Although latest data may reflect impact of temporary environmental measures and seasonal distortions, we expect Chinese growth to moderate in 2018.China’s official manufacturing Purchasing Manager Index (PMI) for February came in at 50.3, down from 51.3 in January and 51.6 in December 2017. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month.Due to the floating date of the Lunar New Year (LNY), Chinese data in January and February are usually quite noisy. Although both the official PMI and the Caixin PMI are supposed to be seasonally adjusted, the actual data series still exhibit a fair amount of seasonality in the first two months of the year. For the official PMI, the month that contained the LNY on average

Topics:

Dong Chen considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Although latest data may reflect impact of temporary environmental measures and seasonal distortions, we expect Chinese growth to moderate in 2018.

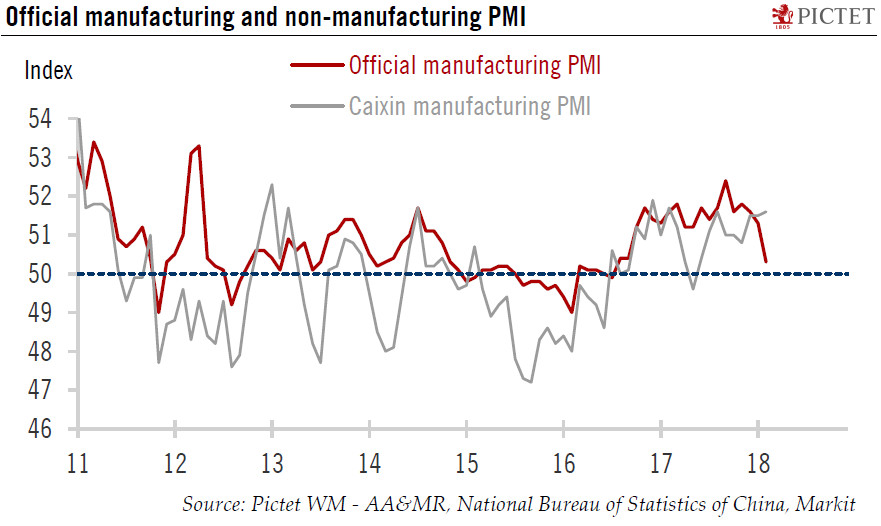

China’s official manufacturing Purchasing Manager Index (PMI) for February came in at 50.3, down from 51.3 in January and 51.6 in December 2017. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month.

Due to the floating date of the Lunar New Year (LNY), Chinese data in January and February are usually quite noisy. Although both the official PMI and the Caixin PMI are supposed to be seasonally adjusted, the actual data series still exhibit a fair amount of seasonality in the first two months of the year. For the official PMI, the month that contained the LNY on average lowered readings by 0.42 points in 2005-2017. In some years, the drop can be as big as 2-3 points. So the decline of 1 point in the official PMI in February, when the LNY occurred in 2018, could be partly caused by seasonality.

However, the weakening in the official PMI may also reflect a real deceleration in Chinese industrial activity, which is consistent with our view of a moderation in Chinese growth in 2018 following a strong 2017. Stringent pollution control measures in northern China may have also contributed to the deceleration in industrial activity.

We will likely see growth decelerate fairly sharply in the first quarter of year. but activity should see some meaningful rebound in Q2 when the more stringent winter pollution control measures are removed. In any case, to better gauge China’s current growth momentum, one should wait to see the actual activity data for January and February.

In our core scenario, we expect Chinese growth to moderate slightly to 6.5% in 2018 after having risen strongly in 2017. Our forecast remains unchanged following the latest PMI figures.