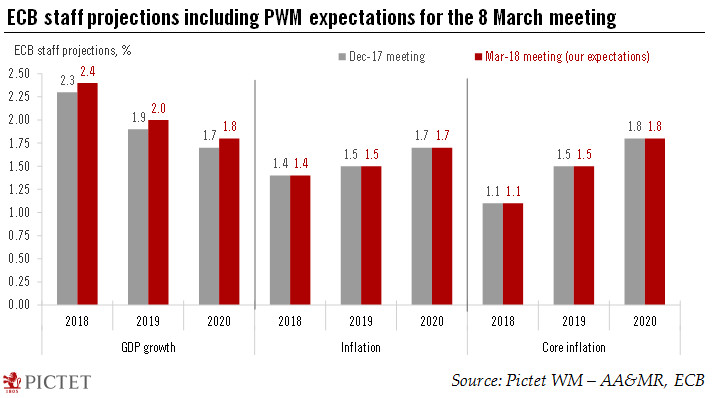

We expect only small changes to the ECB staff projections, with GDP growth likely to be revised slightly higher again.The ECB remains on a cautious exit path. At the 8 March meeting, we expect the ECB to drop its commitment to increase QE in terms of its size and/or duration, if needed – a change that is long overdue, in our view, against a very favourable economic background and given that constraints linked to bond scarcity make it all but impossible to increase QE anyway. Ideally, this should come along with the first incremental steps towards a forward guidance based on the broader monetary stance, including policy rates.We expect only small changes to the ECB staff projections, with GDP growth likely to be revised slightly higher again. Either way, the ECB’s confidence in higher

Topics:

Frederik Ducrozet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We expect only small changes to the ECB staff projections, with GDP growth likely to be revised slightly higher again.

The ECB remains on a cautious exit path. At the 8 March meeting, we expect the ECB to drop its commitment to increase QE in terms of its size and/or duration, if needed – a change that is long overdue, in our view, against a very favourable economic background and given that constraints linked to bond scarcity make it all but impossible to increase QE anyway. Ideally, this should come along with the first incremental steps towards a forward guidance based on the broader monetary stance, including policy rates.

We expect only small changes to the ECB staff projections, with GDP growth likely to be revised slightly higher again. Either way, the ECB’s confidence in higher inflation will have increased further despite the recent strike of weak HICP prints.

The most important decisions are likely to be made in June, if not later, including the tapering of QE. Ultimately, the timing and pace of monetary tightening will depend on core inflation, which we forecast to rise more meaningfully in H2 2018.