Bern, 04.08.2016 – Consumer sentiment remained unchanged between April and July 2016* and is now below the long-term average for the fifth quarter in a row. Most sub-indices also saw no major change, except regarding inflation, with the 1,200 or so individuals questioned expecting prices to rise more sharply over the next twelve months than they had in April. There was also a belief in July that prices had been rising...

Read More »Carney Gets Ahead of Market Expectations; Sterling Slumps, Gilts Soar

Summary: BOE cuts rates and expands QE. Door is open to more easing. Sterling stabilizes after selling off 2 cents. Sterling has slumped two cents in the wake of the Bank of England’s announcement. It cut the base rate 25 bp and announced a resumption of its asset purchase program. It will buy GBP60 bln of Gilts and added corporate bonds to its purchase plan, which will be completed over the next six...

Read More »Why Americans Get Poorer

Secular Stagnation OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting...

Read More »Real vs. Nominal Interest Rates

What is the real interest rate? It is the nominal rate minus the inflation rate. This is a problematic idea. Let’s drill deeper into what they mean by inflation. You can’t add apples and oranges, or so the old expression claims. However, economists insist that you can average the prices of apples, oranges, oil, rent, and a ski trip at St. Moritz. This is despite problems that prevent them from agreeing on what should...

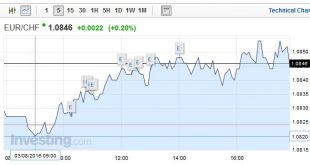

Read More »FX Daily, August 03: Consolidation Featured

Swiss Franc Click to enlarge. FX Rates The US dollar is consolidating yesterday’s losses. The greenback’s upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week’s RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week. The asset markets are more...

Read More »Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

Investec Switzerland. © Vividrange | Dreamstime.com The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on...

Read More »Swiss National Bank’s U.S. equity holdings hit record $61.8 billion last quarter

Investec Switzerland. © Vividrange | Dreamstime.com The value of the Swiss National Bank’s U.S. stock portfolio jumped to a record in June, helped by equity market gains. The holdings climbed to $61.8 billion from $54.5 billion at the end of March, according to calculations by Bloomberg based on the central bank’s regulatory filing to the U.S. Securities and Exchange Commission and published on...

Read More »Gorilla or Elephant, Chinese Surplus Capacity is the Challenge

Summary: China’s excess capacity is one of the most formidable challenges the China and the world face. Unexpectedly, China’s steel industry reported a profit in H1 16. M&A for industry rationalization and foreign markets seem to be the main ways China is trying to address the excess capacity. Americans have a saying about an 800-pound gorilla in a room. It refers to a person or organization so...

Read More »FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

Swiss Franc The euro appreciated against both Swiss Franc and dollar. Swiss retail sales was again very weak, but emphasize our last month comment: The measurement of retail sales (and also GDP) ignore the active second-hand markets in Switzerland. The Swiss SVME PMI was at 50.1 close to contraction, another piece of bad data. Click to enlarge. FX Rates The US dollar is offered against the major currencies, but...

Read More »Should the Government Give Us Infrastructure?

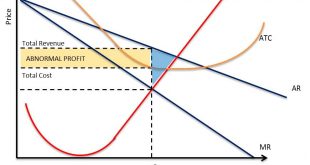

“Bad” Monopolies? An argument against absolutely free markets comes up often. What about so-called natural monopolies? So-called infrastructure projects (e.g. sewage plants) have high barriers to entry, and are a challenge to true competition. Therefore, if left to private companies, they would become bad monopolies. So it is best for the government to provide them. I think there are answers on several levels....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org