———WHERE——— AlhambraTube: https://bit.ly/2Xp3roy Apple: https://apple.co/3czMcWN iHeart: https://ihr.fm/31jq7cI Castro: https://bit.ly/30DMYza TuneIn: http://tun.in/pjT2Z Google: https://bit.ly/3e2Z48M Spotify: https://spoti.fi/3arP8mY Castbox: https://bit.ly/3fJR5xQ Breaker: https://bit.ly/2CpHAFO Podbean: https://bit.ly/2QpaDgh Stitcher: https://bit.ly/2C1M1GB Overcast: https://bit.ly/2YyDsLa SoundCloud: https://bit.ly/3l0yFfK PocketCast: https://pca.st/encarkdt...

Read More »Powell Would Ask For His Money Back, If The Fed Did Money

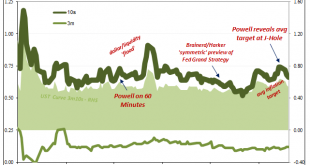

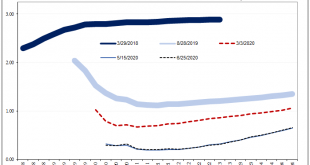

Since the unnecessary destruction brought about by GFC2 in March 2020, there have been two detectable, short run trendline upward moves in nominal Treasury yields. Both were predictably classified across the entire financial media as the guaranteed first steps toward the “inevitable” BOND ROUT!!!! Each has been characterized as the handywork of master monetary tactician Jay Powell. There is some truth underlying, only stripped of all that hyperbole. These backups in...

Read More »Writing Rebound in Italian

As the calendar turned to September, the US Centers for Disease Control and Prevention (CDC) issued new guidelines expanding and extending existing moratoriums previously put in place to stop evictions during the pandemic. Families affected by COVID either through the disease or as a result of job loss due to the coronavirus have been protected from landowner actions including eviction as a final means to reclaim rental properties from non-conforming tenants. There...

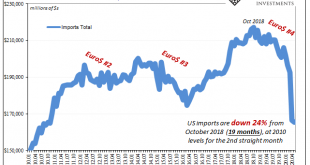

Read More »Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting. Getting closer to a bottom. Unlike any of the sentiment numbers, however, these trade figures better demonstrate just how far from a rebound let alone recovery the world...

Read More »Monthly Market Monitor – July 2020

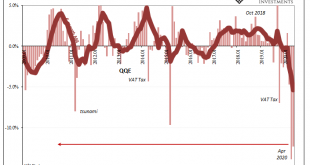

Most Long-Term Trends Have Not Changed A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime. The rest of Asia responded to the initial outbreak better than the Chinese (and most everywhere else we now know) and generally mitigated...

Read More »Gratuitously Impatient (For a) Rebound

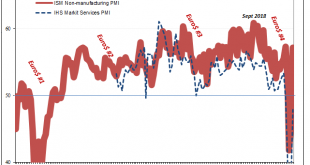

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in its optimism resides in the lower tiers of all statistics. The sentiment contained within the ISM’s PMI’s were at least in the same area as the unemployment rate, and...

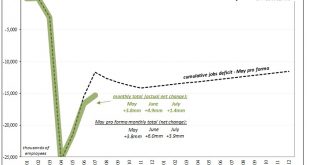

Read More »Reality Beckons: Even Bigger Payroll Gains, Much Less Fuss Over Them

What a difference a month makes. The euphoria clearly fading even as the positive numbers grow bigger still. The era of gigantic pluses is only reaching its prime, which might seem a touch pessimistic given the context. In terms of employment and the labor market, reaction to the Current Employment Situation (CES) report seems to indicate widespread recognition of this situation. And that means how there are actually two labor markets at the moment. Occupying the...

Read More »What The PMIs Aren’t Really Saying, In China As Elsewhere

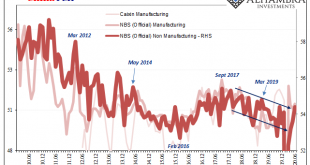

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance. According to one such group, China’s official manufacturing index, the one calculated and...

Read More »Looking Ahead Through Japan

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China. Three days in, news reached the Diamond that the Communists had closed down the affected region....

Read More »Wait A Minute, What’s This Inversion?

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board. And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute. That’s the part which caused so...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org