Mad as a Hatter Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to. They may not die of old age… but they do occasionally die. Photo credit: Brett Cole Presumably, it was used as rationale for why stock prices should go higher. Quite frankly, we don’t know why anyone would ever say such baloney. But it likely makes the person who emits it feel content about their place in the world and their brilliant wit and wisdom. No doubt, the current old age bull market has gone mad as a hatter. Who in their right mind would invest their hard earned savings into a business for the opportunity to receive of current earnings for every invested? Aside from Swiss or Japanese bonds, or lottery tickets, we can’t think of an investment with shoddier long-term prospects. Can you? Hatter time! Shortly before they die, bull markets tend to transform into something like this… Illustration by fearofthedarko.deviantart.com Yet, based on the current cyclically adjusted PE ratio of roughly 26, this is exactly what S&P 500 investors are signing up for.

Topics:

MN Gordon considers the following as important: Debt and the Fallacies of Paper Money, Featured, Gary Shilling, general price level, Human Condition, Irving Fisher, Jeremy Grantham, newsletter, On Economy, Stanley Druckenmiller, The Stock Market

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Mad as a HatterSomewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to. |

|

| Presumably, it was used as rationale for why stock prices should go higher. Quite frankly, we don’t know why anyone would ever say such baloney. But it likely makes the person who emits it feel content about their place in the world and their brilliant wit and wisdom.

No doubt, the current old age bull market has gone mad as a hatter. Who in their right mind would invest their hard earned savings into a business for the opportunity to receive $1 of current earnings for every $26 invested? Aside from Swiss or Japanese bonds, or lottery tickets, we can’t think of an investment with shoddier long-term prospects. Can you? |

|

| Yet, based on the current cyclically adjusted PE ratio of roughly 26, this is exactly what S&P 500 investors are signing up for. What gives? The feint promise of shares trading on a public exchange, and a 7-plus year bull market, must warm the hearts and soften the minds of otherwise intelligent individuals like no other.

We don’t say this in jest. We’re scratching for perspective. We want to understand what in the world is going on. |

S&P 500 index and the Shiller P/E ratio since 1871 – it is noteworthy that its current level was only exceeded in 1929 and 1999/2000. Moreover, it can occasionally fall into single digits. It seems that more often than not, it does so right after it has scaled one of those extreme peaks. Of course this can no longer happen in the new era. Permanent plateau, baby! – click to enlarge. |

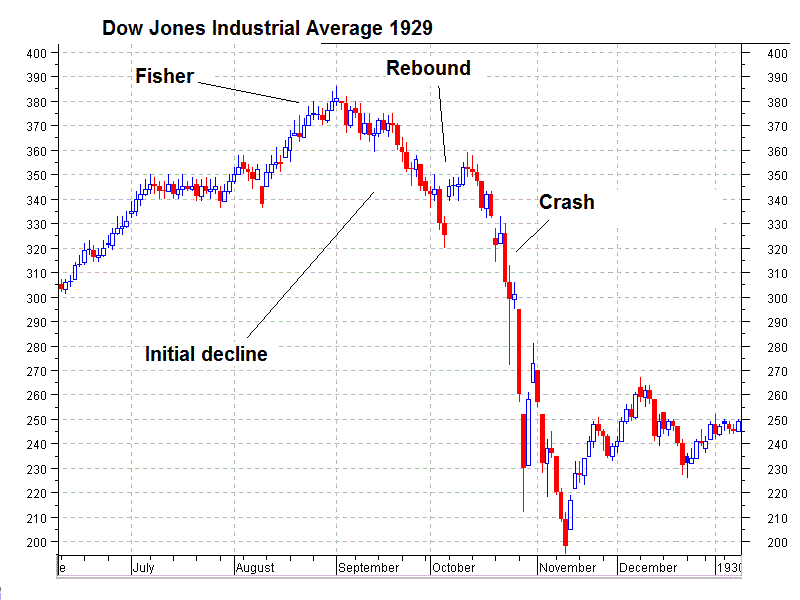

Human FallacyFor example, there was something powerfully unfounded that compelled Yale economist Irving Fisher to publicly declare in early October, 1929, that “stock prices have reached what looks like a permanently high plateau.” What was it? Did he believe he was giving a hot stock tip? By the time the month concluded the stock market had crashed and crashed again. Those hopeful optimists, who bought on Fisher’s prescience, didn’t break even for a quarter century. Many died with their brokerage accounts still underwater. |

Irving Fisher of “permanently high plateau” fame. He was not only a terrible stock market prognosticator, but also a famous economist and “progressive” whose work includes inter alia the tautological (and nonsensical) quantity equation and indexes that allegedly measure the mythical “general price level”. He was also a dyed-in-the-wool central planner. Sadly, economic science has yet to rid itself of a great deal of Fisherian baggage. Photo credit: George Grantham Bain Collection / Library of Congress |

| Like today, Fisher’s judgment was clouded by the foggy rear view mirror of a 7-plus year bull market. Naturally, he suffered from the classic human fallacy of believing that tomorrow will be pretty much like today.

Maybe the particulars will change – maybe the Cubs will finally win the World Series – but overall, says the belief, things will generally be the same. In this case, stocks will be higher tomorrow than today because they are higher today than yesterday. Unfortunately, this belief is only right, only some of the time. What’s more, occasionally it is spectacularly wrong and brutally catastrophic to one’s investment portfolio. |

|

| Not even a cyclically adjusted PE ratio of 30 gave Fisher pause before opening his mouth. To be fair, this wasn’t a metric that was tracked at the time, and with the benefit of 20/20 hindsight, it’s easy to point and heehaw at Fisher for being so remarkably wrong.

Admittedly, from experience, we know the hefty doses of humility the stock market dishes out with impartial judgment. Even the best and brightest get their backsides handed to them on occasion. For the rest of us, it is a more frequent occurrence than we’d like to acknowledge. |

|

Visions of Tomorrow from the Permanently High PlateauMarkets are confounding. They appear to be almost predictable. Moreover, being right does not always translate to success. For sometimes it’s more costly to be right at the wrong time than wrong at the right time. As far as we can tell, Tesla has always been a bad investment. We thought the same thing about Facebook and Google. But what do we know? Those who bought Tesla before March of 2013 have been on the receiving end of a fantastic speculation – for now. Through Thursday of this week, stocks by-and-large traded sideways. Is the bull market still intact? Is it a topping formation? Is it a consolidation? The answer to these questions depends upon who you ask. What is crystal clear, however, is that it is not a permanently high plateau. Caution is advised… and not just from us. Specifically, it is advised from people worth listening to. Presently, several investing legends – Stanley Druckenmiller, Jeremy Grantham, and Gary Shilling – are independently warning of a market crash. Whether you agree with them or not is up to you. But, at a minimum, you should take serious consideration of their warning. These guys usually know what they are talking about and have the track records to back it up. |

There are a few reasons to remain skeptical on technical grounds as well… there is a quite glaring divergence between the big cap index S&P 500 and the broad market (as represented by the NYSE index above). Unfortunately we can no longer ask Fisher what he thinks and then do the opposite. Maybe we should ask this guy – reportedly he’s a kind of Fisher on steroids – click to enlarge. |

Charts by Doug Short/ advisorperspectives, sharelynx/ goldchartsrus, stockcharts

Chart and image captions by PT