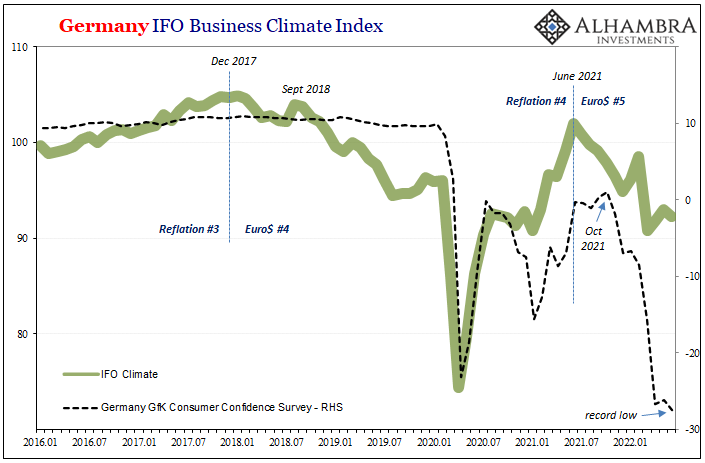

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation. From GfK back then: The growing consumer optimism signals that consumers here consider the German economy on course for recovery, although the momentum is somewhat more moderate than expected a few months ago. . A stable labor market also contributes significantly to the high level of economic expectations. The words just don’t match the data; when the quote above was written and released, the

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, Consumer Sentiment, CPI, currencies, economy, eurodollar futures, Featured, Federal Reserve/Monetary Policy, Germany, HICP, inflation, Markets, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation.

From GfK back then:

|

|

| A stable labor market also contributes significantly to the high level of economic expectations.

The words just don’t match the data; when the quote above was written and released, the headline estimate for consumer sentiment in Germany had just ticked above zero for the first time since the coronavirus debacle in 2020. Sounds terrific, but that wasn’t really meaningful, just another technically-correct phrase which only agreed with the inflation narrative on its narrowest surface. The index remained well below each and every pre-2020 estimate. |

|

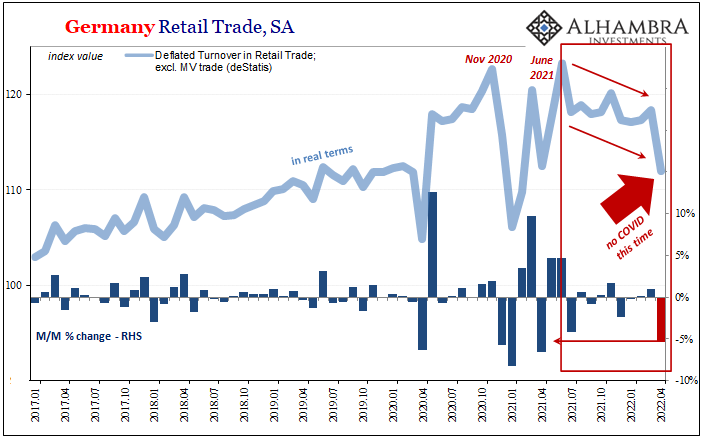

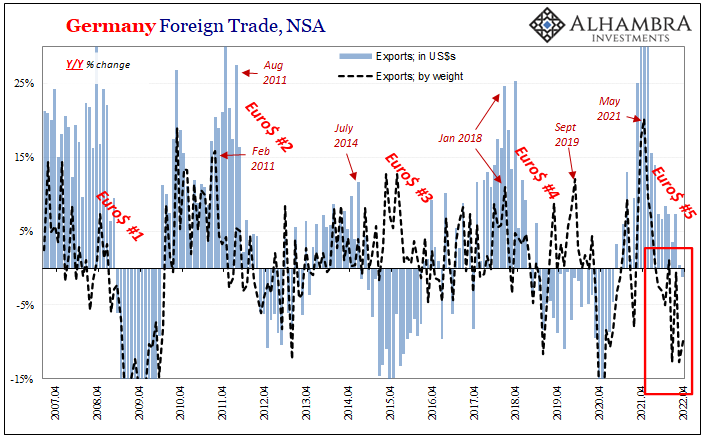

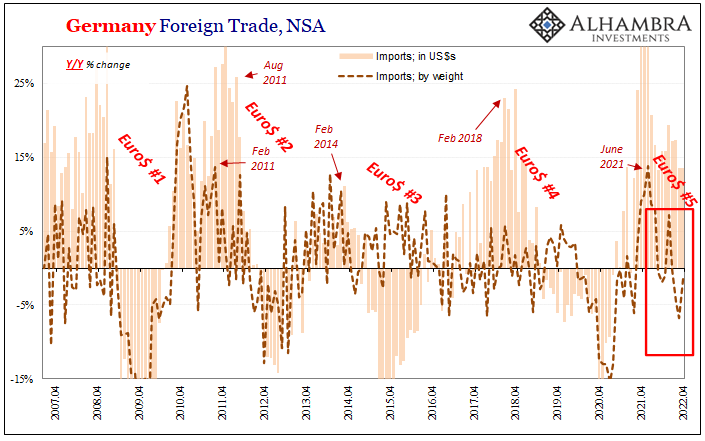

| It has been (widely) assumed this was only temporary, that Germany’s then-accelerating consumer price indices represented a true picture of recovery, if only too much of one. From that, you’d presume normality just a few more months ahead.On the contrary, it’s been downhill – way downhill – ever since. And the downslope began months before Russia went foraging for Ukrainian luster. In other words, as consumer (and producer) prices in Germany started their current climb, consumer confidence reversed into what is today an epic collapse – not only the GfK.

Like Americans, Germans have never been more pessimistic. |

|

| As of today’s forecast for the month of July, GfK has it a record low.

What happened to “high level of economic expectations?” Complete and total mirage, mainstream pundits and the like convincing themselves that “stimulus” works, that CPIs are a result of economic activity rather than gross imbalances, ultimately the failure to see the world as it had truly been. The entire global economy never recovered, not even close, and then the full weight of the worldwide supply shock (because it wasn’t American “money printing”) slammed down before Putin went full-on stupid. |

|

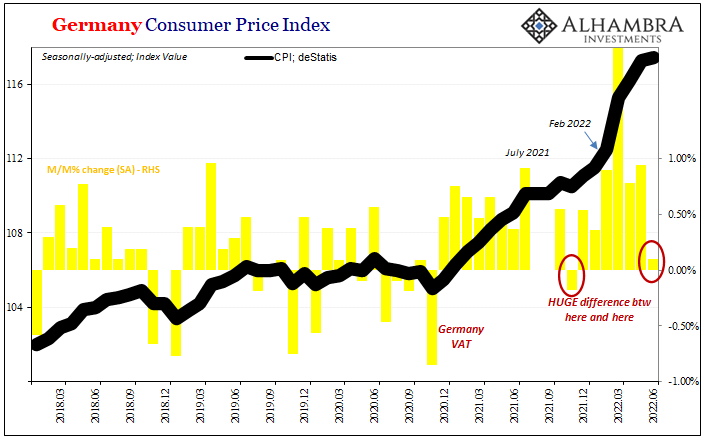

| Just as the hapless ECB begins to grow hawkish wings (I am very close to retracting my apology to Ms. Lagarde, though not entirely surprising), Europe’s economy falls apart. That region’s “inflation” was always going to be “transitory”, too, even if most people don’t have the patience to wait more than a year for it to be fulfilled.The day’s other “shocking” news was Germany’s HICP advance for June 2022. It fell month-over-month; dropped, declined. The headline CPI, which is calculated a little differently from the harmonized HICP, gained only 0.1% month-over-month.

This could be nothing more than short-term noise, just as the situation had been last November the last time the CPI gained so little on a monthly basis. But that’s the thing; there’s a vast difference between now and last November, as German consumers will attest. When consumer prices rebounded December and after, consumers weren’t yet so downtrodden. They are now, and then some. |

|

| And not just consumers, business expectations are falling fast, too, which only threatens the labor market Europe-wide; planet-wide.

To that end, Germany’s deStatis put the preliminary June year-over-year CPI gain at 7.6% compared to 7.9% during May. That was the other “shock”, an actual decelerating annual rate which had been widely expected (consensus was 8.0%) to further rise. This despite a god-awful, economy-crushing 38% year-over-year increase and contribution from energy (and 12.7% y/y for food). Services prices were the primary reason, a huge macro uh-oh for all those inflation hawks to now digest. Except maybe the ECB which is following Jay Powell’s path toward yet another embarrassing turnaround. Time will tell whether or not Europe or Germany’s June price reading proves temporary, or it actually does represent the start of the other side of supply shock transitory. We know which way markets are currently betting globally. All those out there who said you couldn’t rely on especially the Treasury market because the Fed bought bonds during its QE’s, somehow spoiling and tainting good, relevant, validated information. Now these disbelievers are seeing their flippant (frankly irrational) dismissals of the curve thrown right back at them by the current flood of uniformly gross data. |

Add the growing prospect for falling CPIs Europe and beyond, no rate hikes ever required.

But it had never been just USTs, had it? That’s what the Fed (Lagarde) Cult would also attempt, to limit their scope to just Treasuries while leaving unexplained how and why Treasuries were thoroughly corroborated up and down the market spectrum. Even by what were not too long ago the darlings of “store of value” “inflation” protection, crypto and real estate.

Digital currency prices started downward around October and November, too. Random coincidence? Not a chance.

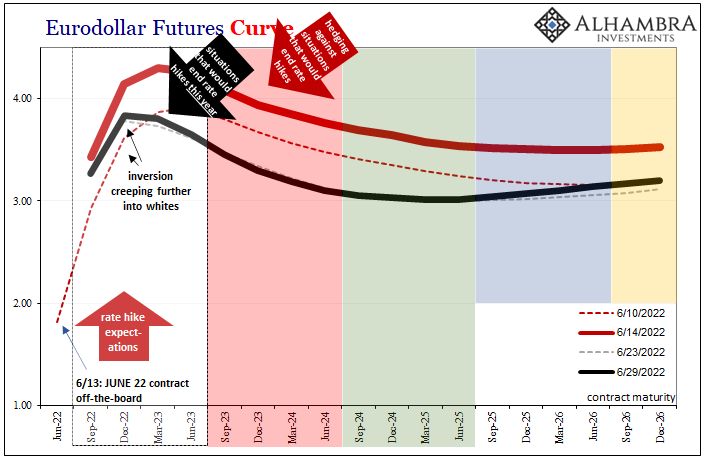

I mean, that’s also exactly when eurodollar futures flattened into inversion.

The whole thing has been corroborated from one side to the next, from top to bottom, across geographical boundaries and from one market to another. This data is just confirming what has been increasingly priced in for over a year.

That’s the thing now, though. Markets have moved on from “if” and “when” to now “how bad.” Eurodollar futures, much more difficult to try to impeach (especially given history, recent history), inverted in whites at the December 2022 contract says Jay Powell is nearing certainty to get embarrassed this year. We can easily infer what that would mean for the ECB and Christine Lagarde (maybe just maybe, depending on timing, sparing her the same humiliation).

What would it take across the global system to turn Jay Powell from ultra-hawk (ostrich) to rate cutting dove? And do it in a matter of months!

The data we see here would be a start. But it’s not just here, it is everywhere.

Irony of irony, GfK stands for Growth from Knowledge. Here now, neither.

Tags: Bonds,Consumer Sentiment,CPI,currencies,economy,eurodollar futures,Featured,Federal Reserve/Monetary Policy,Germany,hicp,inflation,Markets,newsletter