This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely decentralised, with the ECB buying no more than 10% of assets itself. The largest part of the Bundesbank’s 2017 net interest income of EUR 4.2bn came from banks’ deposits, which are subject to a negative interest rate of 0.40%. This amounted to EUR 2.2bn – twice the figure in

Topics:

Frederik Ducrozet considers the following as important: Featured, Macroview, newsletter, Pictet Macro Analysis, Swiss and European Macro

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely decentralised, with the ECB buying no more than 10% of assets itself.

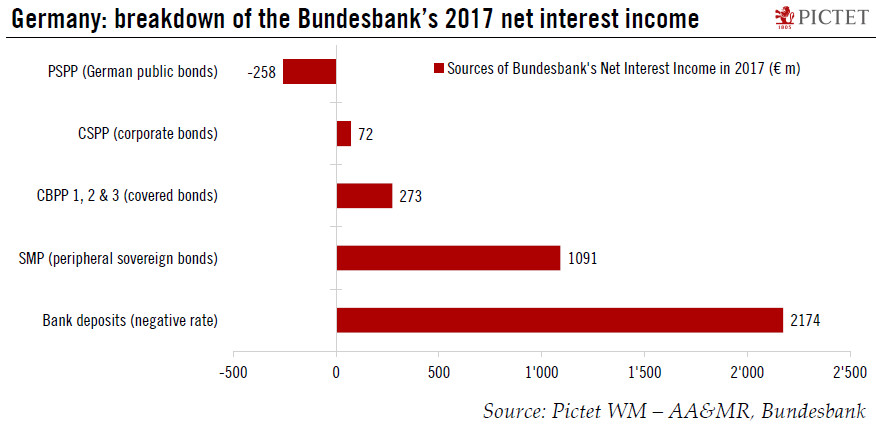

The largest part of the Bundesbank’s 2017 net interest income of EUR 4.2bn came from banks’ deposits, which are subject to a negative interest rate of 0.40%. This amounted to EUR 2.2bn – twice the figure in 2016. The legacy Securities Market Programme (SMP) was the second largest source of interest revenue (EUR 1.1bn). In terms of QE programmes, covered bonds (CBPP) and corporate bonds (CSPP) generated a combined EUR 345m. Finally, purchases of public bonds, the majority of which provide a negative yield, led to a EUR 258m loss in 2017. The upshot of all this is that the Bundesbank made a net profit from ECB QE last year, while the combination of all unconventional measures boosted the Bundesbank’s net profit by EUR 3.4bn. The Bundesbank also sets provisions each year, including for the risk that higher interest rates in the future lead to “negative results potentially for a number of years”. The existing risk provisions were raised by EUR 1.1bn last year, to EUR 16.4bn. The Bundesbank also added a EUR18m specific provision for the impairment of a bond issued by Steinhoff (accounting for 26% of the aggregate EUR 69m provision decided by the ECB). This is both a big and small amount, depending on one’s perspective. The Steinhoff loss represents a miniscule part of total Eurosystem profits, 5% of the ECB’s profits, and 20–25% of CSPP profits, according to our estimates. |

Bundesbank's Net Interest Income, 2017 |

Tags: Featured,Macroview,newsletter