The US economy is creating a lot of low-skilled and low-productivity jobs.Productivity is a crucial missing link in US growth. Q4-2017 productivity data was again disappointing: labour productivity was up just 1.1% year-on-year (y-o-y). It averaged only 1.3% in 2017 as a whole, while the five-year average is a lacklustre 0.8% (versus more than 3% in the early 2000s).Low productivity growth remains a front-and-centre worry of Federal Reserve officials. Before lawmakers on 27 February, the new Fed Chair, Jerome Powell, highlighted the need for stronger productivity to drive wage growth down the road, itself crucial to sustaining US prosperity.It does not help that the US economy has tended to create a lot of low-skilled services jobs in recent years. A particularly striking illustration is

Topics:

Thomas Costerg considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The US economy is creating a lot of low-skilled and low-productivity jobs.

Productivity is a crucial missing link in US growth. Q4-2017 productivity data was again disappointing: labour productivity was up just 1.1% year-on-year (y-o-y). It averaged only 1.3% in 2017 as a whole, while the five-year average is a lacklustre 0.8% (versus more than 3% in the early 2000s).

Low productivity growth remains a front-and-centre worry of Federal Reserve officials. Before lawmakers on 27 February, the new Fed Chair, Jerome Powell, highlighted the need for stronger productivity to drive wage growth down the road, itself crucial to sustaining US prosperity.

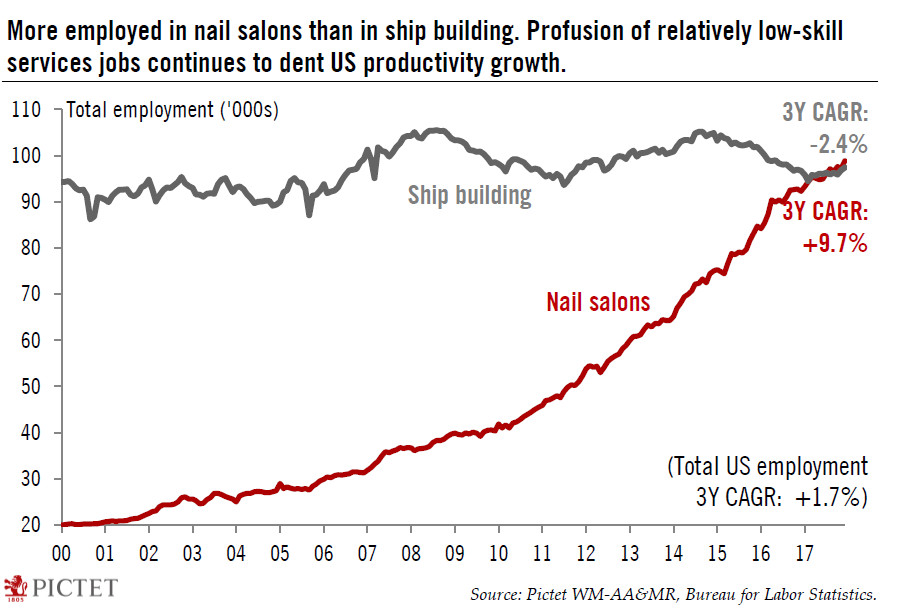

It does not help that the US economy has tended to create a lot of low-skilled services jobs in recent years. A particularly striking illustration is the sharp rise in employment at nail salons. Nail-salon jobs have risen 9.7% per annum (p.a.) in the past three years, much more rapidly than total US employment growth (+1.7% p.a.), to reach 98,900 jobs as of last December. This is more than those employed in ship building (97,400; 3-year CAGR: -2.4% p.a.).

We still believe that a cyclical rise in investment starting this year, as well as technological advances, could lead to higher productivity in the medium term. Still, the fact that relatively low-skill jobs in areas such as nail salons, but also bars and restaurants, have been accounting for a large share of employment gains means expectations for significant US productivity growth risk being disappointed.