Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record. In this case, it is demand that drives supply rather than the other way around. The constant demand for answers creates an audience for those willing to give them and also drives engagement on social media. You don’t get Twitter followers with a series of posts that effectively say “I don’t know”. I can attest to that personally. Prognostication in the investment business is more about drawing an

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, bonds, Citigroup, commodities, Consumer Sentiment, CPI, credit spreads, currencies, economy, Featured, industrial production, inflation, Jamie Dimon, jobless claims, Markets, Morgan Stanley, newsletter, PPI, Real estate, Retail sales, stocks

This could be interesting, too:

investrends.ch writes Neuzugang im Schweizer Vertriebsteam von Morgan Stanley

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Investors crave certainty. They want to know that there are definitive signals for them to follow as they adjust their investments to fit the current market and economy. They want to know that A leads to B leads to C. Tea leaf readers are always in high demand on Wall Street and they continue to find employment despite their almost universally dismal track record. In this case, it is demand that drives supply rather than the other way around. The constant demand for answers creates an audience for those willing to give them and also drives engagement on social media. You don’t get Twitter followers with a series of posts that effectively say “I don’t know”. I can attest to that personally. Prognostication in the investment business is more about drawing an audience than providing actual, useful advice.

We got some bad inflation news last Wednesday with the CPI report and it was confirmed by more bad inflation news on Thursday with the PPI report (although that one wasn’t as bad). The inflation fears led to concern that the Fed would raise interest rates by a full percent when they next meet and that in turn produced selling in stocks. The negative inflation reports were complemented by a report of rising jobless claims and fears of recession. High inflation and slowing growth is about as lousy an outcome as is possible in economics. And stocks were reacting negatively to the data; at the lows Thursday morning the S&P 500 was off by 4.5% for the week and it was looking like another big leg down in this relentless bear market. New lows have outpaced new highs for 34 weeks in a row, a streak only outdone in the past 16 years by the 2008 bear market.

Then, we got some good news. Friday morning retail sales were reported up 1% in June, much better than expected and relieving some of the recession fears. The report was even strong ex-autos and gas, up 0.7%. There were questions about how good sales were in light of the high inflation reading, although I’m not sure how accurate it is to use CPI to inflation correct retail sales. The CPI calculation includes a lot of things that aren’t in retail sales. But if you want to see something negative, you’ll see something negative. The Empire State manufacturing survey was harder to dismiss but for some, there’s always a cloud even if it’s tainted by a silver lining. Here’s what the NY Fed said about the report:

Business activity increased modestly in New York State, according to firms responding to the July 2022 Empire State Manufacturing Survey. The headline general business conditions index climbed twelve points to 11.1. New orders increased marginally, and shipments expanded significantly. Unfilled orders edged lower for a second consecutive month. Delivery times lengthened at the slowest pace in months, and inventories picked up. Labor market indicators pointed to a solid increase in employment and a slightly longer average workweek. While still elevated, both the prices paid and prices received indexes moved significantly lower, pointing to a deceleration in price increases. Firms turned pessimistic about the six-month outlook, a rare occurrence in the survey’s history.

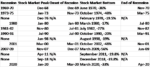

| The report is filled with positives but ends on a down note. It is indeed true that the survey’s six-month outlook has only been negative only 2 other times since its inception in 2001: September 2001 (9/11) and February 2009. You might note, as I did, that both of those dates were pretty good times to buy stocks. From the 9/11 lows the S&P 500 rallied 24.5% over the next 4 months although the bear market of that era was far from over. As for February 2009, we were within a few weeks of making the post GFC lows; from the February ’09 close to the following April, the S&P 500 rallied 65%. While that is comforting, it really doesn’t say much about what happens from here; it merely tells you that this negative reading is rare and the two past times it happened the market outcome was positive. Two data points may make a line but they don’t make a trend.

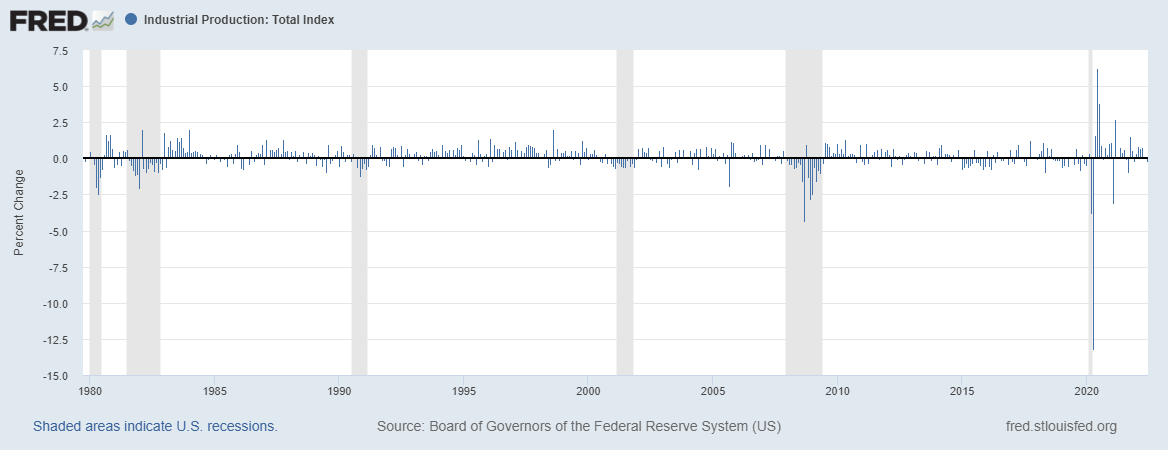

The good news continued with readings on import and export prices both of which rose much less than expected although I don’t think many people took notice. These reports come out every month but are always overshadowed by the CPI and PPI reports. Import prices, in particular, probably deserve a little more respect considering our trade deficit. Next up was Industrial Production which fell by 0.2% versus an expectation of a modest rise. That certainly isn’t a positive but it doesn’t tell you much about the odds of recession. Negative readings on IP are quite common during a business cycle as growth accelerates and moderates as it normally does. |

|

| That doesn’t mean the reading should be ignored but it has to be put into context and given the weight it is due, which isn’t all that much based on history.

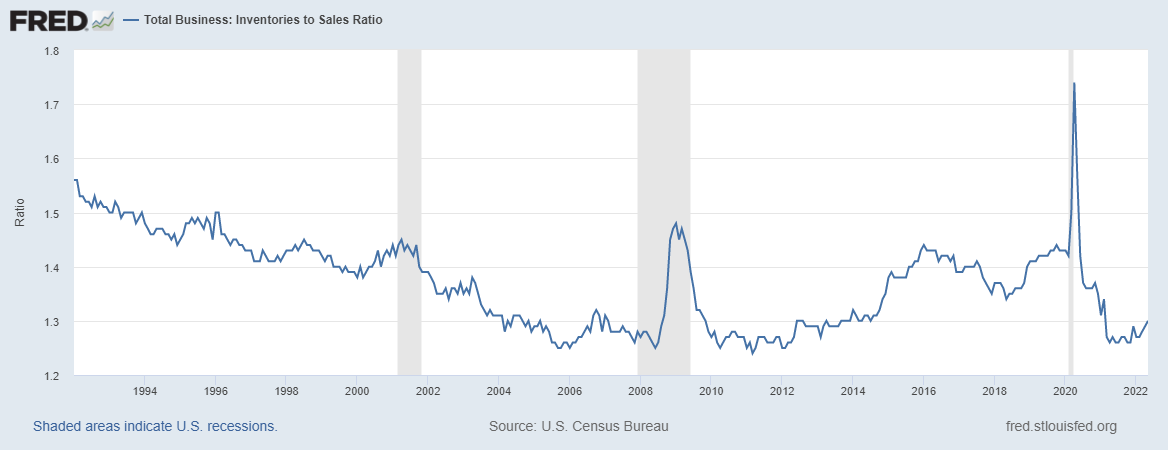

Later in the morning we received information on inventories but it is as of May and of little use in real time. Still it is interesting that the total business inventory to sales ratio remains low: |

|

| The latest University of Michigan Consumer Sentiment poll (preliminary for July) was also released Friday and improved to 51.1 from the all time low last month. Of more importance was the 5 year inflation expectations reading which fell to 2.8% from 3.1% last month. You might recall that it was the preliminary report for June that spurred the Fed to shift from a 50 basis point to a 75 basis point hike at the last FOMC meeting, a move that I called panic. That report had shown a jump in expectation to 3.3%, a reading that obviously spooked Jerome Powell. By the time the final reading came out it was down to 3.1% and now it falls further to 2.8%. Let it be known that the members of the FOMC are just as vulnerable to panic as the average retail investor. | |

| My only question about the U of Michigan poll is who exactly are they polling and whether they mentally stable. With all the news about the slowing economy and rising inflation over the last month, how did their mood improve and their inflation expectations fall?

From the lows near the open Thursday to the close Friday after all that “good” news, the S&P 500 rallied 3.8% to close the week down a fraction of a percent. There were other things going on as well so it wasn’t just about the economic data. J.P. Morgan and Morgan Stanley both reported earnings that were less than expected due to a big slowdown in investment banking; they led the way down Thursday with JP Morgan off 3.5%. There were confident pundits all over the news talking about how negative the JP Morgan report was and what it portended for the economy as a whole. That view was reinforced by the company as it suspended its share buyback and raised its provisions for future loan losses. While Jamie Dimon said that current conditions are quite good – “the U.S. economy continues to grow and both the job market and consumer spending, and their ability to spend, remain healthy..” – he’s worried about the future:

In other words, the guy who runs one of the biggest banks in the world, with access to research you can’t even imagine, doesn’t have any idea what the future economy will look like. He’s worried about all the same stuff you’re worried about and he has no better idea how it will turn out than you. I’d add that for us old timers who have spent a career watching Jamie Dimon be wrong about the economy, his pessimism is quite welcome. Contra JP Morgan, Citigroup reported their earnings Friday and they were a lot better than expected. The analysts were so wrong on Citi that their revenue estimates were off by over $1 billion in the quarter. If ever there was a reason to listen to Wall Street sell side analysts I’ve yet to find it. And with that report from Citi the banks led the market higher Friday, as if the Morgans’ earnings never happened. JP Morgan still ended the week down but Morgan Stanley finished up 1.7% for the week, outpacing the market as a whole. We will continue to get earnings over the coming weeks and the only sure thing is that we’ll see more of this. Some companies and industries will do well and some companies and industries will do poorly. Overall, I’d still expect earnings to rise this quarter but everyone will be focused on what companies say about the rest of the year, as if they have any better idea what will transpire over the next six months. I think people forget sometimes that the people providing those outlooks about the next quarter or the rest of the year are human too and subject to all the same failings as the rest of us. Adding confusion to the earnings puzzle is the big drop in commodity prices over the last month. Last quarter’s earnings will reflect high commodity prices that no longer exist. For many companies those high input costs hurt margins while for others it won’t matter a bit because they were able to raise prices. Rather than shifting earnings expectations down over the remainder of the year, analysts may be upgrading based on moderating inflation. Much emphasis on the word “may”. If you hang on every economic report like it is handed down from on high, as if you can discern something useful from every report, you’re going to be in a constant state of distress. Every report isn’t worth your attention. Most of the breathless Santelli reports from the floor are nothing more than noise. There are some indicators that have been useful in the past and I respect those but even with those I’m a practicing skeptic. The economy is a chaotic system that defies prediction. Small things can sometimes have big consequences for markets but only when they reach a critical phase. Today, when we ask how the economy will look in the next 6 months or the next year, we are actually asking a range of questions which are unanswerable:

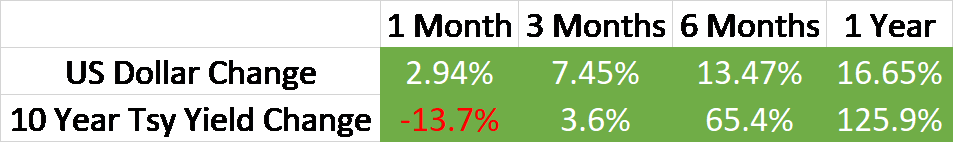

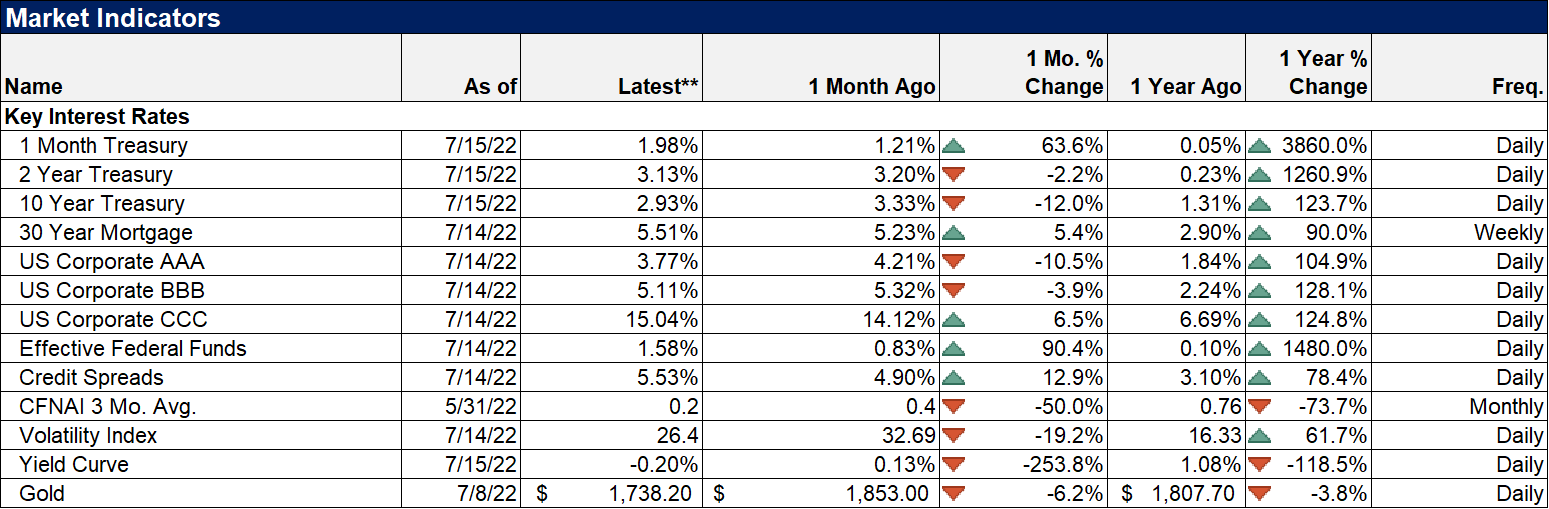

That’s just a sample of things we don’t know and can never know with any degree of accuracy. The global economy is, more than anything, a giant social network that disseminates information – and disinformation – faster than ever before. How does the degree of connectedness in today’s world impact the economy? Can the democratization of economic and market information change the way markets and economies react to news? When I started in this business over 30 years ago, no one on Wall Street – and certainly no one on Main Street – paid any attention whatsoever to yield curves. Does it matter that everyone is aware of them now and what they’ve meant in the past? Could knowledge of yield curve inversions affect the yield curve itself, inducing inversions – and steepenings – more rapidly than in the past? Could this knowledge lead to inversions that wouldn’t have happened in the past? What most people think of as the Heisenberg uncertainty principle – but is actually the observer effect – would seem to apply here. Merely knowing about the past relationship and measuring it in real time will affect the system. The list of things that once worked on Wall Street and no longer do is long and distinguished. Investors can never have the certainty they crave. If you wait to invest until all the uncertainty is gone you’ll be waiting forever. We monitor a long list of economic reports but in isolation most of them hold little or no meaning. It is like the parable of the blind men and the elephant, where each blind man touches only one part of the elephant. When they describe the elephant based on their limited experience their descriptions differ from the other men. In some versions of the story they accuse the others of being dishonest and come to blows. That encapsulates the ongoing debate about the economy to a tee. Each side of every economic argument claims to be able to reveal the “truth” about the economy based on their limited, subjective experience and will ignore all evidence that contradicts their conclusions. And on Twitter, they are willing to come to verbal blows to defend their position. I believe there are some economic indicators that are useful to the investor but it is a short list. Don’t get caught up in the day to day reports of impending boom or gloom. Concentrate on what you can control and don’t forget what investing is really all about. Your portfolio is not a series of bets. The elements of your portfolio, from stocks to real estate to commodities to bonds, are investments in the future and your future returns depend on what you pay today. Yes, something could happen that changes that future and if it does you’ll have to adjust. But today, right now, the market is offering good investments at reasonable prices and long term investors should be taking advantage of current volatility. You need to be choosy but that isn’t something that should only apply in a bear market. Tune out the day to day noise and concentrate on what really matters. The rising dollar, rising rate environment continues although the 10 year yield did come down some last week. What didn’t come down was the 2 year rate and the 10/2 curve is now pretty steeply inverted (about 20 basis points). I noticed a plethora of economic commentators last week equating the depth of the inversion to the severity of the potential outcome. Since this is a family blog I’ll just say balderdash when I want to say something much cruder and intemperate. It is true that this curve inverted by 19 basis points before the 2008 crisis. It is also true that the inversion was in November of 2006 and the onset of recession was just over a year away. An even bigger inversion was in March of 2000 (52 basis points) and the 2000 recession was one of the mildest on record, not even encompassing two quarters of negative growth. The depth of the inversion tells you nothing more than how aggressive the Fed is about raising rates. What’s more important is that the trend of rates is still up except for the very short term. I’ve said before that the 10 year could fall to 2.25% or so and still be in an uptrend. That hasn’t changed. The dollar uptrend has been strong but I’m getting skeptical that it will continue much longer. I suppose the key to that may be the Ukraine situation since Russian energy directly impacts Europe and Japan (euro and yen). But everyone is betting on the buck at this point; this trend is not unknown so if you’re long, you are the crowd. |

|

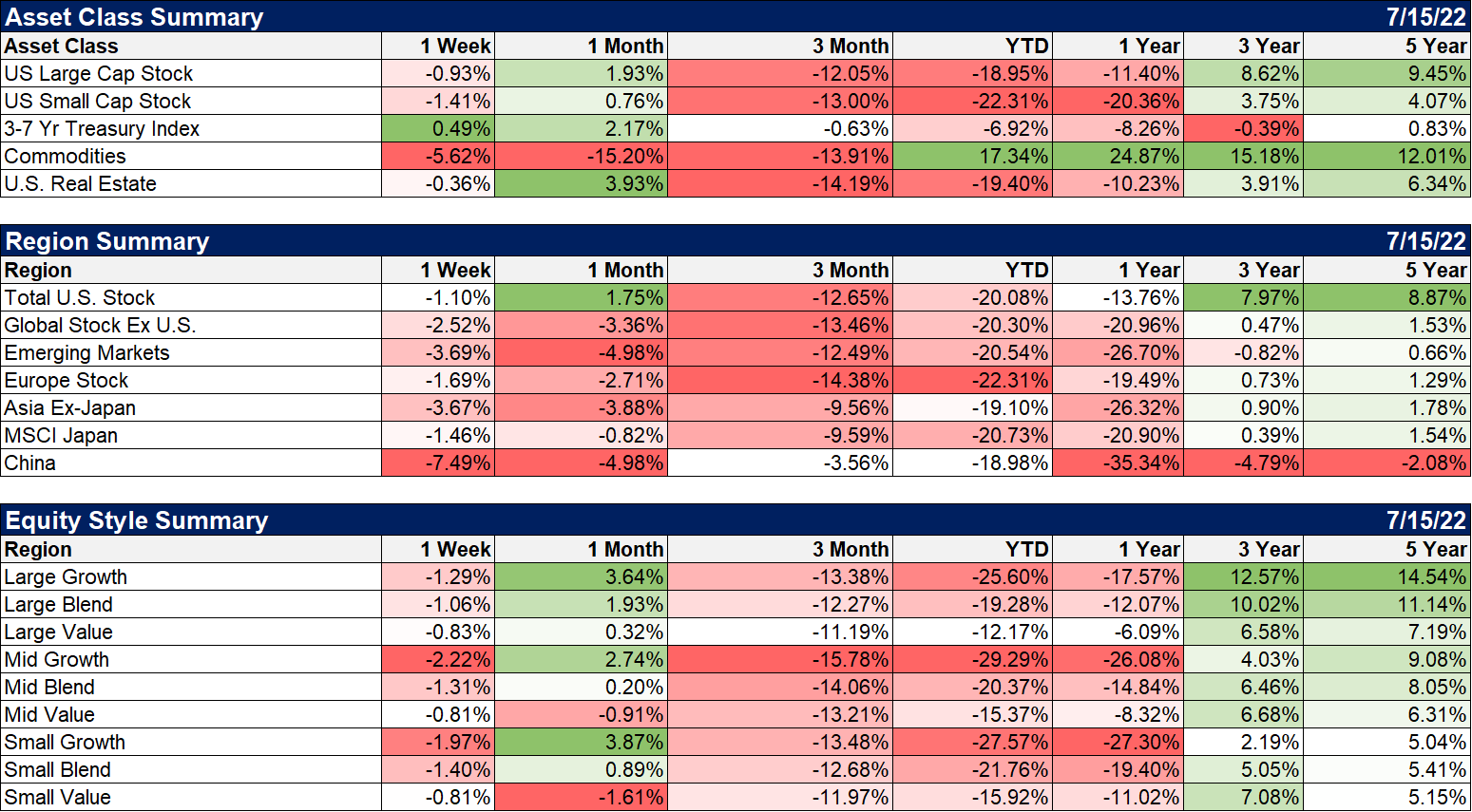

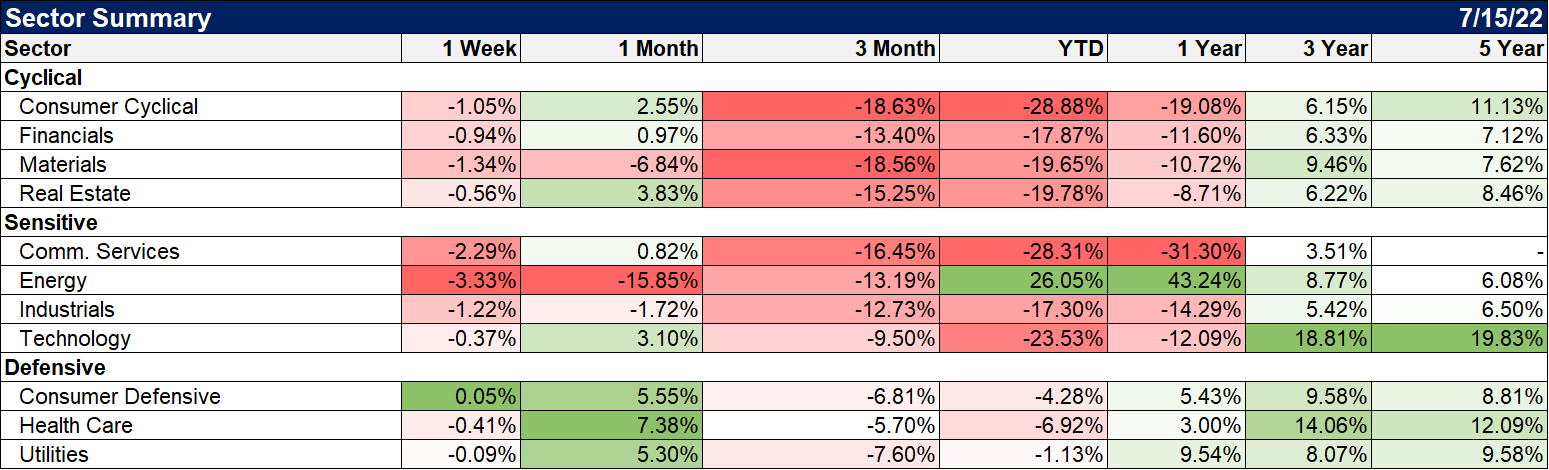

| Despite the big rally on Friday stocks still finished the week lower. Over the last month, however, we do see some positive signs. I can’t tell you whether that will continue but it is encouraging. Stocks are up, bonds are up and commodities are down. I think that is exactly what we would expect if the inflation scare is coming to an end.

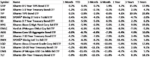

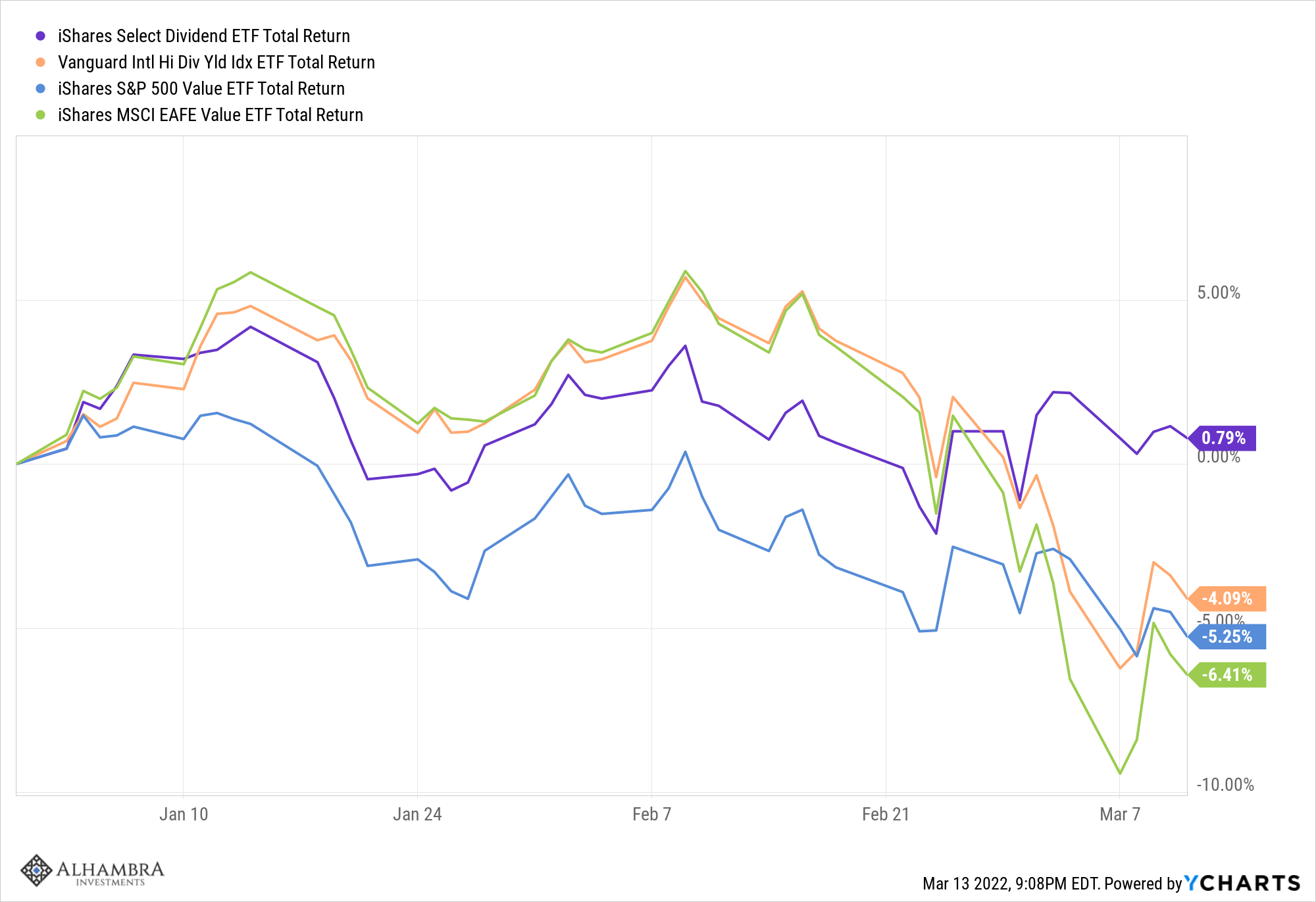

Value outperformed last week but still finished down. Value is down less than half the growth indexes YTD and over the last year. There is no doubt though that growth is trying to make a comeback here. I’m not convinced and the trend hasn’t changed but I’m watching it closely. |

|

| Non-US stocks continue to struggle and that will probably be the case until the dollar comes back down. Energy stocks continued to correct last week. My target for crude in the mid to high 80s hasn’t changed so I’d keep waiting on the stocks. We should see the stocks start to improve before crude hits bottom though so we’re probably getting close to a buy point.

One of the better performers last week was technology which is starting to look interesting from a valuation standpoint. Both the major Tech ETFs (IYW and XLK) trade for about 19 times earnings with historical earnings growth of about 25%. One thing to be aware of though is the heavy weighting of Apple and Microsoft in these funds. In the iShares version (IYW) the two amount to 35% of the fund while in the SPDR version (XLK) they total 46% of the fund. |

|

| Credit spreads have backed off from the recent high around 6% and fell under 5.5% on Friday. That’s at least in the right direction. | |

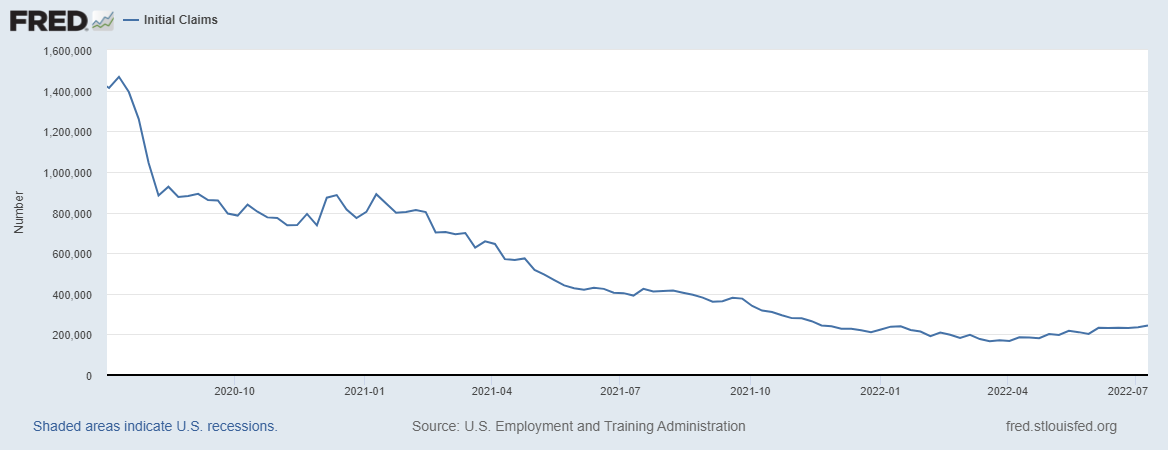

| There is no road map for investors to follow when it comes to the economy and the markets. The best you can do is to keep things in perspective and context. The rising jobless claims I mentioned in the opening are a great example. Weekly claims have risen from their lows of 166k back in March. Last week’s count was 244k which sounds like a big jump if you don’t know the context. The last time claims were that low was in 1968 when the US population was about 200 million versus roughly 330 million today. From the mid-70s until 2014 that number rarely got under 300k through multiple business cycles. The reading in early March 2020, right before the first round of COVID lockdowns, was 186k.

So claims have indeed risen but they are still below the nadir of claims in all business cycles since 1975 except the most recent one. The rise so far doesn’t look like much: Should you worry that claims are rising? Sure. Does it represent some imminent threat of recession that requires you to make big changes to your portfolio? Seems unlikely. |

|

Economies are big chaotic systems that defy prediction. COVID was a – hopefully – once in a lifetime event. It led to unprecedented actions by government and private businesses. Getting back to where we were prior to COVID is, if we’re honest with ourselves, impossible. Everything we do today, every policy we enact, every geo-political connection – everything – is colored by that event. It will lead to outcomes no one expects, some of them good, many of them bad. We can’t predict any of them and I’m convinced that the more connected we become via technology, the more feedback loops we’ll create and the more unpredictable things will become. There will always be clues to the future in our markets; the wisdom of crowds still exists. But if you’ve spent even a little time on Facebook or Twitter, you know the crowd probably isn’t as wise as it once was. All voices are amplified on social media, even the most ridiculous. It is hard to tune out the noise of the crowd, the social media echo chambers, but it is critical to investing success. No one on Twitter or Facebook knows what the future holds but they will not hesitate to tell you all about it anyway. And most of them have something to sell. Caveat emptor.

Tags: Alhambra Portfolios,Bonds,Citigroup,commodities,Consumer Sentiment,CPI,credit spreads,currencies,economy,Featured,industrial production,inflation,Jamie Dimon,jobless claims,Markets,Morgan Stanley,newsletter,PPI,Real Estate,Retail sales,stocks