Urs Birchler Am Tag, als die Nationalbank Negativzinsen auf ihren Girokonti einführte, schrieb ich hier naiv, allzu negativ könnten die Zinsen nicht werden. Sonst würden die Banken ihre Giroguthaben lastwagenweise in bar bei der SNB abholen. Jedoch: so klar ist dies anscheinend nicht. These: Die Zürcher Rechtsprofesssorin Corinne Zellweger-Gutknecht argumentiert in der ZfPW (3/2015, S. 350-375), dass gemäss Währungs- und Zahlungsmittelgesetz (WZG) aus dem Jahre 2000 die Giroguthaben der...

Read More »SNB Reduced Loss from 50 Billion in June to 23 Billion

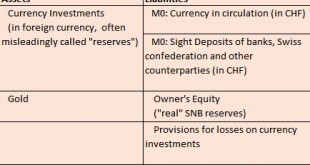

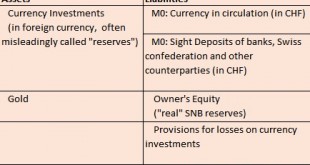

According to the latest news release, the Swiss National Bank expects an annual loss of 23 billion CHF, after reporting a loss of 50 billion at the end of June. Primarily thanks to the stronger dollar, the SNB was able to achieve unrealized gains of 27 billion CHF in the second half. This reduced her annual loss to 23 billion. With its rate hike, Fed is helping the SNB: the dollar has appreciated by 6% since July. Balance Sheet The SNB balance sheet looks as follows. In this post we...

Read More »Die Helikoptergeld-Illusion

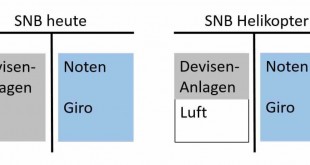

Urs Birchler Wenn dem Schweizer auf der Bergwanderung die Luft ausgeht, schwenkt er den REGA-Ausweis und hofft auf den Helikopter. Ähnliches scheint sich gegenwärtig in der Geldpolitik abzuspielen. Der Konjunktur geht die Luft aus, und schon denken wir an den Helikopter. Dieser soll Geld abwerfen, sei es über den Bürgern oder gleich über dem Bundeshaus. Die beiden Bilanzen der SNB zeigen den Unterschied zwischen Helikoptergeld und Geld nach herkömmlichem Anbau. Das von der SNB geschaffene...

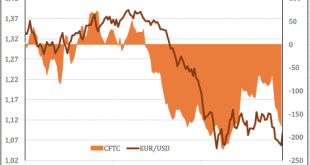

Read More »Weekly SNB Intervention Update: Sight Deposits and Speculative Position

Headlines Second week of February: Speculative position: As expected rise to 7268 x 125k contracts long USD, short CHF.Sight Deposits: SNB intervenes for 0.9 bln. CHF during the bad market conditions; safe haven inflows were directed towards CHF or Swiss did not cover their trade surplus with the purchase of foreign assets.FX: EUR/CHF fell under 1.10 and EUR/USD over 1.12. Background Sight deposits are currently the by far most important means of financing for SNB currency purchases, for...

Read More »Swiss inflation: in negative territory, but no sign of a deflationary spiral

Despite the deeply negative inflation rate, the SNB has become somewhat less sensitive to persistent undershoots of its inflation target. According to Swiss Federal Statistical Office, consumer prices in Switzerland remained broadly stable at -1.3% y-o-y in January, in line with consensus expectations and thus marking the seventeenth consecutive month in negative territory. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) was stable at...

Read More »Stiglitz und Strahm beim Tricksen

Urs Birchler Dieser Tage musste man wieder aufpassen beim Zeitunglesen. Beispiel 1: Rudolf Strahm behauptet in Der Bund, dass Rohstoffspekulanten (a) profitorientiert seien und (b) die Preise destabilisieren. Dies geht aber schlecht zusammen. An der Börse gewinnt in der Regel, wer billig kauft und teuer verkauft — das heisst, derjenige der die Preise stabilisiert. Natürlich kann ein Einzelner einmal Glück haben, indem er eine spekulative „Blase“ kurzfristig mitreitet und noch rechtzeitig,...

Read More »Currencies: persistent market volatility should support funding currencies

The risks implied by the Fed’s tightening cycle and the new Chinese monetary regime, among other things, will favour funding currencies over carry currencies in the next twelve months. Instead of looking at single currencies, it is sometimes interesting to look at broader themes to have a better understanding of how a certain group of currencies might behave. Among the best-known themes or strategies are carry trades, which are based on the principle of systematically buying...

Read More »Will The Franc Follow In The Euro’s Footsteps?

The SNB’s expected December 10 rate cuts have already been priced in to the Swiss Franc. The central bank’s failure to do more than the market expected resulted in a stronger CHF. Growing uncertainty over the Fed’s 2016 monetary policy is a bullish factor for the franc. As they watched the euro strengthen following the ECB’s meeting, SNB representatives rubbed their hands in glee. However, by the start of the Asian FOREX session, the franc was already recovering from its wounds. Now, Bern...

Read More »SNB’s history of balance sheet and Monthly bulletin

Since 2015, the SNB provides its balance sheet items in a different form. Previously the monthly bulletins provided a history of the balance sheet. The last monthly bulletin appeared for August 2015. It contained all important data of the SNB and the Swiss economy. The balance sheet data is often 2 months or older. The weekly monetary data and the IMF data about FX reserves and more are published a lot more quickly, but they are not that complete like the monthly bulletin. SNB...

Read More »Versuchter Hammerschlag gegen US Fed

Urs Birchler Am Donnerstag schlug das amerikanische Repräsentantenhaus (vergleichbar unserem Nationalrat) zu. Er entschied gemäss Bericht der New York Times, einen Reservefonds des Fed, d.h. der Notenbank, heranzuziehen zur Strassenfinanzierung. Aufgrund abweichender Haltung des Senats (unser „Stöckli“) geht das Geschäft an diesen zurück. Heute hat der ehemalige Gouverneur des Fed, Ben Bernanke, auf der Homepage der Brookings Institution dazu Stellung genommen. Bernanke wehrt sich gegen den...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org