It has been a turbulent end to the summer for financial markets. The renewed market sell-off in China has reverberated across markets globally, as it amplified concerns, following the recent devaluation of the yuan, about the outlook for economic growth in China. We view recent developments on Chinese markets as a sharp correction rather than the start of a long-term bear market. In the meantime, the economic recovery in the US and the euro area continues to gain traction. Recent developments in China need to be seen in the context of long-term economic trends. China is in a delicate transition period, between its ‘emerging’ phase (roughly 1990 to 2006), when it joined the capitalist club and posted astonishing rates of real GDP growth, at 12-13% annually, and ‘maturity’, which should begin before 2020 and will see growth settle at around 5%. The transition period involves a challenging shift of economic model, from investment- and export-led growth to growth based on private consumption. At the same time, China’s transition has been delayed and complicated by the fallout from the US subprime crisis, which forced the Chinese authorities to unleash massive stimulus. This kept growth on track, but at the cost of creating sizeable imbalances. The big question is whether the Chinese authorities can complete the transition phase without suffering a financial or economic crash.

Topics:

Christophe Donay considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

It has been a turbulent end to the summer for financial markets. The renewed market sell-off in China has reverberated across markets globally, as it amplified concerns, following the recent devaluation of the yuan, about the outlook for economic growth in China.

We view recent developments on Chinese markets as a sharp correction rather than the start of a long-term bear market. In the meantime, the economic recovery in the US and the euro area continues to gain traction.

Recent developments in China need to be seen in the context of long-term economic trends. China is in a delicate transition period, between its ‘emerging’ phase (roughly 1990 to 2006), when it joined the capitalist club and posted astonishing rates of real GDP growth, at 12-13% annually, and ‘maturity’, which should begin before 2020 and will see growth settle at around 5%.

The transition period involves a challenging shift of economic model, from investment- and export-led growth to growth based on private consumption. At the same time, China’s transition has been delayed and complicated by the fallout from the US subprime crisis, which forced the Chinese authorities to unleash massive stimulus. This kept growth on track, but at the cost of creating sizeable imbalances.

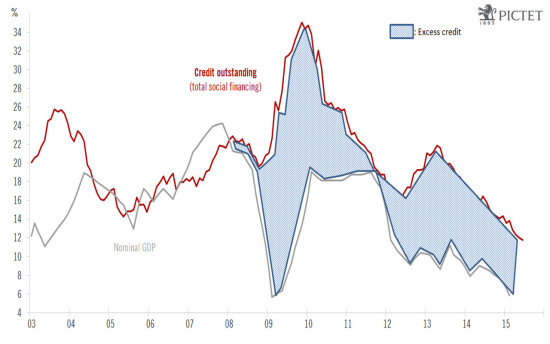

The big question is whether the Chinese authorities can complete the transition phase without suffering a financial or economic crash. In our view, they will probably fail, for two reasons. First, China’s growth is still excessively reliant on investment. Second, growth has been driven in recent years by pumping up credit, which has substantially exceeded nominal GDP growth for several years (see chart) — this tends to create dangerous instability in the economy.

These imbalances point towards an eventual Minsky moment in China — a sudden, sharp collapse of asset prices [1]. The timing is impossible to predict but conditions do not yet seem ripe for it — unless there is a serious policy mistake by the Chinese authorities. Government debt is just 40% of GDP (compared with typically around 100% of GDP in developed economies), so the state can continue to fuel the credit cycle for now, and maintain economic growth at close to our forecast of 6.5% this year and next. However, although the authorities have the resources to avoid a crash for now, they will not succeed in doing so indefinitely, as imbalances continue to rise.

For the moment, though, continued robust growth in China makes for a global economic outlook that is still, in our view, reasonably upbeat. In the US, signs of stronger consumption-driven growth are mounting. The fall in commodity prices is boosting real incomes, and we expect the US economy to enjoy a stronger second half in 2015. There are also encouraging signs in the euro area, albeit more modest. Economic expansion in both the US and the euro area is supported by credit growth, which is well engaged in the US and running at around 7% y-o-y, and has finally turned positive in the euro area, currently around 1% y-o-y.

This fairly positive outlook for the global economy is likely to support a rebound in markets —although potentially not before a second spike in volatility, which usually takes place around 28 days after the first, if we take past corrections as a guide. In this scenario, the bull trend in developed-market equities is likely to remain intact.

Christophe Donay

Head of Asset Allocation & Macro Research

[1] A Minsky moment is a sudden major market collapse that follows a lengthy period of speculation or unbalanced growth financed by credit excess. The concept holds that such periods will eventually end in crises, as rising investment values prompt increasing speculation. It is named after Hyman Minsky, an economist who argued that markets, especially bull markets, are inherently unstable, and was coined to describe the 1997 Asian debt crisis. The US subprime crisis was an example of a Minsky moment.