History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen...

Read More »Weekly Market Pulse: Opposite George

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld From the Seinfeld episode “The Opposite” I...

Read More »Ask Bob: Is Maxing Out Your 401k A Good Investment Decision?

Since the beginning of 401(k) plans in 1978, people have considered it to be the quintessential retirement plan—you get to save money before taxes and in most cases, the company puts money into your account, too. What could be better than that? But now, 44 years later, it’s time to take a broader look at 401(k)s that considers taxes on 401(k) distributions. 401(k)s certainly have a place in your investment plan. Most employers offer some kind of match up to a...

Read More »Weekly Market Pulse: There Is No Certainty In Investing

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record. In this case, it is demand that drives supply rather than the other way around. The constant demand for...

Read More »Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since...

Read More »Weekly Market Pulse: Things That Need To Happen

Perspective: per·spec·tive | pər-ˈspek-tiv b: the capacity to view things in their true relations or relative importance Merriam-Webster Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view. Things that seemed so important at the time, years ago, turned out to be nothing more than bumps along the road of life. That is as...

Read More »Demand Down, Supply Down, Ugly Up

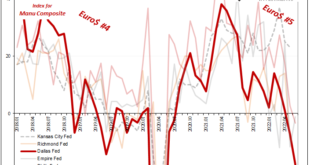

Well, that was a mess. The Richmond Fed’s Manufacturing Survey was at first released before being taken back. Initially reported as a plunge in the headline number, it was quickly scrapped once the statisticians remembered they had just discontinued their average workweek component – but had kept a zero in its place when tallying the overall PMI. With it, the PMI was originally calculated to have gone from bad in May (-9) to horrible in June (-19). Refiguring the...

Read More »Getting Whipped Will Really Hurt

The Federal Reserve’s various branches don’t just do manufacturing surveys anymore. This is a modern economy, after all, meaning industry isn’t the same top dog as what it used to be. While still important, and still able to tear down even the global-iest synchronized of growth-y, services are the big macro enchilada. Reflecting this fact, there are now regional Fed services surveys producing services indices to go along with the manufacturing sentiment stuff. I’ll...

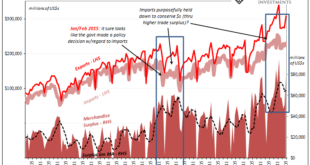

Read More »Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed. Yes, 2008. Also everything after. The Chinese have followed closely this style having realized what took Bernanke too long. That is, the...

Read More »Eurodollar Futures Interpretation Is Everywhere

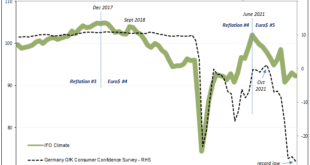

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation. From GfK back then: The growing consumer optimism signals that consumers here consider the German...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org