PMI surveys surprised to the upside in March. The euro area composite PMI surged to 56.7, its highest level since April 2011.The average composite PMI is now consistent with a GDP growth rate of about 0.6% q-o-q in Q1, above our forecast. At the same time, hard data came in slightly weaker than expected, suggesting that business surveys might be overstating the pace of growth to some extent. As a result, we are keeping our growth forecast unchanged at 1.5% for 2017Both the euro area...

Read More »Take-up of TLTRO loans is good news for euro bank credit

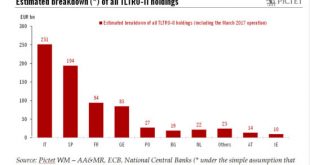

The ECB’s scheme of negative interest rate loans to banks has also helped boost inflation in the euro area.The fourth and final of the ECB’s Targeted Long-Term Refinancing Operations (TLTRO) today attracted EUR233bn in demand from 474 euro area banks, well above consensus (EUR110bn). Expectations of an ECB deposit rate hike may have boosted demand for this operation, as it provided a last opportunity for banks to secure four-year funding at a rate that can go as low as -0.40%.There is no...

Read More »Escaping from planet NIRP

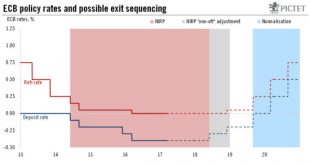

The ECB could announce further changes to its forward guidance in June as part of its exit strategy from negative rates. But we think proper rates normalisation will only start in late 2019.The debate over the ECB’s exit strategy from its negative interest rate policy (NIRP) has started in earnest. Recent comments point to a possible reversal in the exit sequencing, with a deposit rate hike preceding the end of net asset purchases.A one-off adjustment in negative rates would have some...

Read More »A more neutral tactical stance on the EUR/USD rate

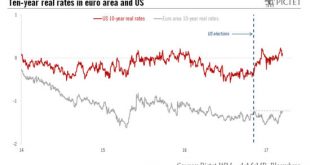

Barring a French election surprise, the downside potential for the euro against the US dollar looks limited in the next few months, but there is still room for the US dollar to strengthen again.The monetary policy meetings of the European Central Bank (ECB) on 9 March and of the Federal Reserve on 15 March have put upward pressure on the euro versus the US dollar. Euro area real rates have risen on prospects for an early rate hike whereas US real rates have declined on the perceived...

Read More »No hint of Swiss rate rise

The Swiss National Bank left monetary policy unchanged at its latest meeting and forecast that the Swiss economy would grow 1.5% in 2017.At its latest policy meeting on 16 March, the Swiss National Bank (SNB) left the interest rate on sight deposits at a record low of -0.75% and the central bank reiterated its willingness to intervene in the foreign exchange market if needed, “taking the overall currency situation into consideration”, as it had mentioned in its previous press release. The...

Read More »Markets react well to Fed hike

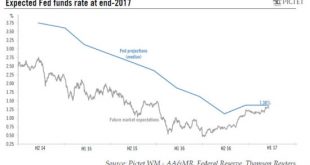

Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets...

Read More »China: growth looking good for first half before possible deceleration in second

Data shows strong fixed investment and industrial production, but consumption has weakened. We still expect 2017 GDP growth of 6.2%.The first batch of hard data on domestic activity for 2017 point to strong momentum in fixed-asset investment (FAI) and industrial production, while consumption has been on the weak side. In the first two months of 2017, FAI grew by 8.9% y-o-y, compared to 6.5% for December 2016 and 8.1% for 2016 as a whole. As FAI has been the key variable that drives China’s...

Read More »Monthly Investment Strategy Highlights, March 2017

Pictet Wealth Management’s latest positioning in fast-evolving markets.Asset allocationWe remain comfortable with our overweight position in developed-market (DM) equities and believe there are good reasons to be positive on Japanese equities,With volatility low and risks looming in the short term, this is a good time to add protection to portfolios. We have bought derivative protection on EUR high yield bonds and a call option on gold.Expecting yields on core sovereign bonds to rise further...

Read More »Healthy job reports open the way to rate increases

Job metrics continue to improve in the US, but our GDP estimate for this year remains unchanged.February’s US non-farm payroll figure was strong (although partly due to temporary factors and unusually mild weather), with non-farm payrolls rising 235,000, above expectations. Other data in the February employment report were also upbeat. The US unemployment rate fell back from 4.8% to 4.7% in February, slightly below the Fed median estimate for full employment (4.8%). And the U6 measure of...

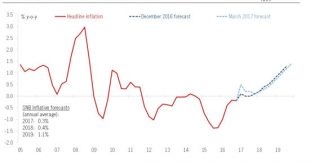

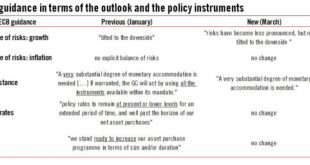

Read More »ECB fine tunes communication as recovery broadens

A generally more optimistic ECB looks set to announce its roadmap for QE tapering in September. QE tapering itself may start in Q1 2018.The ECB delivered a fairly balanced, albeit more optimistic message at today’s press conference, echoing upward revisions to the staff projections for 2017-18 euro area GDP growth and inflation. Crucially, however, the 2019 projection for inflation was left unchanged at 1.7%.Looking ahead, the ECB’s four inflation criteria are unlikely to be fully met before...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org