History never repeats itself. Man always does. Voltaire Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine. I have been a professional investor for now over 30 years and I have seen investors make the same mistakes over and over, as if they are ruled by some mysterious force that prevents them from learning from their past. And that may well be true. Reality is, as Einstein may have said, an illusion, albeit a very persistent one. What we see as reality is in actuality merely an

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, Bear Market, bonds, commodities, copper to gold ratio, currencies, Featured, inflation, Interest rates, Inventories, Investing, Market Sentiment, Markets, newsletter, Real estate, Recession, S&P 500, S&P 500, stock market, stocks, US dollar

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

History never repeats itself. Man always does.

Voltaire

Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

I have been a professional investor for now over 30 years and I have seen investors make the same mistakes over and over, as if they are ruled by some mysterious force that prevents them from learning from their past. And that may well be true. Reality is, as Einstein may have said, an illusion, albeit a very persistent one. What we see as reality is in actuality merely an approximation, a prediction of our brains. We can’t actually see the present because there is a lag between the information being captured by our eyes and processed by our brains. To make our life easier, our brains essentially predict the future, based on past experience, and present us with reality as it believes it should be based on what it was a few milliseconds ago.

In a sense then, our brains use our past experiences to predict the future (which we call “the present”). See where I’m going with this now? There are a multitude of psychological barriers, cognitive biases, that effectively prevent us from being good investors. Today, in an age of instant information we are bombarded by seemingly convincing evidence that continually reinforces our existing biases and prevents us from breaking free of our past experiences. Investors today are forced to see all economic slowdowns and all bear markets in the context of 2008 and 2020. And if they’re a bit older, maybe 2000-2002.

And so, the bear case today is not that we will have a mild economic slowdown and an average bear market but that the economy will implode and stocks must fall, as they did in those bear markets, by a lot more than they already have. For those who discount 2020 as atypical, so much the better since both the 2000-2002 and the 2008 bear markets fell by 50%. Now that’s a bear market.

I have said many times that it isn’t my job to predict the future but merely to accurately observe the present. I’m human too so it isn’t easy but after 4 decades as an investor, I have learned to recognize my own biases and shortcomings – most of the time. I spend a lot of time trying to figure out the consensus and how it will be wrong. How do you figure out the consensus? That’s another one that isn’t easy because what you see as the consensus is biased by your sources. That’s why I put a lot of emphasis on what people are doing rather than what they are saying. I also try to avoid sources with an agenda whether Zero Hedge or the average Wall Street strategist.

I’d say the consensus today is undoubtedly negative about the economy and markets. Sentiment has certainly improved from where it was at the lows but overall, I think most investors are still quite negative about the future. The pessimism isn’t surprising really because there does seem to be a lot of things about which to worry. Recession seems inevitable as yield curves invert. Inflation is coming down but not fast enough and wages aren’t keeping up. Europe is in a natural gas noose of its own making. Inventories are rising and real retail sales peaked 16 months ago in March of 2021. Consumer sentiment is awful and the leading economic indicators are down for 5 consecutive months.

You have to ask yourself though, with all that bad news, why is the S&P 500 up 17% from its lows? How, in the face of all that bad news about the economy, can anyone have the confidence to buy stocks? The answer is that there are some people who can do what Warren Buffett says you should do in these situations (and what he is actually doing by the way), namely buy when everyone else is fearful. It’s hard to do because the bad news is obvious while the good news is not.

I could tell you that bank balance sheets look nothing like they did in 2008 and an outcome that bad is highly improbable. I could tell you that household balance sheets have never looked this good prior to a recession. I could tell you that inflation is fading rapidly, that commodity prices – including agriculture – are back to where they were prior to Russia’s invasion of Ukraine. I could tell you that China’s problems are not new or unknown to the market. I could tell you that the semiconductor chip shortage is ending and a glut of chips is developing right now.

I could also tell you that banks are lending with C&I loans (corporate) up at a nearly 20% annual rate in July. That, despite all the doom and gloom around real estate, real estate loans were up at a double digit pace in July and banks holdings of Treasury securities are down every month since March. And that while inventories are up, the total business inventory/sales ratio is lower today than in every month from August of 2014 to March of 2021. I could tell you that core capital goods orders are up 24 of the last 26 months and that in rejiggering their supply chains, US companies will reshore 350,000 jobs this year.

I could tell you that the stock market usually bottoms with consumer sentiment and that may have already happened. I could tell you that the number of stocks in the S&P 500 trading above their 200 day moving average hit its low of 11.8 in June and that readings under 15 tend to be fleeting and almost always consistent with bottoms. I could tell you all those things and if you think we’re headed for some 2008 style crack up, you won’t care.

Investing is not easy and anyone who tells you otherwise is lying. It is hard to buy when every bone in your body is screaming no. It is hard to be greedy when everyone else is fearful. It is easy to find the bad news because it is in your face all the time. Bad news gets clicks and readers. Good news is hard to find and gets ignored when it is.

I don’t know where the economy or the markets are headed from here. But I am absolutely certain that whatever the outcome, it will be different than 2000 or 2008 or 2020. Because it is always different this time but investors are not. They will always be fearful at the bottom and ecstatic at the top. They will always be ruled by their emotions rather than logic. And it will always be tempting to embrace the bosom of the consensus.

In Candide, Voltaire said that “life is bristling with thorns, and I know no other remedy than to cultivate one’s own garden”. I can think of no better advice for today’s investor.

Economic Environment |

|

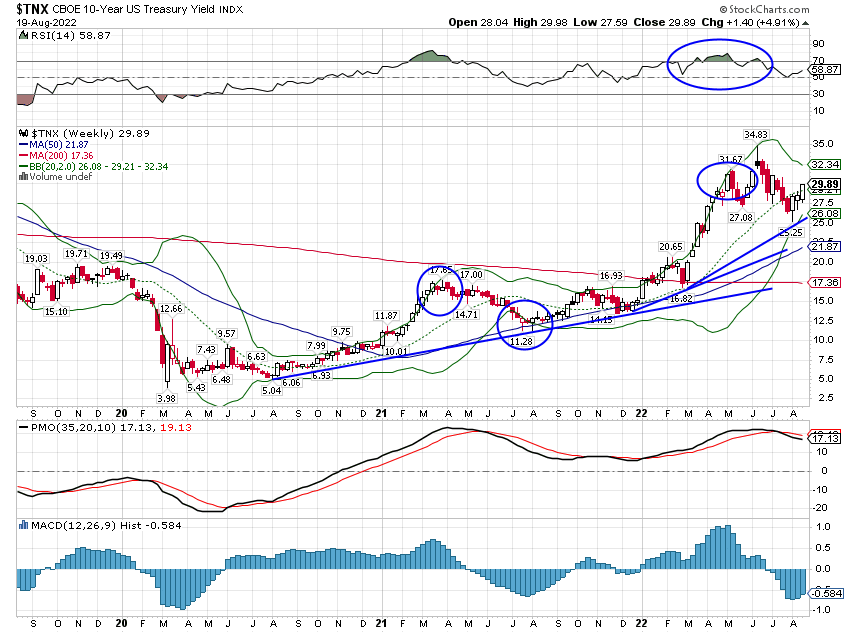

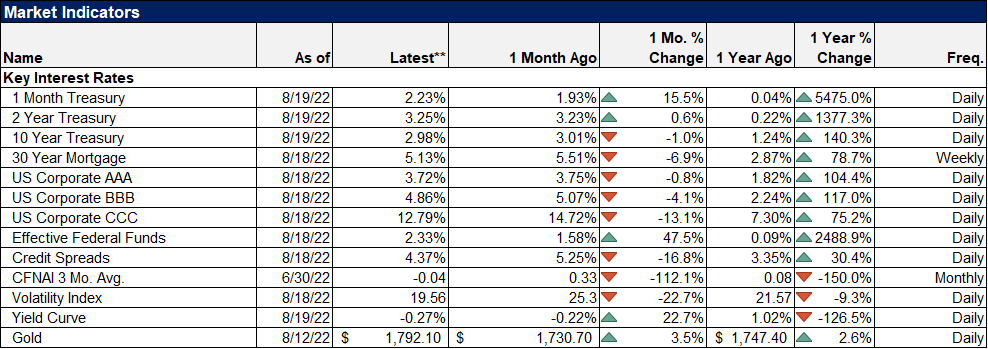

| The rising dollar, rising rate environment is well known and entrenched at this point. For those focused on the 10 year Treasury note, yields rose last week but it is a bit more complicated than that. The 10 year Treasury yield rose 14 basis points, the 3 month T-Bill yield rose by 8 basis points, the difference between the two widening ever so slightly. The 2 year Treasury note yield, in contrast, was unchanged and so the 10/2 curve everyone obsesses about also steepened a bit. In fact, the 2 year yield is essentially unchanged since its early June peak and the 10 year yield is no higher today than it was in mid-April. And yet, we still call this a rising rate environment. Why? Perspective. You don’t need to be a Certified Market Technician to see that the 10 year rate is in an uptrend. And the movement of the 10 year yield is more important that the 2 year because the latter is too influenced by expectations for Fed policy. | |

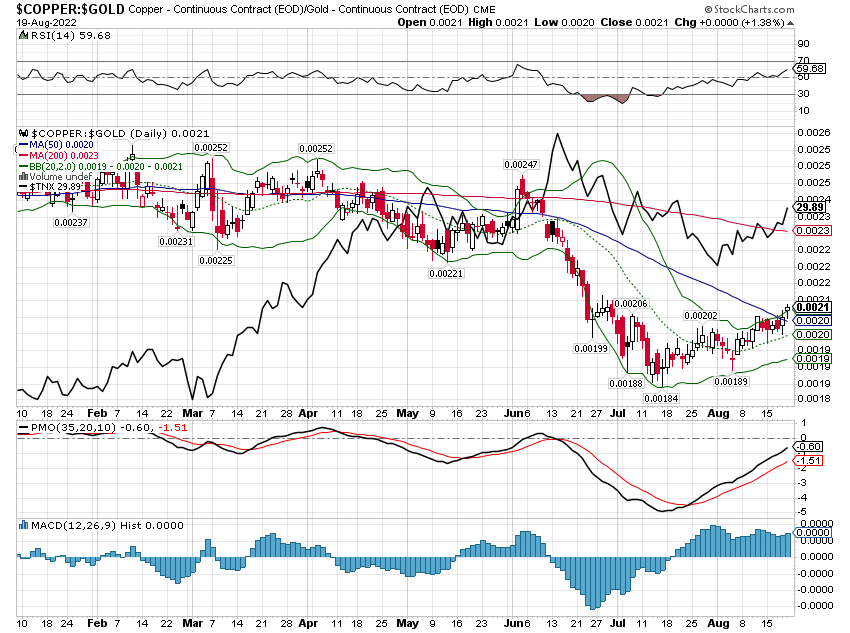

| The uptrend in rates is important because it belies the basic bearish argument that we are in, or on the verge of, recession. It’s a piece that doesn’t fit the narrative puzzle. The rise in rates last week was also confirmed by the copper/gold ratio. | |

| By the way, when this ratio was falling in June and early July, the bears were out in force, telling anyone who would listen that this was just one more indication that we were in recession. Again, perspective, get some. This ratio is a good check on rates because it is highly correlated with the 10 year yield. It is not, by itself, useful as a recession indicator. We’ve entered recession with it falling and with it rising just as we’ve entered recession with rates falling and rates rising. | |

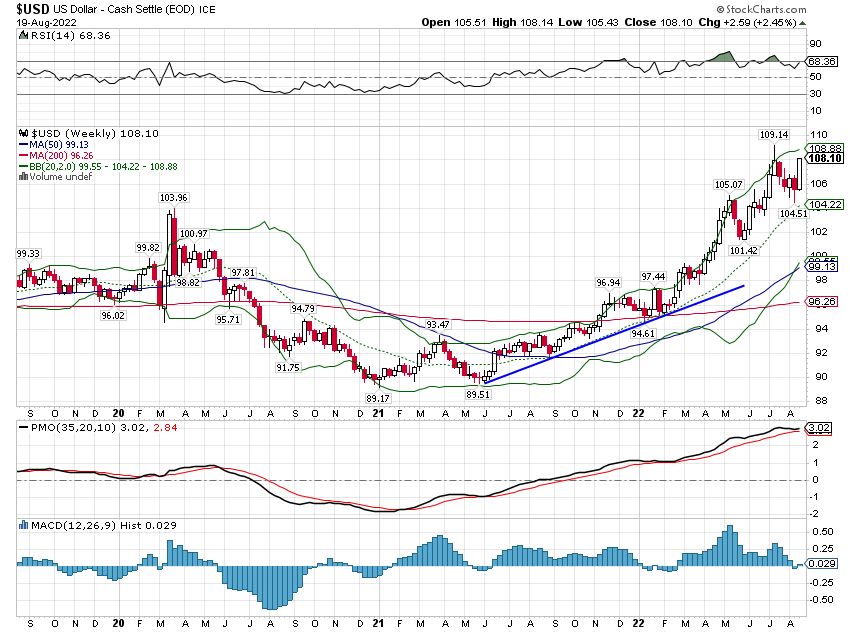

| The dollar is also in an obvious uptrend and despite everybody and his brother being long already, I said last week that it would probably persist. And it did have a very good week and the uptrend is obvious and continuing. There will be a reversal at some point but it’s probably going to take some good news out of Europe. Which means good news out of Ukraine. It’s not hard to imagine if you try.

There is no shortage of people who will tell you how negative this rising dollar is because the world is awash in dollar denominated debts that become harder to pay when the dollar rises. In this view of the world, there is a shortage of dollars – to which I say, poppycock. There is certainly a lack of dollars in places where a dollar loan today is a Swiss bank deposit tomorrow. Thus, you can’t get dollars in places like Nigeria and Pakistan. For good reason I would add. As for the rest of the emerging world, I’m pretty sure their bankers know how to hedge currency risk. A rising dollar can cause stress in other parts of the world and that can blow back on the US. But can is not will and right now I see dollar strength as a boon not a bane. |

|

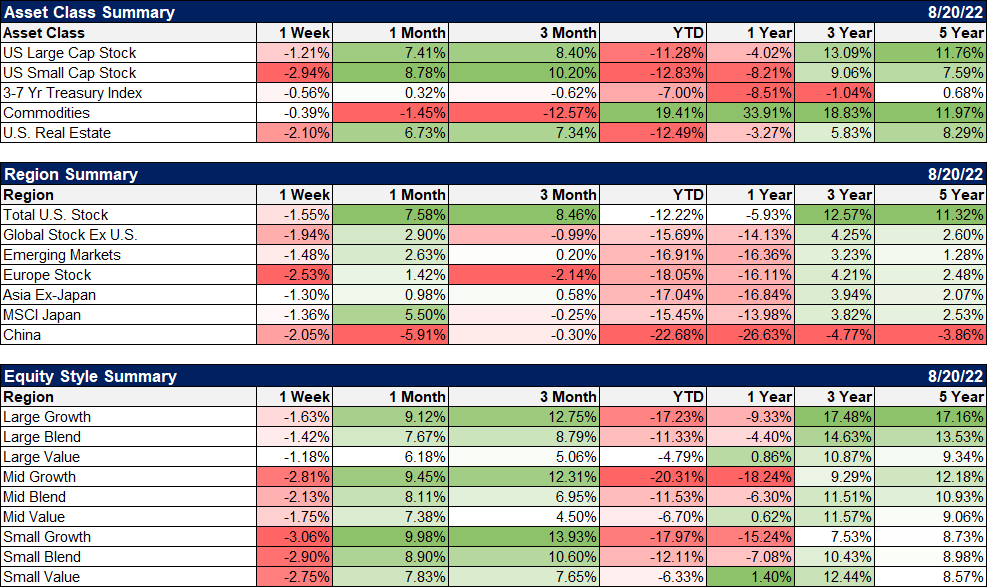

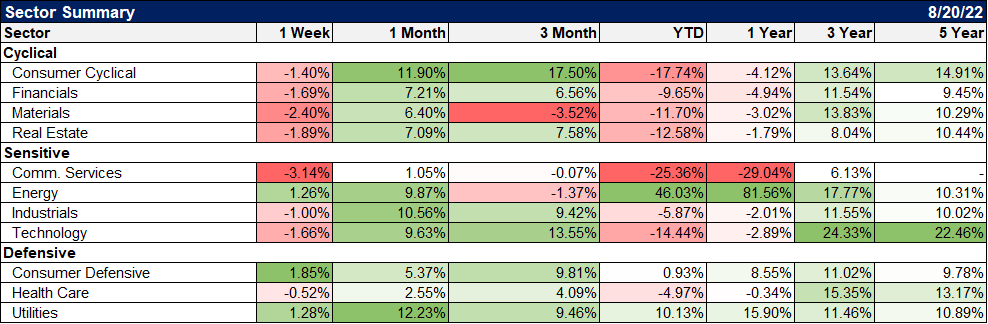

MarketsStocks, bonds, real estate and commodities were all lower last week although I’d be hard pressed to provide a concrete reason for the selling. Most stocks are in a short term uptrend that started in mid-July and most indexes have reached their 200 day moving averages, a widely accepted dividing line between up and down trend. Exceptions to that are rare but the dividend indexes, some of which have made new all time highs early last week, certainly qualify. If I were in the marketing department I’d take this opportunity to remind you that we have a large allocation to dividend ETFs. The selling last week at the 200 day moving averages is not surprising in the least since it is a logical place to sell if you are in a downtrend. If you are in a downtrend defined by being under the 200 day moving average and you expect the downtrend to continue, then selling at that level is literally the highest you can do so. And it seems there are still a lot of people who expect the downtrend to continue, including all those futures market traders who are still sitting on record short positions. Value outperformed last week but the difference was insignificant. |

|

| Traders mostly favored defensive names last week with utilities posting a gain despite rising rates (they tend to be rate sensitive). Energy made a rally attempt and ended the week higher but I’d still keep my powder dry. Crude oil traded with an 85 handle last week and is still in a downtrend that started, not coincidentally, when rates hit their high and stocks hit their low (mid-June). I think you want to stay patient and not take any big positions until the trend turns back up. | |

| Credit spreads widened slightly last week but are still well below levels we associate with credit market stress.

In his Philosophical Dictionary Voltaire said that “common sense is very rare”. That is certainly true in financial markets, the only market where people wait for prices to go up before buying. The outlook at the lows is always negative or perceived that way or we wouldn’t be at the lows. But there are times when reality is quite different than perception, when the consensus has become complacent and lazy. Sometimes the good news is out there for all to see but it still gets ignored. |

As I’ve said plenty lately, I’m not advocating an all in bet on stocks here. There are still some problems we have to get past. And the rally off the lows has improved sentiment to a point where a correction of this rally seems likely. But everyone today knows the bearish case and making money from things that everyone knows is rare on Wall Street. I’ll end with one more quote:

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

Mark Twain or someone no one remembers who sounded like Mark Twain

Tags: Alhambra Portfolios,Alhambra Research,Bear Market,Bonds,commodities,copper to gold ratio,currencies,Featured,inflation,Interest rates,Inventories,Investing,Market Sentiment,Markets,newsletter,Real Estate,recession,S&P 500,stock market,stocks,US dollar