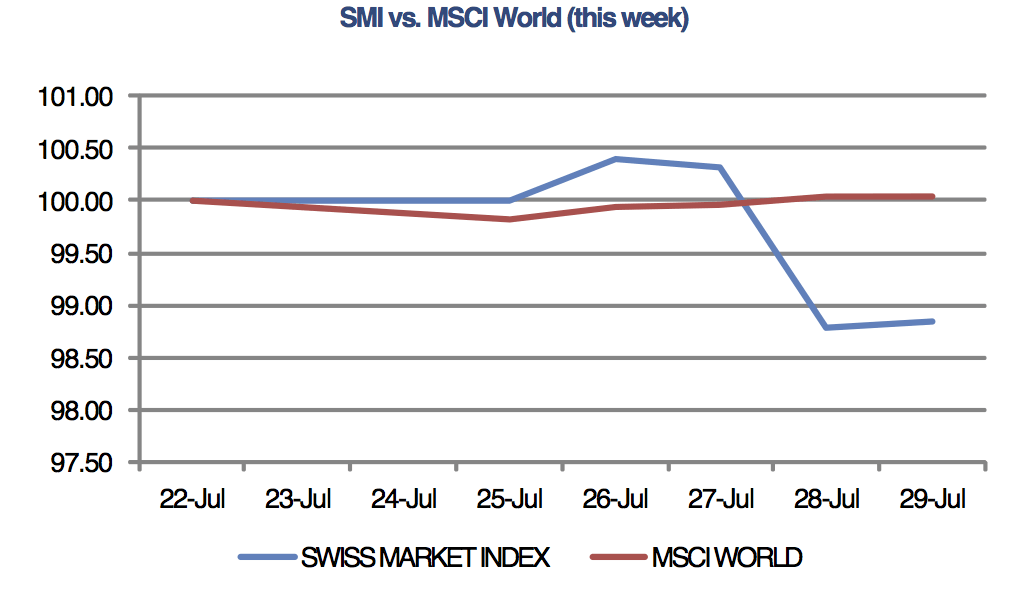

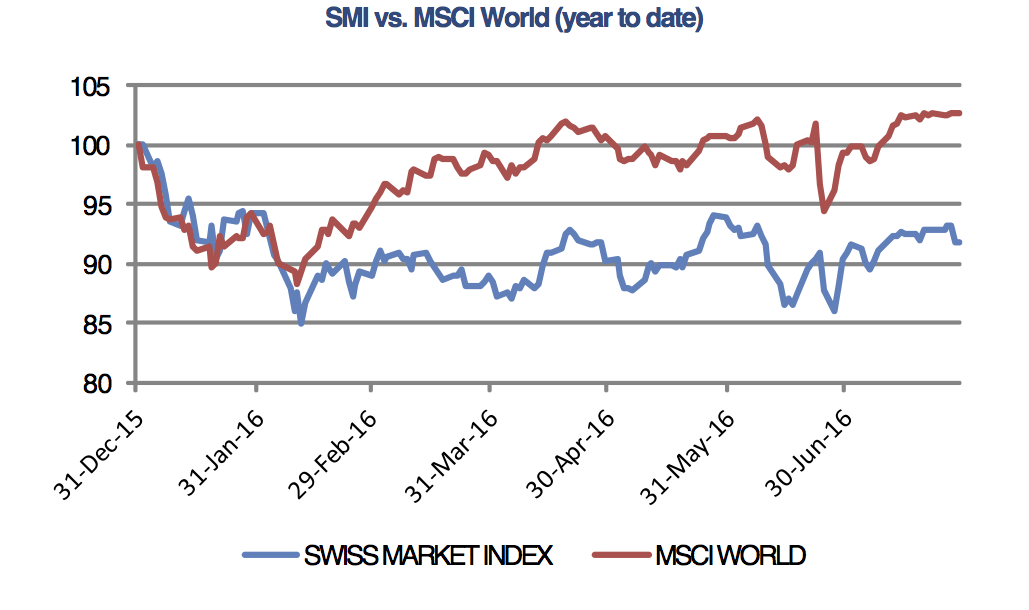

SMI The Swiss Market Index and global stock markets failed to extend last week’s rally after the Federal Reserve and Bank of Japan left rates unchanged and gave mixed messages about the global economic outlook. Japanese Economic Stimulus Japanese shares received a short-term boost after Prime Minister Shinzo Abe’s announced plans of a 28 trillion yen (5 billion) economic stimulus drive, including a 13 trillion yen fiscal spending package for national and local governments on Wednesday. However, the Bank of Japan failed to match the measures on Friday, announcing that its government-bond buying target and policy interest rate would remain unchanged and instead opted to increase its exchange-traded fund purchases. The yen and stocks markets fluctuated on the news. click to enlarge Federal Reserve In the US, Federal Reserve policy makers stopped short of signaling a September rate hike on Wednesday but declared, in their statement, that near-term risks to the outlook have diminished although inflation still remains low. Focus turns to GDP numbers which are due for release later on Friday. click to enlarge UBS Consumption Indicator In Switzerland the UBS consumption indicator advanced 10 points in June to 1.34 as the tourism industry and trade picked up.

Topics:

Investec considers the following as important: Business & Economy, Editor's Choice, Featured, MSCI World, newsletter, SMI, Swiss Markets, Swiss stock market

This could be interesting, too:

Investec writes Swiss inflation falls further in January

Investec writes Catching ski pass cheats – reactions, fines and worse

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

SMIThe Swiss Market Index and global stock markets failed to extend last week’s rally after the Federal Reserve and Bank of Japan left rates unchanged and gave mixed messages about the global economic outlook. |

|

Japanese Economic StimulusJapanese shares received a short-term boost after Prime Minister Shinzo Abe’s announced plans of a 28 trillion yen ($265 billion) economic stimulus drive, including a 13 trillion yen fiscal spending package for national and local governments on Wednesday. However, the Bank of Japan failed to match the measures on Friday, announcing that its government-bond buying target and policy interest rate would remain unchanged and instead opted to increase its exchange-traded fund purchases. The yen and stocks markets fluctuated on the news. |

|

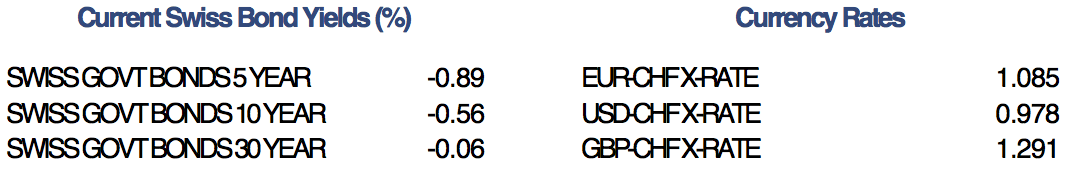

Federal ReserveIn the US, Federal Reserve policy makers stopped short of signaling a September rate hike on Wednesday but declared, in their statement, that near-term risks to the outlook have diminished although inflation still remains low. Focus turns to GDP numbers which are due for release later on Friday. |

|

UBS Consumption IndicatorIn Switzerland the UBS consumption indicator advanced 10 points in June to 1.34 as the tourism industry and trade picked up. |

|

Italian BanksInvestors remain nervous about European financials ahead of the publication due for release late on Friday of “stress tests” on the continent’s biggest lenders. The fear is that a poor set of results could dampen the recent lending revival in a region already at risk from slowing growth and the fallout from Brexit. |

|

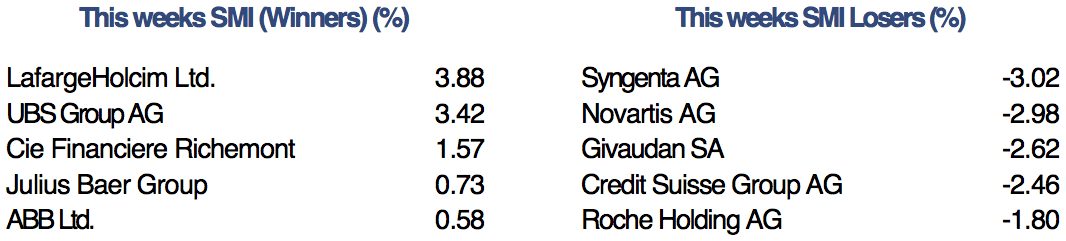

Swiss CompaniesSecond quarter earnings season is underway and surprising overall slightly on the upside. Credit Suisse Group AG reported this week that the bank had returned to profit in the second quarter, with all operating units contributing to its first positive result since CEO Tidjane Thiam set out to reinvent the Swiss bank. However, the bank’s revenue tumbled by 27%, operating expenses fell to the lowest in more than two years and the lender’s core capital ratio increased. UBS Group AG also published results this week, its profit slipped in the second quarter as both wealth management and investment banking generated less revenue during a rocky period for markets. |

|