Mad as a Hatter Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to. They may not die of old age… but they do occasionally die. Photo credit: Brett Cole...

Read More »KOF Economic Barometer: Prospects for the Swiss Economy Remain Favourable

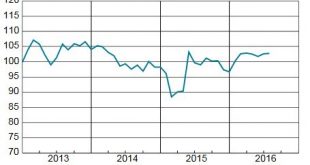

The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the outcome of the vote in the United Kingdom and...

Read More »Greenspan explains negative Swiss Yields

Jeff Gundlach is not the only person who is feeling “maximum negative” on Treasuries. In an interview, none other than the “Maestro” Alan Greenspan, the man whose “great moderation” policy made the current global bond bubble possible, said that he is worried bond prices have risen too high. Asked if he finds what is happened in the bond market right now “in any way, shape, or form concerning for financial...

Read More »Emerging Markets: Preview of the Week Ahead

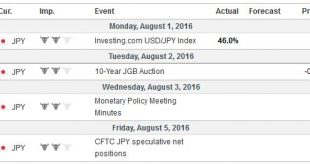

EM ended last week on a firm note, helped by the weaker than expected US Q2 GDP report as well as the small bounce in oil. With the RBA and BOE expected to ease this week, the global liquidity backdrop remains favorable for EM and “risk.” US jobs report Friday will be very important for EM going forward. We get our first glimpse of the Chinese economy for July with the PMI readings this week. EM CPI data this...

Read More »FX Weekly Preview: After this Week, Does August Matter?

Summary: RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan’s fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful. There are four events this week that will command the attention of global investors. The Reserve of Bank of Australia is first.It is a close call, though the median in the...

Read More »FX Weekly Review, July 25 – July 29: Dollar Hobbled; Technicals Warn of More Losses

Swiss Franc Currency Index The Swiss Franc continued its bad performance against the dollar index that started with Brexit until the middle of the week. From the mid of the week the two indices converged again, because the U.S. had two bad data releases: Click to enlarge. Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket) On a three...

Read More »Weekly Speculative Postions: Speculators Sell European Currency Futures

There does not seem to be a large pattern in the speculative position adjustments in the CFTC reporting week ending July 26. There was only one significant position adjustment (10k of more contracts). Euro The euro bears added another 10.3k contracts to their gross short position, which brought it to 221.8k contracts. This is this is the largest gross short position since early January. It is the fifth...

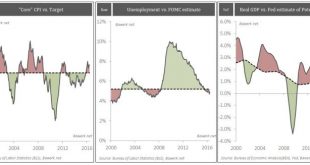

Read More »The FOMC Butterfly that Will Ruin the World

Imagine the financial crisis knocked you out and you did not wake up from the coma that followed until this day. Then, presented with the following three charts you were asked to guess where the federal funds rate was trading. Given the fact that the core CPI is on a steep uptrend and currently over the arbitrarily set 2 per cent target; unemployment below what the FOMC regards as full employment and; GDP running at a...

Read More »Swiss stock market rally loses momentum

SMI The Swiss Market Index and global stock markets failed to extend last week’s rally after the Federal Reserve and Bank of Japan left rates unchanged and gave mixed messages about the global economic outlook. Japanese Economic Stimulus Japanese shares received a short-term boost after Prime Minister Shinzo Abe’s announced plans of a 28 trillion yen ($265 billion) economic stimulus drive, including a 13 trillion...

Read More »Emerging Markets: What has Changed

Indonesian President Widodo shuffled his cabinet Egypt has requested a three-year $12 bln loan from the IMF Johannesburg Stock Exchange data on investment flows into South Africa was wrong Fitch downgraded South Africa’s local currency rating by one notch to BBB- with a stable outlook Fitch cut its outlook on Colombia’s BBB rating from stable to negative In the EM equity space as measured by MSCI, Turkey (+4.8%),...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org