The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since the onset of COVID, has been so unusual that anyone confidently predicting anything about how the economy will develop over the coming months is lying – to themselves or you or both. Any model or indicator or rule of thumb that has worked over the last few decades to predict the future course of the

Topics:

Joseph Y. Calhoun considers the following as important: 5.) Alhambra Investments, Alhambra Portfolios, Alhambra Research, bonds, commodities, credit, credit spreads, Crude Oil, currencies, durable goods, economic growth, economy, employment report, energy stocks, Featured, household survey, housing, Interest rates, labor force, lending, manufacturing, Markets, natural gas, newsletter, Real estate, Russia, services, stocks, Unemployment, US dollar, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy. I do think the bulls had the better case on this particular report but there have been plenty of others recently to support the ursine side of the aisle too. My take is that everything about the economy right now, and really since the onset of COVID, has been so unusual that anyone confidently predicting anything about how the economy will develop over the coming months is lying – to themselves or you or both. Any model or indicator or rule of thumb that has worked over the last few decades to predict the future course of the economy is suspect.

No one alive today has any experience with a post pandemic economy, especially one with so much government intervention as this one. Comparisons to the 1918 flu economy are ridiculous. |

|

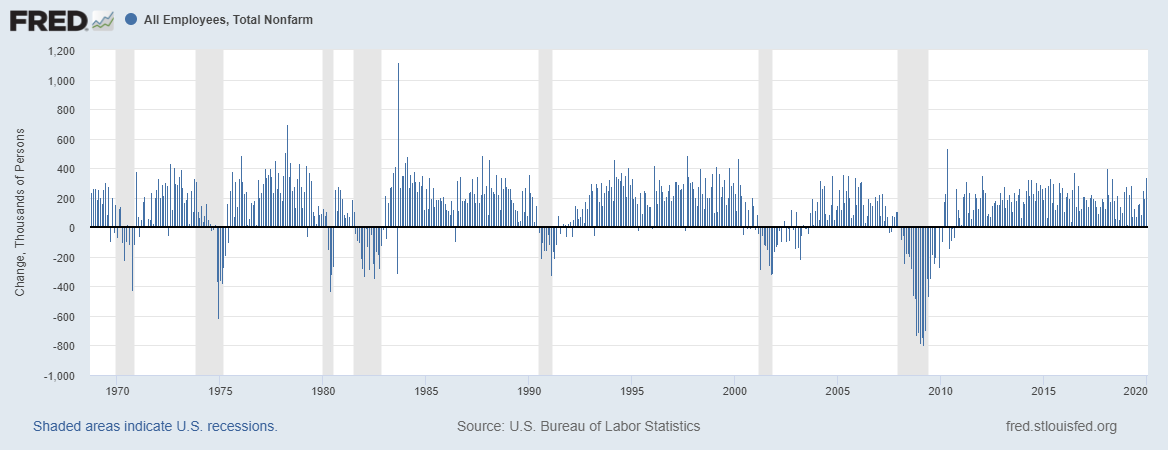

| The employment report was indeed better than expected, the gain of 372k jobs well in excess of expectations of 240k. The bulls were quick to point out that this means we aren’t in recession right now. It is true, obviously, that employment falls in recession. But it isn’t true that employment has to fall for us to be in recession. Of the 8 recessions since 1970, job growth persisted past the official onset of recession in 6 of them. Job growth in the current month does not in any way preclude recession conditions. Employment is a lagging indicator and sometimes it lags by months; the 1973/74 recession started in November 1973 and the first negative employment figure wasn’t until August 1974.

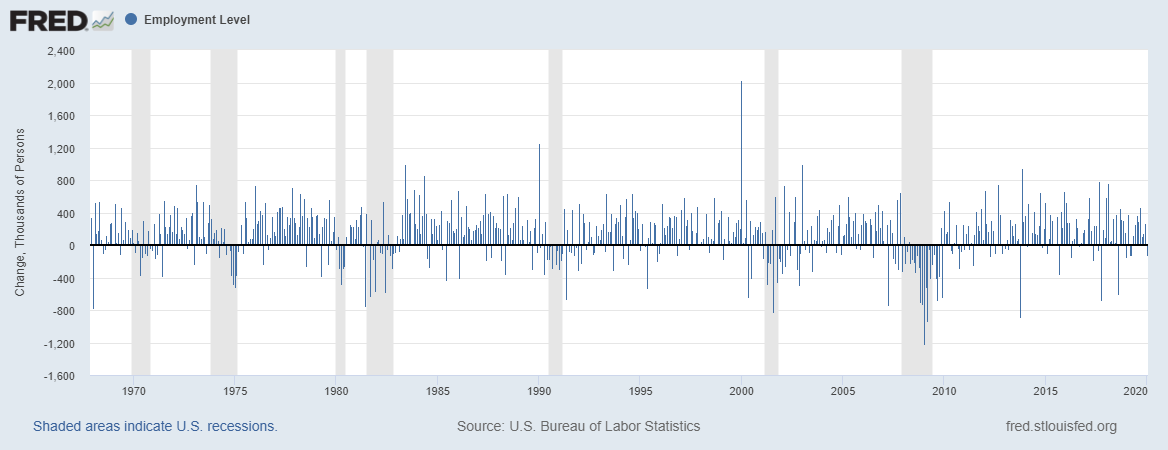

Note: I’ve truncated this chart and some others at January 2020 so the detail can be seen. The drop in employment in the COVID recession was so extreme that it distorts the chart. The bears pointed to the Household report, from which the unemployment rate is calculated. In particular they cited a drop in the employment level of 315K. Unfortunately for them, this isn’t uncommon. As a recession indicator a drop in the employment level in the Household survey tells you exactly nothing: |

|

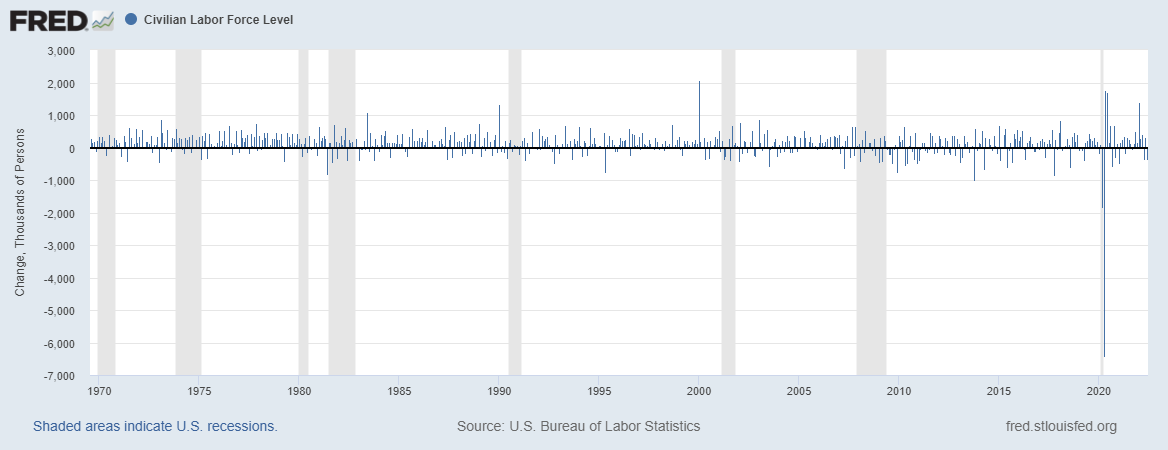

| Others cited a drop in the labor force as evidence of impending doom. I dare you to find a recession signal in this chart. | |

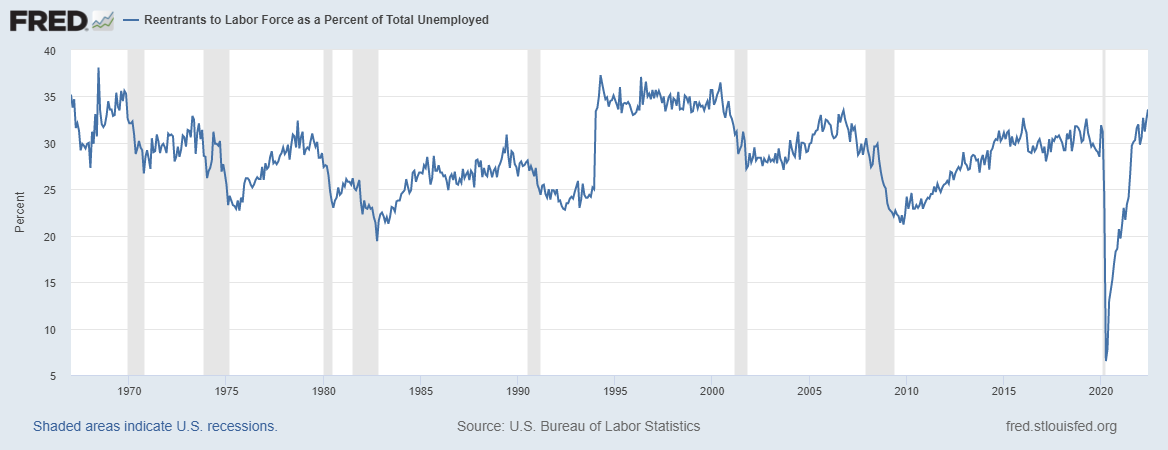

| As I said above, I give the bulls a little more of the benefit of the doubt on this one because there was some data in the report that was less ambiguous in its meaning. For instance, nearly 42% of the unemployed are either new entrants or re-entrants to the workforce. Both are rising strongly which is not something we’d expect in or near recession. These figures tend to fall as we near recession: | |

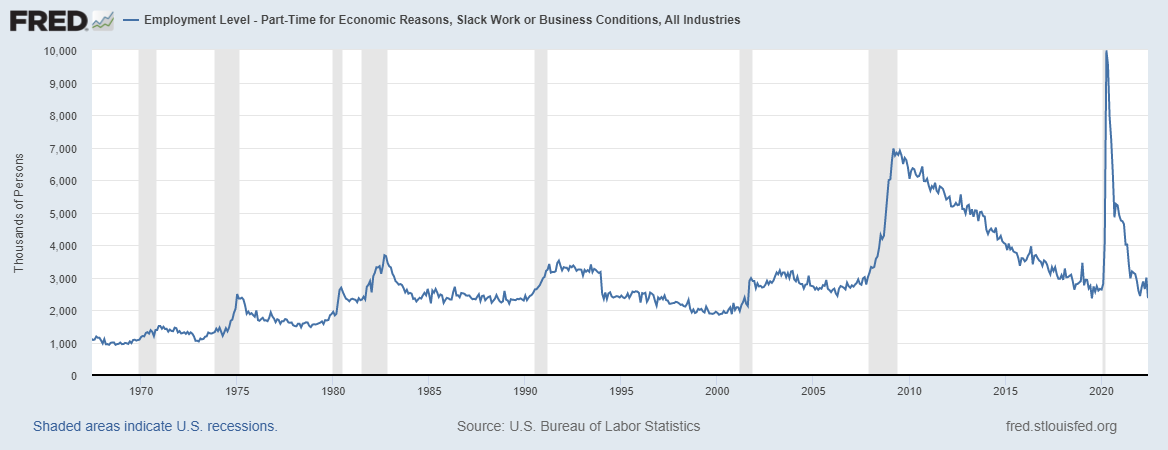

| Here’s another one: Part time for economic reasons, slack work or business conditions. It usually starts rising for months – sometimes over a year – before the onset of recession. In the 2008 recession, it hit its nadir in April 2006 while the recession didn’t start until December 2007. It is still falling: | |

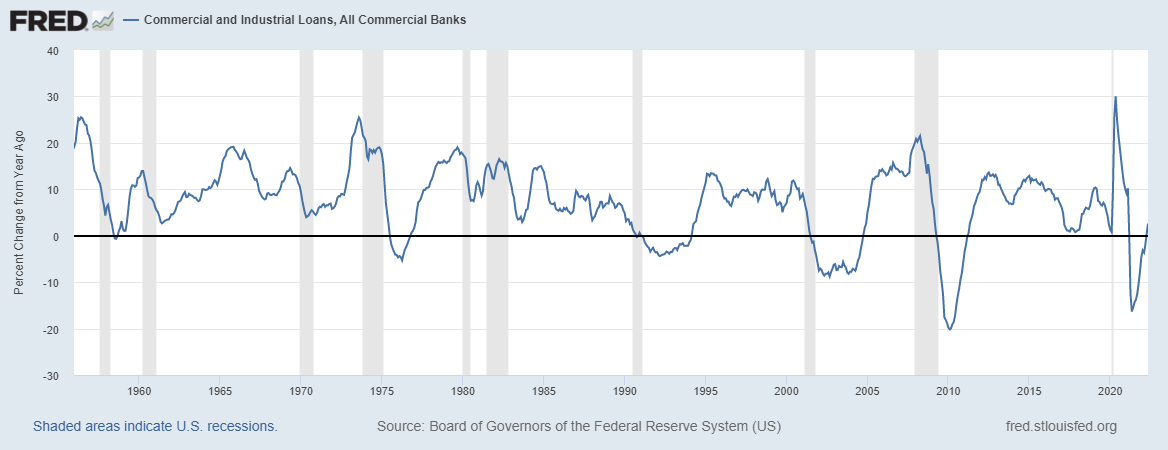

| I’ve also been reading a lot of commentary lately that classifies the current economy as “late cycle”, meaning that we are nearing – or already in – recession. They seemingly have good reason to make that distinction. In general, late cycle is said to be marked by a peak in growth with rising inflation and a tight labor market. That seems to describe the current economy pretty well. This part of the cycle also favors energy and utility stocks which just so happen to have outperformed this year. And yet, I can point to a number of indicators that look decidedly early cycle. C&I (commercial and industrial) loans have turned positive year over year: | |

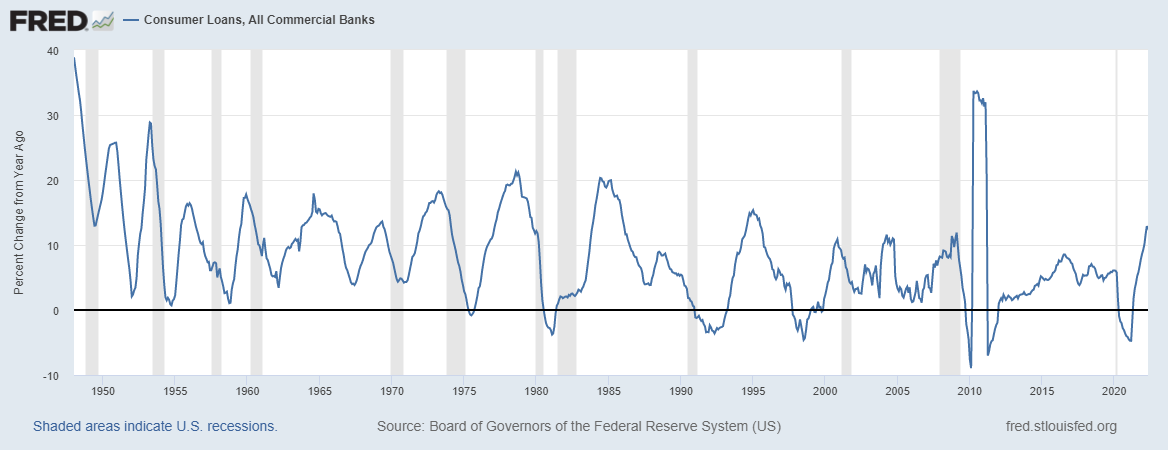

| Consumer loan growth is strong: | |

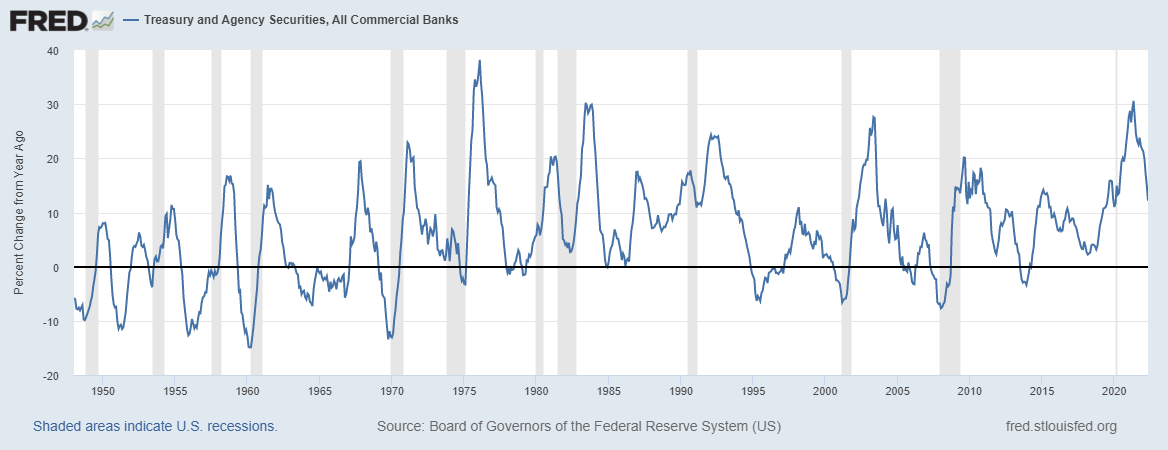

| And banks are accumulating Treasuries and MBS at a slower rate: | |

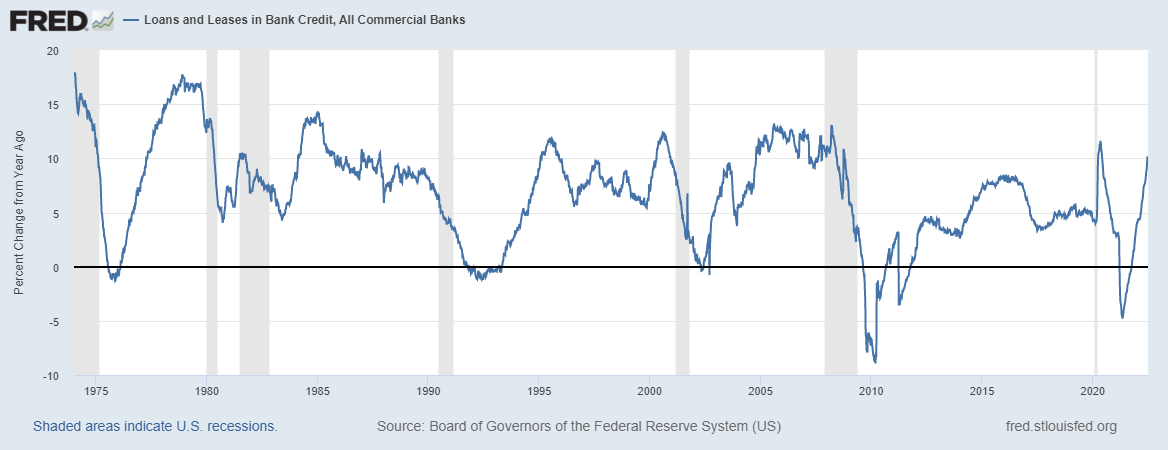

| I’d be remiss if I didn’t point out that this data is from May but if you want a more up to date figure, here’s total loans and leases in bank credit as of June 29th:

You don’t need to be an economist to see that, in the past, changes such as these have happened early in the business cycle. They are also all things we’d expect from Quantitative Tightening by the way and it may be that banks are just getting ahead of the Fed. Okay, I’m sure you get the picture so I’ll stop with the charts for a while. This economy is different than anything we’ve ever seen and every prediction you read about it is just guessing. Which is what most economic punditry is all the time but it’s just more so right now. I have said many times that it isn’t our job to predict the future but rather to interpret the present as best we can. That is more true in this cycle than ever before and harder than ever as well. |

|

| I believe the economy is normalizing after all the distortions of the COVID era.

The goods economy is slowing after being the only game in town for much of the COVID period. The services side of the economy continues to recover but is still below the pre-COVID trend. I think both will converge with their pre-COVID trends although both may overshoot initially. I know some will say that is wishful thinking but to me it’s just common sense. We were growing at 2.1% for the decade prior to COVID and we didn’t do anything to change that trajectory during the pandemic. It seems quite logical that growth would go back to where it was. Of course, logic often has little to do with the course of the economy since it is based on human behavior so I’m not making any big bets on that. More important than either of those consumption trends though is the course of investment. It is investment that generally leads us into and out of recession. While there has been a lot of attention recently on the housing market because of rising mortgage rates. the more interesting part of investment is in nonresidential. Housing is certainly coming off the boil. Mortgage rates are all the way back up to where they were in the mid-00s but have pulled back from the 6.3% peak. Mortgage rates in the 5s is enough to cool things but as I’ve said about some other items, that was needed. Vacancy rates are at lows last seen in the early 80s and existing home inventory is still very low, about half the pre-COVID level. But real residential investment was flat from 2016 to 2020 and only in the post-COVID period has moved above that prior range. Residential investment hasn’t been the driver of the economy for quite some time. Real nonresidential investment, on the other hand, has been rising and continues to do so. It was up 2.4% in Q1 and is at an all time high. One part of that rising investment is in manufacturing capacity in the US. The talk of returning some production home after the COVID supply shock has turned out to be more than just talk. According to Dodge Construction Network, manufacturing starts are up 116% on a 12 month rolling basis as of June. The Census Bureau has more subdued figures but still showed manufacturing construction up 26% year over year in May. This may not be de-globalization – and we shouldn’t want that – but it is a change in supply chains to add redundancy, to diversify to become more resilient. And part of that is bringing production closer to home, whether it be in Mexico or Arizona (Intel and TSM) or Buffalo (Ingersoll-Rand) or right here in my home state of South Carolina where Generac just opened a new plant about 25 miles from my house. |

|

| The long term impact of these changes, assuming they continue, is hard to judge just yet but more resilient looks a lot like less efficient so it likely means lower margins or higher prices in the long run. But in the short term, building factories shows up in investment and feeds directly into GDP growth. If that continues in the quarters ahead, it likely makes recession less likely. Figuring out where we are in the business cycle is hard in the best of times but it is particularly difficult right now when we are in the midst of a recovery like no other after a recession like no other. Could we actually be in the early part of this business cycle when seemingly everyone is looking for recession? Maybe, maybe not but I wouldn’t rule it out.

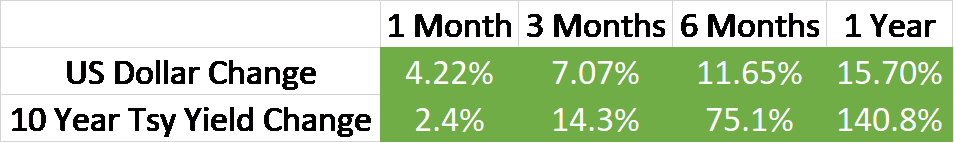

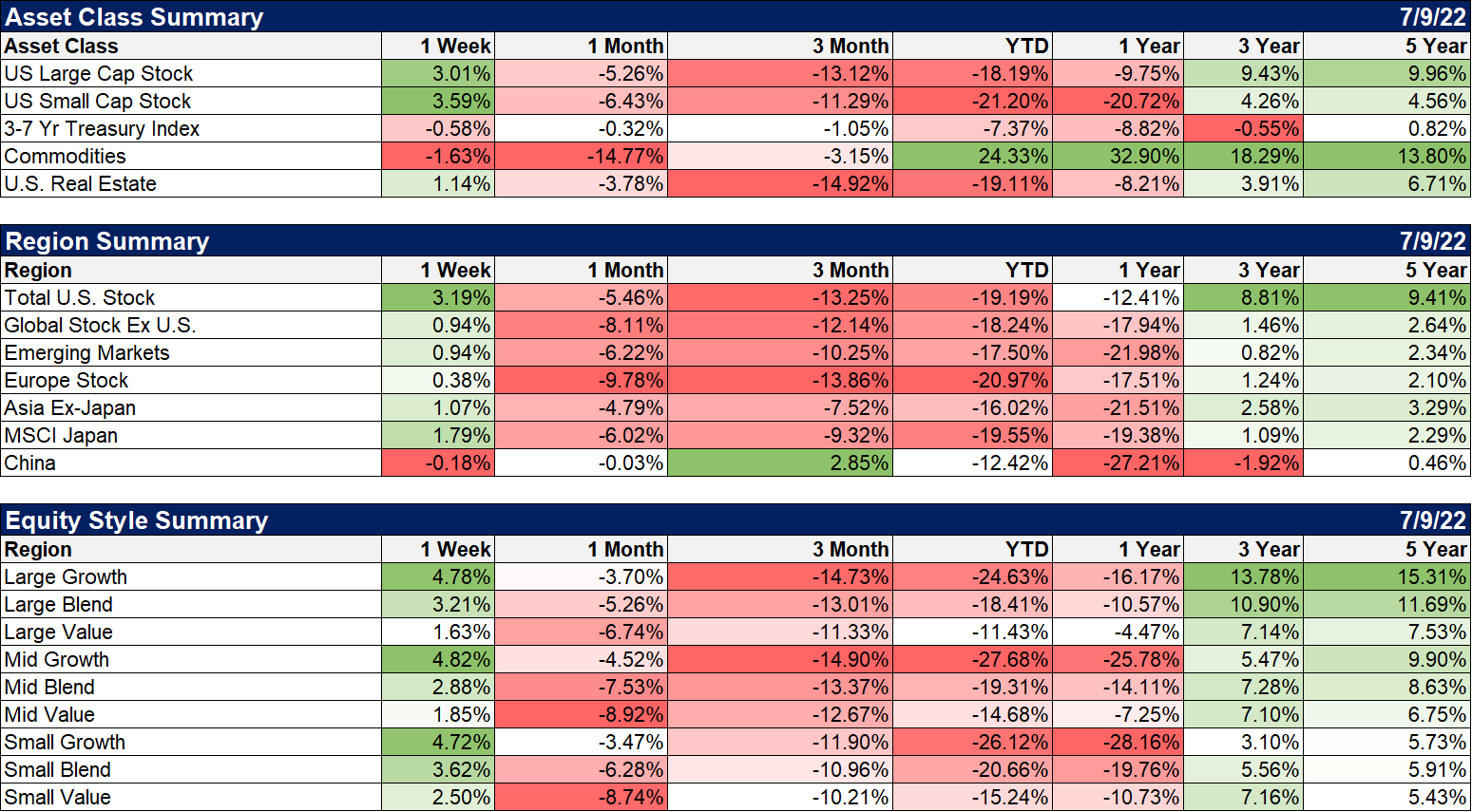

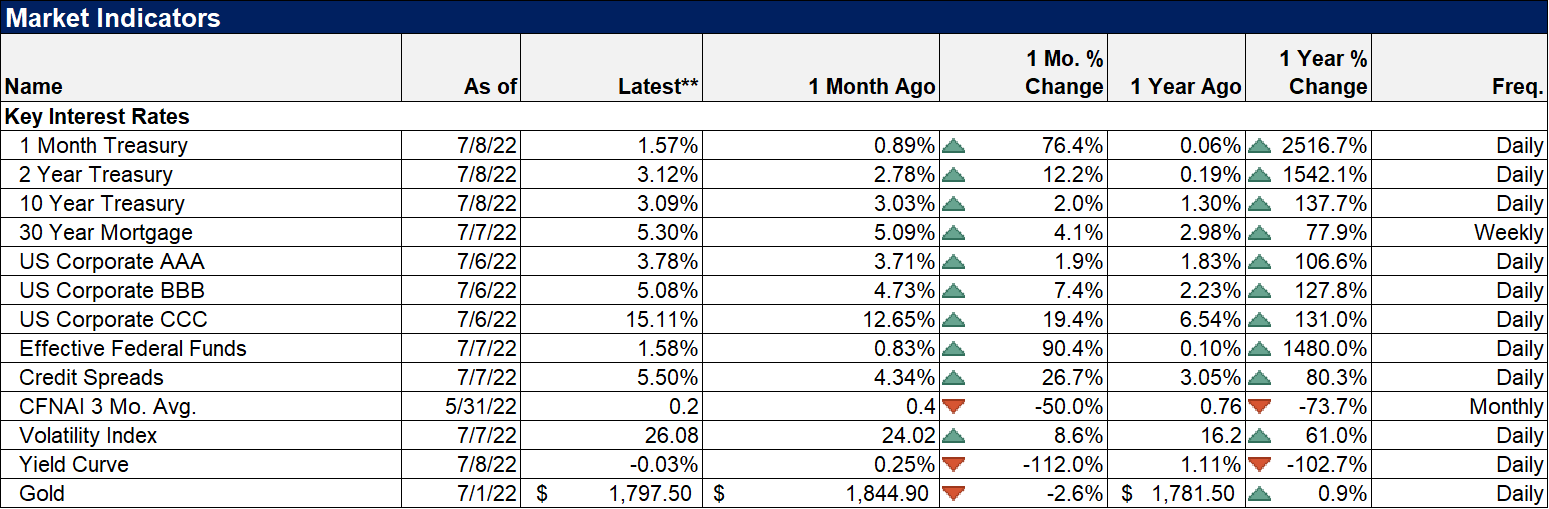

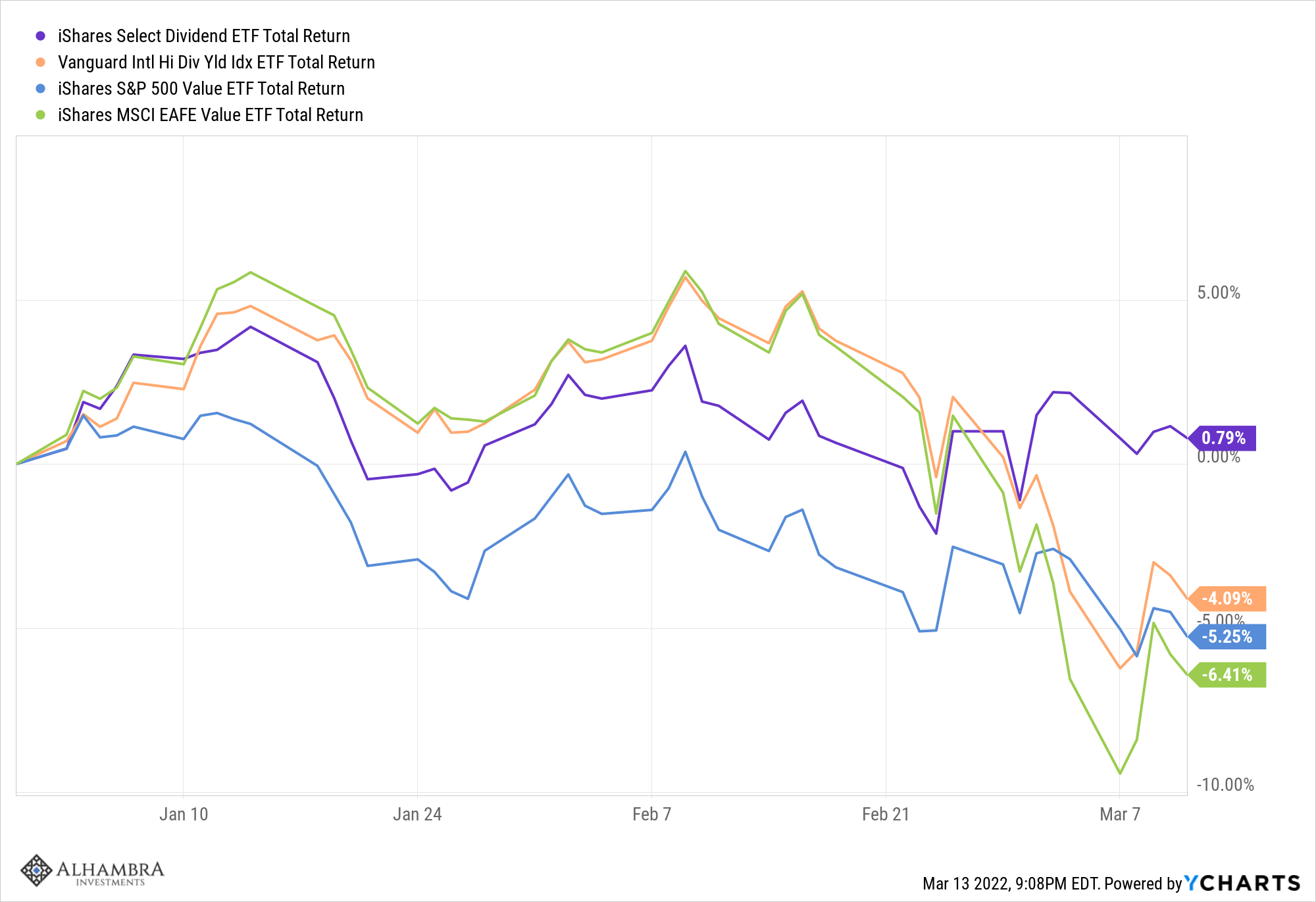

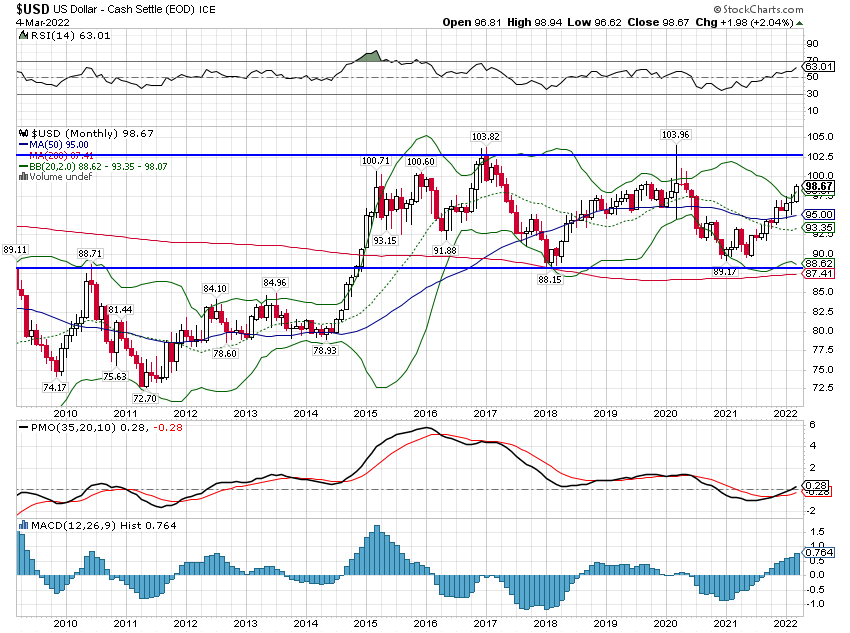

The rising dollar, rising rate environment continues. Interest rates rose last week after a string of better than expected economic reports. Factory orders, global services and composite PMIs, ISM non-manfacturing index, job openings, payrolls, wholesale inventories and consumer credit were all more positive than expected. By the way, remember all the fretting about the big March rise in consumer credit? It was cited repeatedly as evidence that consumers were running out of cash and resorting to credit cards to pay their bills. Cited without evidence I’d say. The May data was released last week and lo and behold, it was less than half the March figure. In fact, the monthly increase was less than 6 of the last 9 months. Why the big jump in March? My guess is tax payments but I don’t really know. Whatever the reason, the “crisis” appears to have passed. The dollar hit a 20 year high last week, driven primarily by the Euro’s drop toward parity. I don’t think that should be particularly surprising given the continent’s precarious position with regard to Russian natural gas. That is my top worry right now with the pipeline being shut down this week for maintenance. There is a fear that it won’t come back on line after the maintenance period but I’m a little skeptical. Putin needs Europe’s cash as much as they need his gas. But we aren’t dealing with a rational customer in Putin so who knows? What I do know is that if he cuts them off completely, a recession is nearlyst assured. How bad would it get? I have no idea but I would say it doesn’t guarantee a US recession. I don’t know how many more blows the global economy can take though so it is the top of my worry list. Note: The figures below are from the last 5 trading days. Stocks and real estate were higher over the last week while commodities and bonds were down. International stocks were up as well but not as much as the US; not surprising given the surge in the dollar. Growth stocks led the recovery but value stocks were up as well. Value still has a big lead YTD and over the last year and the trend is still in place. Are stocks out of the woods? I don’t know what the short term holds but unless we’re headed for a bad recession I think most of the damage is behind us. If you can look out 6 months to a year – and if you can’t you probably shouldn’t be in stocks – the returns will probably be quite positive if history is any guide. |

|

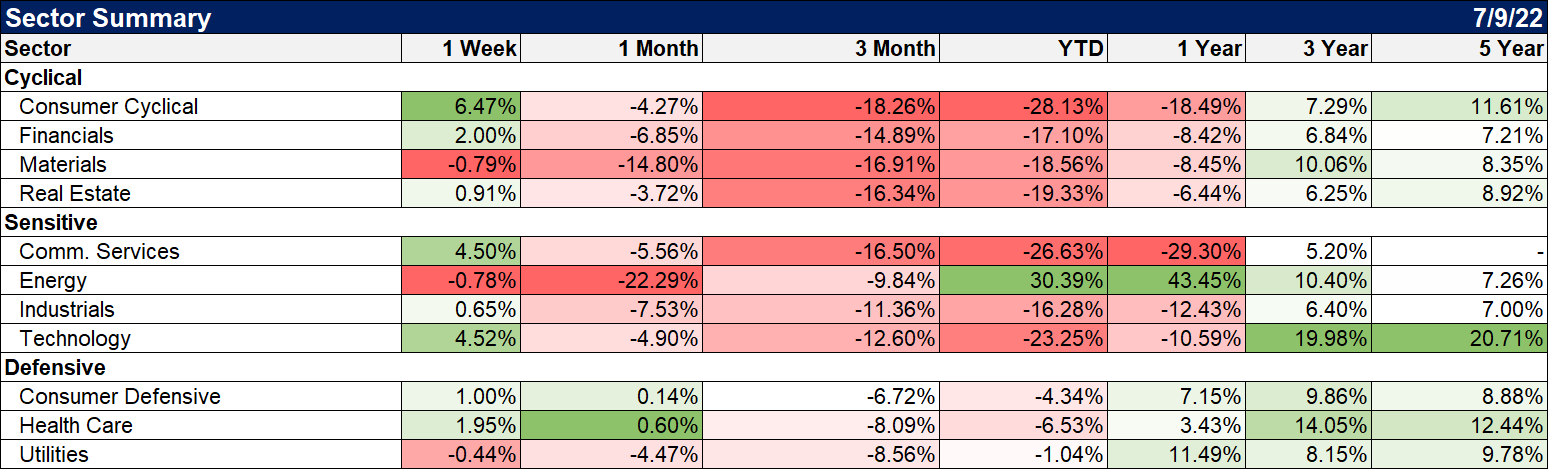

| Tech and cyclicals were the big winners last week with the communication sector also hot. Commodity related equities are still in correction mode but I think this will prove a buying opportunity in energy stocks (Warren Buffett apparently thinks so too). Despite what you may have read the drop in crude oil recently was not driven by demand concerns. Crude remains in steep backwardation (future months lower than spot) which indicates strong demand for crude now. It appears it was more technical and based on thin trading conditions than anything else. Still the uptrend this year has been incredibly steep and I expect the correction to continue down to the 80s. | |

| There are only two items in the chart above that are flashing yellow on my economic dashboard. Credit spreads have widened recently but narrowed considerably last week. We’ve seen higher spreads in the past without recession and we’ve seen them around this level and been at the start of recession. By themselves, spreads are not sufficient to get us to change our portfolio. But they are a warning sign that we take seriously. The other indicator flashing yellow is the yield curve. The 10/2 curve is slightly inverted again but the 10/3 month spread is still over 100 basis points. The latter is at least as important as the former and so I take it as a warning but, like spreads, nothing that warrants any big changes. |

The economy does not appear to me to be in recession right now. Are we on the verge of one? I don’t think so but another outside shock – like Russian cutting off Europe’s gas maybe – could easily push us there. Will that happen? I have no idea and no way of predicting that outcome with any degree of accuracy. So, I’ll stay conservative with a cash reserve and wait to see how things develop. No prediction, just observation. That’s as good as we can do in this most unusual of economic environments.

Tags: Alhambra Portfolios,Alhambra Research,Bonds,commodities,credit,credit spreads,Crude Oil,currencies,durable goods,economic growth,economy,employment report,energy stocks,Featured,household survey,Housing,Interest rates,labor force,lending,manufacturing,Markets,Natural Gas,newsletter,Real Estate,Russia,services,stocks,Unemployment,US dollar,Yield Curve