The slide recorded by Chinese leading indicators has ignited fears of a severe slowdown in the making. Nevertheless, the Beijing authorities still have plenty of firepower to hand to counter deflationary threats. China may be giving rise to much concern, but growth in the world economy is still being driven by the quickening US economy and the, admittedly, gentler acceleration in Europe. China’s authorities have a target for economic growth of around 6.5%. To offset the threat of a slowdown, the People’s Bank of China (PBoC) has two effective weapons in its armoury to stimulate lending: trimming the reserve requirement ratio for banks and lowering benchmark interest rates. There is also still enough room to manoeuvre with budget policy to give a boost to infrastructure investment. China has continued to pursue its overall ‘stop/go’ policy which involves pressing on the stimulus pedal when the economy betrays signs of slowing and turning off the credit pumps when it starts to gather momentum. These toings and froings between hopes and fears of a slowdown have been fuelling volatility in both economic and financial spheres.

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The slide recorded by Chinese leading indicators has ignited fears of a severe slowdown in the making. Nevertheless, the Beijing authorities still have plenty of firepower to hand to counter deflationary threats.

China may be giving rise to much concern, but growth in the world economy is still being driven by the quickening US economy and the, admittedly, gentler acceleration in Europe.

China’s authorities have a target for economic growth of around 6.5%. To offset the threat of a slowdown, the People’s Bank of China (PBoC) has two effective weapons in its armoury to stimulate lending: trimming the reserve requirement ratio for banks and lowering benchmark interest rates.

There is also still enough room to manoeuvre with budget policy to give a boost to infrastructure investment. China has continued to pursue its overall ‘stop/go’ policy which involves pressing on the stimulus pedal when the economy betrays signs of slowing and turning off the credit pumps when it starts to gather momentum.

These toings and froings between hopes and fears of a slowdown have been fuelling volatility in both economic and financial spheres.

China: the ‘hard landing’ scenario not looking that likely for this year

The gentle brightening of the economic climate in Q2 this year fizzled out into further deterioration in July and August, as evidenced by Purchasing Managers’ Index (PMI) readings and foreign trade figures. Perceptions of gloom have been further darkened by the slump in share prices. This worsening state of China’s economy needs to be put into context though. First, it can be explained, partly, by some one-off events: cyclones along the coast; temporary halt to pollution-emitting production in the Beijing area; the explosion in Tianjin. Second, the services sector, which has unmistakably grown in importance for China’s economy, would appear to be faring much better than manufacturing industries.

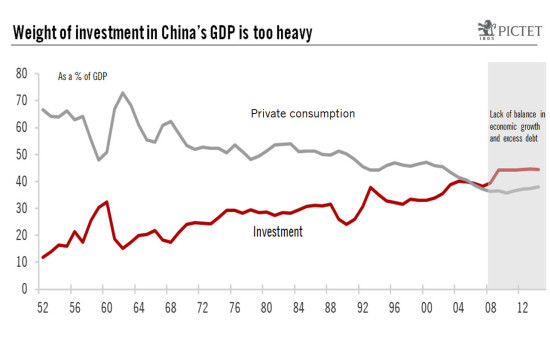

So, what should we expect in the months ahead? The yuan’s recent devaluation is unlikely to provide much support, but the liquidity being pumped in, the interest rate cuts and lowering of the reserve requirement ratio in recent months (the latest steps taken on 25 August), coupled with more expansionary fiscal policy, should have a beneficial impact, albeit after a time-lag. Although we are not resolutely upbeat about prospects for Chinese growth, we do not believe a hard landing in the second half looks all that likely. Conversely, a slight upturn in the economy over the next few months would seem the most plausible outcome. In the medium term though, excess debt and structural measures needed for the transition process do pose quite serious risks for China’s economy.

United States: economic prospects still looking bright

Uncertainty shrouding growth in China and recent setbacks on international financial markets have diminished the chances of the Fed funds rate being hiked in September. We believe the most plausible scenario will be for the US Federal Reserve to make a start on hiking interest rates in December. We are also of the view that, in the aftermath of the tightening of monetary and financial conditions, this first step towards raising the Fed funds rate will probably be followed by a highly circumspect approach being adopted by the Fed next year. We would, therefore, expect to see rate hikes being limited to 75 basis points in 2016, which would equate to a particularly pedestrian pace of tightening by past standards.

Eurozone: deflationary fears resurfacing

The latest business and economic surveys for the eurozone have shown resilience. The Markit Composite PMI, measuring activity in manufacturing and services, climbed a fraction in August to post a four-year high at 54.3. Closer analysis of the numbers reveals that the ‘New Export Orders’ sub-index rose sharply, especially for Germany. This is reassuring considering all the uncertainties hanging over economies in the emerging world, most notably China.

The recoveries in lending and monetary aggregates are still progressing. Lending volume to the private sector rose by 0.9% y-o-y in July, recording its fastest rate of increase since December 2011.

In such circumstances, our forecasts for growth are unchanged. We are projecting GDP growth of around 0.4% a quarter, delivering growth of 1.3% over the whole of 2015.

According to Eurostat’s most recent estimates, the headline y-o-y rate of inflation levelled off at 0.2% in August. Falling commodity prices, coupled with developments on the global economic stage, are once again exerting downward pressures on the inflation outlook. Long-term inflation expectations, as measured by break-even thresholds, had plateaued at around 1.8%, but they have since dropped back to their April 2015 level of 1.6%. If prospects for inflation were to worsen significantly, it might well prompt the European Central Bank (ECB) to take action.

Japan: the protracted process of reform

In late July, popularity ratings for Prime Minister Shinzō Abe fell for the first time below the 40% barrier, their lowest level since he took office towards the end of 2012. This could well spell danger for continuation of the structural reform process although the dip in popularity has been primarily associated with the less pacifist approach being adopted in Japan’s foreign policy. This aspect will remain to the fore for some time to come. Long-running territorial disputes with both China and Russia are still some way from being settled, especially in the aftermath of Dimitri Medvedev’s visit to the Kuril Islands and Abe’s rebuff to China’s invitation to attend the grand military parade to commemorate the 70th anniversary of the end of World War II. In spite of all this, the reform programme is being implemented bit by bit. After the 2011 Fukushima disaster, the first nuclear reactor was recommissioned on 11 August.

Prime Minister Abe’s government has acknowledged the difficulty of attaining its 2% inflation target in a world of low oil prices. On the plus side, a number of economic indicators are still displaying encouraging readings. Investment rose by 5.6% in Q2 2015, while demand for loans from businesses has continued to advance. Retail sales rose by 3.4% y-o-y in July, wiping out the negative effects of the April 2014 VAT hike. For this trend to continue though, wages will need to rise. As such, the figures for July are eagerly awaited.