on inflation perspectives. Compared with setting an exchange rate floor, fixing a quantity has the advantage of avoiding the need to remove currency volatility and thus reduces the risk in the market of “one-way bet”. In addition, it avoids an unlimited commitment by the SNB. Moreover, compared with “ad-hoc FX interventions” as is currently the case (option 1), a fixed quantity of foreign assets purchase could be more effective to signal monetary dovishness, and could therefore raise inflation expectations, spur Swiss franc depreciation and therefore support inflation. This option is currently unlikely, but would be an option if inflation expectations started to de-anchor and negative rates became more controversial.

Another option that could be considered is a “conventional QE programme”, based only on the purchase of domestic assets. However, in contrast to other central banks, the scope for such a programme is more limited in Switzerland, given the small supply of domestic asset. In particular, the outstanding stock of Swiss government bonds is “only” CHF 75 billion (12% of GDP).

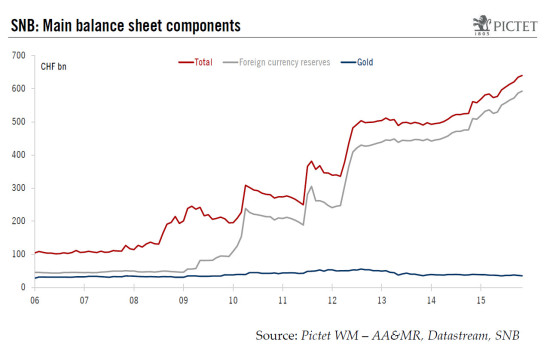

- Sovereign wealth fund

The idea of a sovereign wealth fund (SWF), such as in Norway or Singapore, has always raised strong interest in Switzerland. The idea would be to create a SWF with the SNB’s foreign currency reserves (all or part). Currently, foreign currency reserves represent in total CHF 600 billion (92% of total balance sheet or 94% of GDP). The amount of SNB reserves is the result of monetary policy actions and is subject to variations. As a consequence, any limitation on the SNB’s room for monetary manoeuvre could jeopardise its monetary policy efficiency. Thus, it would be unlikely to help much with currency overvaluation.

- Helicopter money

Helicopter money has been the subject of growing interest among politicians and economists even in Switzerland. The basic principle of helicopter money is that as a central bank aims to stimulate aggregate demand and inflation, an effective tool would be simply to give everyone direct money transfers. Although it could be seen as appealing to receive money from the SNB, this option would not solve the major problem: the Swiss franc’s overvaluation.

Conclusion

Overall, the SNB is not yet out of ammunition to combat the Swiss franc’s overvaluation. If the Swiss franc appreciates, the SNB is likely to continue to rely on its two main pillars: FX interventions, to curb short-term currency appreciation, and further rate cuts. In our view, an option if inflation expectations started to de-anchor and negative rates became more controversial would be to pre-announce the amount of foreign-asset purchases. At this stage, though, such an option appears highly unlikely to be implemented