It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld From the Seinfeld episode “The Opposite” I was talking with a friend last week about the markets and the economy and she said she didn’t understand why the market went up after the GDP report. After all, it was the second quarter in a row of GDP contraction and that’s a recession. Shouldn’t I be selling stocks? I explained that markets are

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, bonds, cfnai, commodities, COVID, credit spreads, currencies, economic growth, economy, energy stocks, Featured, Federal Reserve/Monetary Policy, GDP, growth stocks, Interest rates, Inventories, Investing, Markets, newsletter, Politics, Real estate, Recession, stock market, stocks, TIPS, trade deficit, US dollar, US Dollar Index, value stocks

This could be interesting, too:

Investec writes The Swiss houses that must be demolished

Claudio Grass writes The Case Against Fordism

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

It all became very clear to me sitting out there today, that every decision I’ve ever made, in my entire life, has been wrong. My life is the complete opposite of everything I want it to be. Every instinct I have, in every aspect of life, be it something to wear, something to eat… It’s all been wrong. Every one. – George Constanza

If every instinct you have is wrong, then the opposite would have to be right. – Jerry Seinfeld

From the Seinfeld episode “The Opposite”

I was talking with a friend last week about the markets and the economy and she said she didn’t understand why the market went up after the GDP report. After all, it was the second quarter in a row of GDP contraction and that’s a recession.

| Shouldn’t I be selling stocks? I explained that markets are forward-looking and that stocks bottom well before the end of a recession (about 4 months on average). So, I said, if you want to buy stocks near their recession lows you have to buy before the recession is over. She looked at me and said, Opposite George! As a devoted Seinfeld fan I immediately got the reference and thought, what a wonderful way to think about investing. We may not be as hapless as George Constanza when it comes to most of our life, but investing? Our instincts about investing are horrendous, almost always wrong. Last year when stocks were booming and all the talk was about another Roarin’ Twenties, it was hard to resist the urge to buy. This year, when stocks are falling and we’re arguing about whether inflation or recession is the worse of the two evils we face, it is hard to resist the urge to sell.

The GDP report for the 2nd quarter was indeed negative (-0.9%) and there is now an argument about whether this constitutes a recession since Q1 was negative as well. It is mostly a political Rorschach test where Republicans are certain that it is and Democrats are just as certain that it isn’t. Mostly. For the record, I don’t know and don’t much care. The economy has certainly slowed since last year but what you call that is irrelevant. Q1 GDP fell by 1.6%, mostly due to trade which reduced it by 3.2%. That was reversed in Q2 as trade added 1.43%, pretty close to my back-of-the-envelope calculation last week. What changed in Q2 was inventory, which subtracted 0.35% in Q1 but a full 2% in Q2. What does that tell you? Not much if you ask me. The trade figures were distorted in Q1 by, among other things, the China shutdown. The inventory figures for the first half of this year are just a correction of the large inventor build-up in Q4 2021. It is just the economy trying to adjust to the end of COVID – maybe – and it isn’t easy since no one has any experience with recovering from a pandemic. |

|

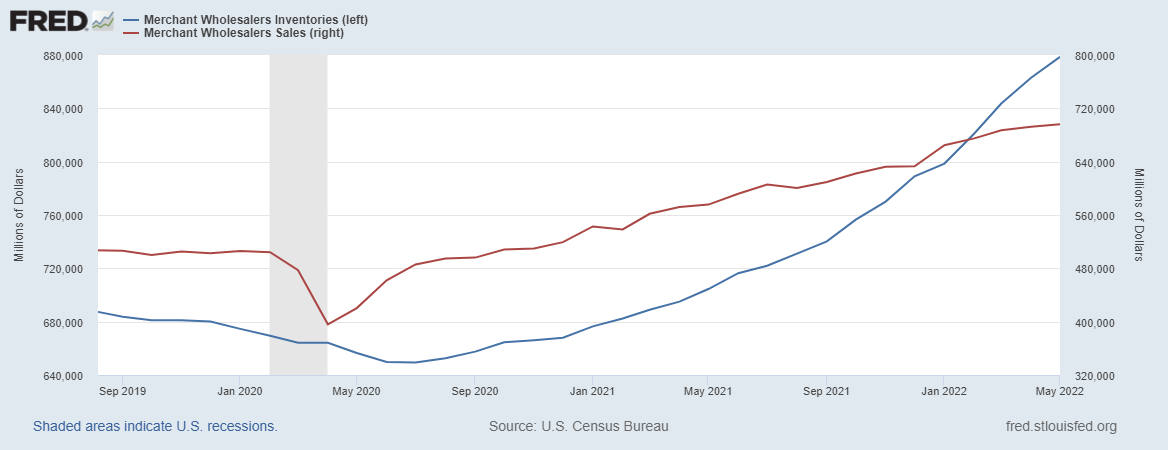

| Inventories have risen recently and there has been a lot of commentary about how this will negatively impact the economy. If you follow these things you’ve probably seen a chart that looks something like this:

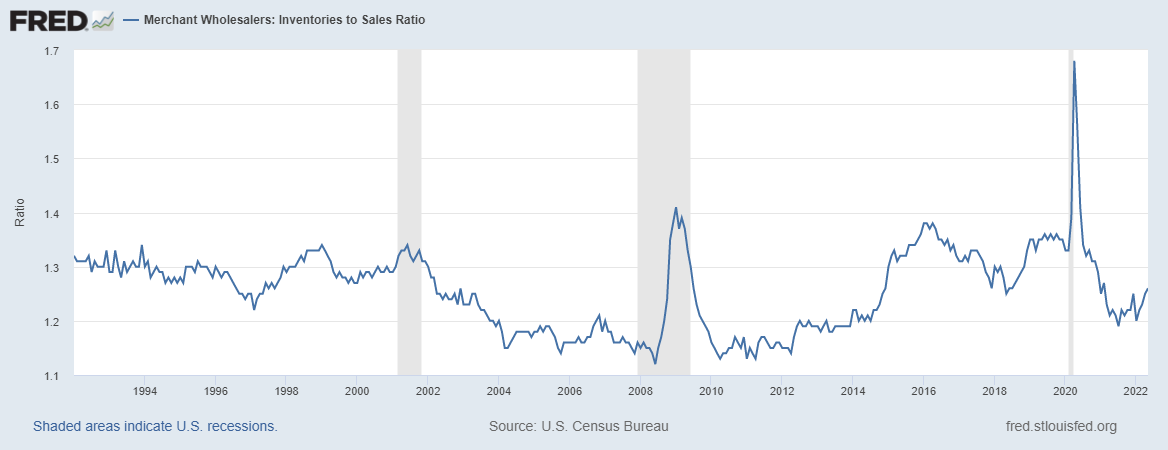

It certainly looks scary with inventories rising much faster than sales and there are plenty of macro gurus who are willing to tell you that production will have to be cut until inventories come back down. That means layoffs and all the other things we normally associate with recessions. Things are about to get a lot worse, right? Here’s another chart that represents the same data. It’s a ratio called inventory/sales: |

|

| Not nearly as dramatic as that first one, huh? The ratio is about average for the data back to the early ’90s. I would also note that we entered recession in 2008 with the ratio falling and we avoided recession in 2016 despite a ratio much higher than the current one. Inventory and production decisions are not simple and they are especially difficult today. Do you really think companies are going to lay off a bunch of their workers to address a – likely – temporary inventory problem? In an economy where workers are so hard to find? What is an acceptable level of inventory in the post-COVID economy with supply chains still not back to normal? Maybe we are in recession but it isn’t because of inventories.

My outlook for the economy hasn’t changed. |

|

| We came into COVID growing at an average of 2.1% over the prior decade. During COVID we didn’t do anything to improve the potential growth rate of the economy. And I don’t think we did anything that significantly reduces that potential either. What that means is that we are ultimately headed back to whence we came, a 2% growth trend. What we’re doing right now is removing the COVID distortions – from the lockdowns and the stimmie checks and the easy money policies of the Fed. What those distortions did was drive goods consumption well above trend and services consumption well below trend. As they move back to trend, the goods side of the economy will slow and the services side will rise. Forget the noise of trade and inventories everyone else is arguing about. When you look at the report, what you find is that goods consumption has subtracted from GDP and services have added to GDP over the last two quarters. And, just to be clear, services added more than goods subtracted (+1.78% vs -1.08%).

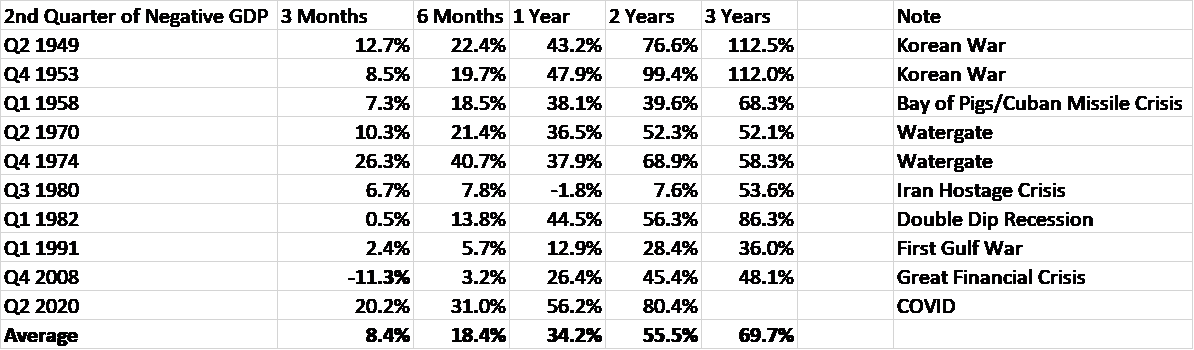

If you shift to the investment part of the GDP equation (again, ignoring inventory) we see something that is also acting just as one might expect with the Fed raising interest rates. Gross Private Domestic Investment subtracted 2.73% from Q2 GDP but we know that 2% of that was inventory. Of the -0.73% left over, -0.71% of that was residential investment – housing. Even in the non-residential side, the biggest detractor was “structures” which sounds a lot like real estate. I don’t know about you, but I’m not exactly shocked that real estate activity has slowed with higher interest rates. The GDP report last week was a non-event. The economy is doing exactly what one would expect given these conditions. The inventory and trade figures of the last 2 quarters are nothing more than distractions for investors and the commentary nothing more than calls to your inner George Constanza to follow your instincts. Another non-event was the Federal Reserve’s FOMC meeting that kicked the stock market rally into high gear. That was so because Jerome Powell’s press conference was widely perceived to be a message from the Fed that they are now “data dependent”. One might think that should always be so, but the Fed is in the same boat as investors, trying to interpret data from the past to predict the future. What they ought to be doing is watching the market rather than the economic data but that seems a lost cause; the Fed is always behind the curve. If the market perceives that the economy is headed for recession, short-term interest rates will fall rapidly as the market prices in future Fed rate cuts, no matter what the data says about yesterday. What the market is saying today about growth is that it is slowing but not precipitously. Inflation expectations have also fallen but the Fed’s perceived dovishness on rates did cause breakevens to tick higher last week. Will stocks keep going up? Well, obviously I don’t know the answer to that question but I can offer some data about previous periods of negative GDP growth. What should you do if we have just had 2 consecutive negative GDP quarters? History says you probably ought to think about doing some buying: |

|

| Just to be clear, I’m not saying you should back up the truck and load up on stocks. We don’t even know yet whether we really had two negative quarters in a row. GDP data has been subject to some pretty big revisions in the past and the first 2 quarters were such small contractions that either or both could be revised away. And that is especially true of Q2 since it was mostly inventories and an estimate was used for June because the data isn’t yet available. Furthermore, there’s nowhere near enough data here to make this meaningful from a statistical standpoint. It is interesting because of the things listed under notes as people seem to think today’s conditions are somehow unprecedented. Russia’s regular threats today about nuclear weapons pales in comparison to the Cuban Missile Crisis. | |

| But this could just as easily be similar to 2008 (from a market standpoint, not an economic one) as 1975 or 2020/21.

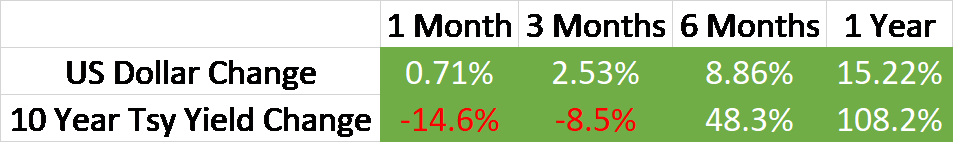

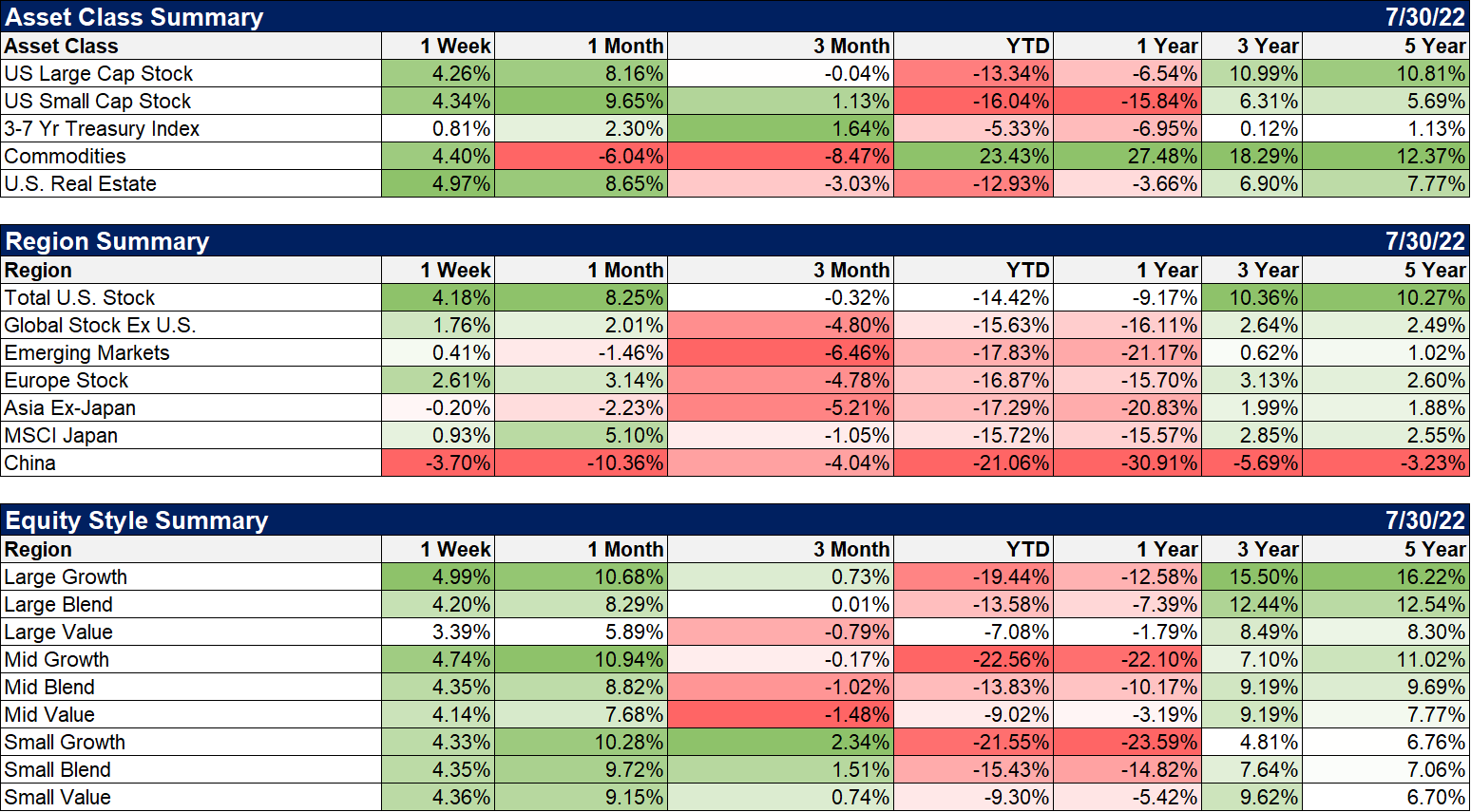

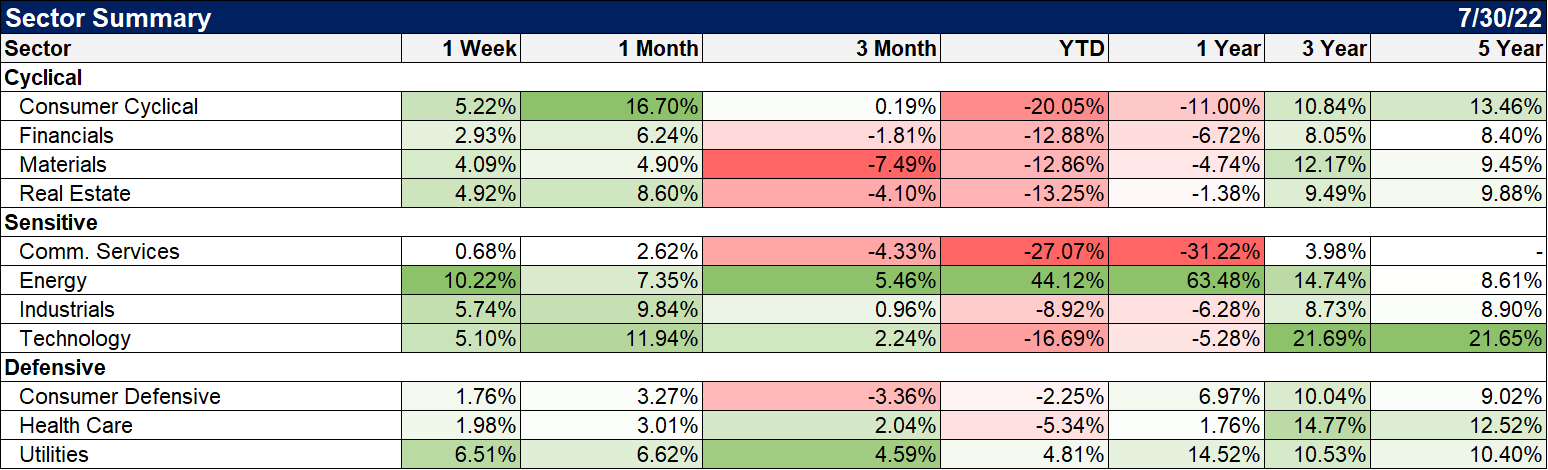

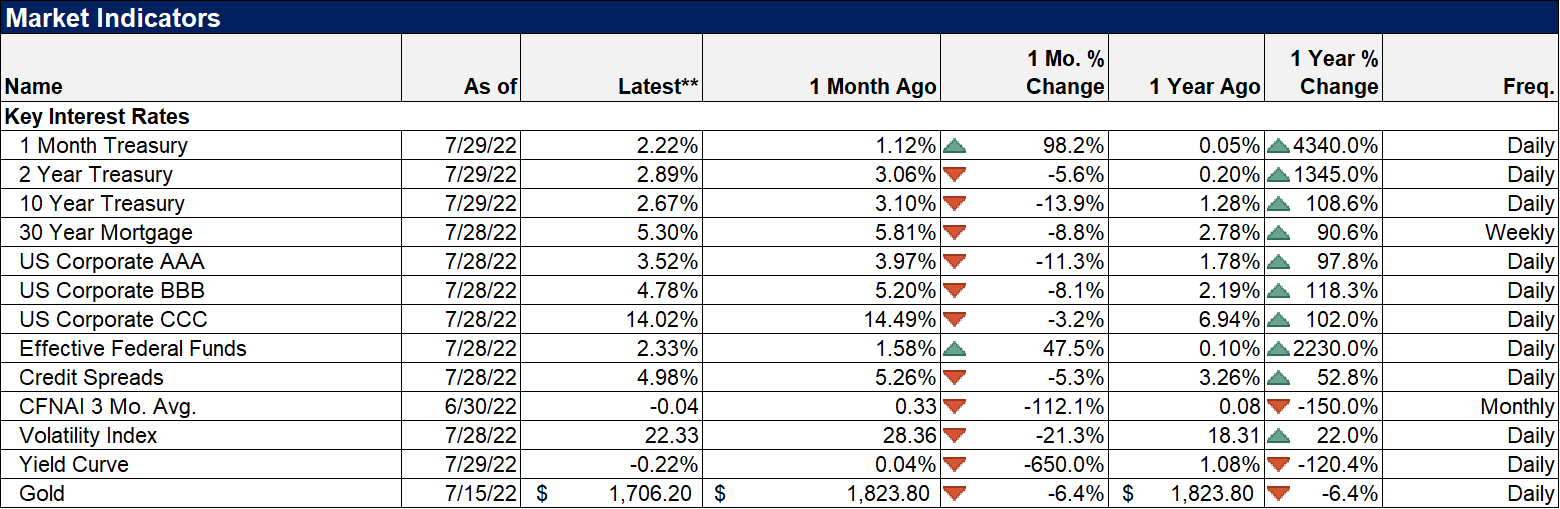

My brief overview of markets is that large growth stocks are still overvalued even as they led the recent rally. Large value stocks are cheaper and small and mid-cap stocks are cheaper still. International is very cheap but the dollar is still in an uptrend – we may be seeing a peak there but it is very premature to call that – and as long as that is the case, it’s an uphill battle. There is also the small matter of the stranglehold Russia has on Europe’s largest economy via the energy markets. I do think the recent rally probably has more to go based on my reading of sentiment. Large specs are still holding sizable short positions in the futures markets and my sense is that most people think this is a bear market rally. Put/call ratios aren’t as high as I’d like but they aren’t so low that we need fret too much either. Don’t waste your time thinking about whether this is a recession or not, it really doesn’t matter. What does matter is that the economy is slowing just as expected and most companies are, so far, finding ways to cope with it. I know you are worried about the economy right now and you should be. We don’t know if things will get worse before they get better (and they will get better). But for goodness sakes don’t make decisions based on your “instincts” or “your guts” or because some chart charlatan scared you. Remember Opposite George! The rising dollar/rising rate environment remains intact although both are moderating. The 10-year Treasury yield is no higher than it was in April but it is still in an obvious uptrend when viewed from a longer perspective. The overshoot in rates this year is quite similar to the overshoot in early 2021. Once it corrected the overshoot the uptrend resumed. That could happen again but I’ll wait, as always, for evidence of that. Right now, we are still in correction mode for the 10-year rate. The 2-year rates has not corrected as much as the 10-year so the 10/2 yield curve is still inverted. As I said above, if the market perceived that the economy was very weak and headed for a bigger slowdown, the 2-year yield would be falling rapidly and that just isn’t the case. Will it do that soon? Maybe but I don’t make guesses about the future. If it does, that will affect our outlook for the economy. But just be aware that both rates can still fall quite a bit and still be in long-term uptrends. The dollar uptrend has also started to correct, down about 3% from the recent high. To be clear though, the uptrend here is more intact than for rates. The dollar index hasn’t even traded below its 50-day MA on this move. If we break that level (about 104.75) I would expect further weakness down to 103. And for further clarity, the index could trade down to about 100 and still be in an uptrend. That’s how far and how fast the move up was and breaking that uptrend is not going to be easy. |

|

| Most markets were higher last week with Asia (China) the lone exception. We are now facing a conundrum with our portfolios. Should we continue to maintain our cash cushion or get fully invested? As one of our clients has put it to us repeatedly, you’ve done well on the downside but how will you do when things turn higher? I am always reluctant to chase big short-term moves but that sentiment is still negative after a big up move may be telling us something. I want to see how the markets trade after last week but I am leaning toward adding some risk here. That doesn’t necessarily mean stocks and it certainly doesn’t mean large growth stocks. But commodities are acting well technically and real rates dropped pretty good last week.

The 10-year TIPS yield is down from 89 basis points to just 20 since July 8th. That’s why gold is finding a bid and if growth holds up, it will likely mean higher commodity prices as well. That’s also why I’m still a little tentative about adding stocks by the way. The market may think the Fed is pivoting to a less aggressive policy but that will only be true if inflation really does come down, something that it hasn’t done yet. Real estate is also attractive if inflation persists but it is also rate-sensitive. Midcap stocks are cheap though and I think we can probably add some high-quality exposure there with less risk than large caps. |

|

| There wasn’t much difference in performance between growth and value last week but growth has led this rally off the bottom. That’s another reason to be a little skeptical of the overall stock market rally. The large growth stocks are not cheap by any measure and they are mostly rallying on the back of lower rates. If rates turn up that will come undone in rapid fashion. Be careful out there if you’re trading that part of the market.

Energy stocks led the way last week and it may be that crude is done on the downside. I had thought we’d see the mid to high 80s and that is still possible but it’s looking less likely. We don’t usually buy energy stocks anyway because we have direct commodity exposure which we are busy rebalancing after the correction (we’re buying to bring our exposure back up to our target). Defensives and health care stocks were down as the market chased beta but utilities had a great week with lower rates. Cyclicals also had a good week. I guess if the Fed is slowing down investors think the odds of recession faded. I don’t give the Fed that much credit or blame but as I’ve said many times, my opinion doesn’t really matter. |

|

| Credit spreads have narrowed by a little over 100 basis points since the July 5th peak. That is a significant positive move in spreads that indicates a lessening of recession fears. Indeed, it isn’t just junk bonds rallying but high-grade corporates as well. The high-grade corporate bond ETF (LQD) is up over 7% since its June low. Shorter-term corporates are also higher. Muni bonds have also rallied, up about 3.5% since mid-June.

One indicator going in the wrong direction is the CFNAI, the 3-month average of which fell to -0.04 last week. With 0 as trend growth, we are now just slightly below trend. But the trend is also down so we’re not out of the woods. A reading of -0.75 means we are likely in recession. |

|

The sentiment about the economy is still quite negative but there is still little evidence of actual recession in the real world – or almost any economic statistics that aren’t sentiment surveys. The Dallas Fed Manufacturing survey from last week is a good example. The comments are the most interesting part of the report in my opinion. Here’s a sample from the July version released last week:

- The concerns of a looming recession have increased over the last month. With supply-chain issues continuing, the cost of raw materials remaining high and significant interest rate hikes, overall business activity has to slow. It is just a matter of when—which I believe is soon.

- We are experiencing a temporary increase in business but have a pipeline that is beginning to decline due to inflation’s impact on interest rates and slowing construction starts.

- We cannot find the qualified people to expand our output.

- President Biden going overseas to beg for more oil supply instead of working with the domestic producers really adds uncertainty to the domestic producers and their budgets. This will affect our plans dramatically for expanding our business.

- About 20 percent of our backlog was not taken by customers as ordered, but we were able find homes for that product and, therefore, continued to sell almost everything we produced. With incremental capacity coming online, we were able to grow finished-goods inventories a bit. We did see weakness in handsets and personal computers consistent with general commentary with the broader industry. Other markets are mixed; industrial markets continue to have pockets of strength, while others are beginning to show signs of weakness. We are expecting that weakness to begin to spread as we move into the second half of the year.

- Broad-based inflation, together with difficulties in recruiting while our customers’ activity is strong, creates a puzzling and uncertain environment.

- The economy is in shambles. There’s no way out that isn’t bad.

And my favorite comment of all:

November can’t get here fast enough.

What we see with these comments is an economy that is probably slowing – although not in all industries – but mostly expectations/concerns that things will get worse. That appears – certainly based on the last comment – to be more a political belief than one based on reality. Media bias has always existed but not to the degree we see today and not when information or disinformation could be spread so easily and quickly as it is today. What that means to me is that most survey data can be safely ignored or heavily discounted. Politics ends where the income statement starts for most businesspeople. Watch what they do, not what they say. And whatever else you do, don’t let your politics dictate your investment strategy.

Tags: Alhambra Portfolios,Bonds,cfnai,commodities,COVID,credit spreads,currencies,Dollar Index,economic growth,economy,energy stocks,Featured,Federal Reserve/Monetary Policy,GDP,growth stocks,Interest rates,Inventories,Investing,Markets,newsletter,Politics,Real Estate,recession,stock market,stocks,TIPS,trade deficit,US dollar,value stocks