– It’s the energy, stupid! The euro area HICP ‘flash’ estimate fell, almost entirely due to the recent drop in commodity prices. But core HICP inflation remained unchanged. The ‘flash’ estimate of euro area Harmonised Index of Consumer Prices (HICP) confirmed what most economists, including at the European Central Bank (ECB), were expecting after the renewed fall in commodity prices over the summer, namely that inflation turned negative again in September. Having reached a trough at -0.6% y-o-y in January 2015, euro area inflation had risen to +0.3% in May before a renewed drop in commodity prices pushed it down again. As shown in the chart below, this latest bout of disinflation is almost entirely down to energy. Euro area headline HICP inflation fell back to -0.1% y-o-y in September (from +0.1% in August), although at -0.06% without the rounding, the figure was somewhat less negative than feared considering the available information from other countries. Indeed, the preliminary figures published yesterday and this morning showed HICP inflation falling sharply in Spain (from -0.5% to -1.2% y-o-y in September, well below expectations) and to a lesser extent in Germany (from +0.1% to -0.2% y-o-y) and Italy (from +0.4% to +0.2% y-o-y). Belgium was a notable exception, with inflation rising to 1.1% in September, from 0.9% in August.

Topics:

Perspectives Pictet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

– It’s the energy, stupid! The euro area HICP ‘flash’ estimate fell, almost entirely due to the recent drop in commodity prices. But core HICP inflation remained unchanged.

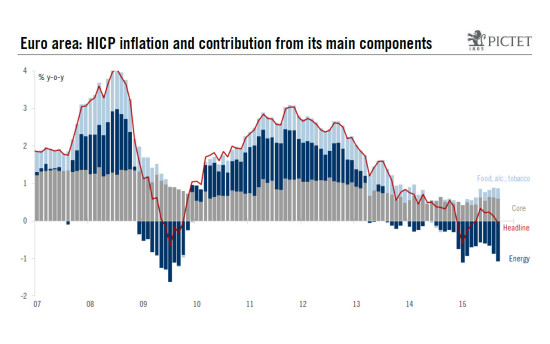

The ‘flash’ estimate of euro area Harmonised Index of Consumer Prices (HICP) confirmed what most economists, including at the European Central Bank (ECB), were expecting after the renewed fall in commodity prices over the summer, namely that inflation turned negative again in September. Having reached a trough at -0.6% y-o-y in January 2015, euro area inflation had risen to +0.3% in May before a renewed drop in commodity prices pushed it down again. As shown in the chart below, this latest bout of disinflation is almost entirely down to energy.

Euro area headline HICP inflation fell back to -0.1% y-o-y in September (from +0.1% in August), although at -0.06% without the rounding, the figure was somewhat less negative than feared considering the available information from other countries. Indeed, the preliminary figures published yesterday and this morning showed HICP inflation falling sharply in Spain (from -0.5% to -1.2% y-o-y in September, well below expectations) and to a lesser extent in Germany (from +0.1% to -0.2% y-o-y) and Italy (from +0.4% to +0.2% y-o-y). Belgium was a notable exception, with inflation rising to 1.1% in September, from 0.9% in August.

Based on the Eurostat report for September, details continue to look stronger than the headline numbers. Core inflation (HICP excluding energy, food, alcohol and tobacco) remained unchanged, at +0.9% y-o-y in September.

In particular, services inflation rose to 1.3%, its highest in over a year. However, non-energy industrial goods inflation slowed for the second consecutive month, suggesting that the (lagged) positive impact of earlier euro depreciation might already be decreasing.

From the perspective of the ECB, the problem remains the same as before. Slightly negative HICP figures do not qualify as deflation, and positive base effects should push euro area inflation higher at the turn of the year, barring a further collapse in oil prices. Answering a question during the last ECB policy meeting on 3 September, Mario Draghi said: “We may see negative numbers of inflation in the coming months. Is that deflation? The Governing Council tends to think that these are transitory effects, mostly due to oil price effects.” This should remain the official message after today’s inflation figures. Low inflation, meanwhile, continues to support households’ purchasing power, which has already translated into stronger private consumption.

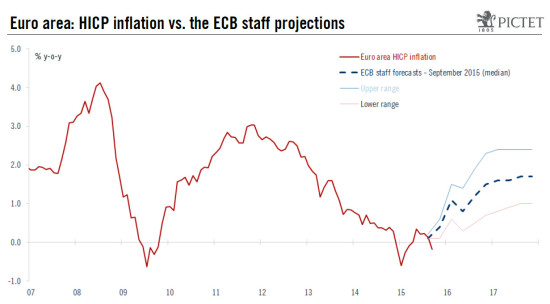

However, risks remain skewed to the downside in terms of the medium-term outlook for price stability, hence the ECB’s explicit dovish bias and the rising likelihood of fresh action. First, the negative drag from energy will lower the whole inflation profile, with ECB staff projections again at risk of being downgraded in December (see chart below). The median HICP projection was projected to be 1.7% in 2017, which is below, but not very close to 2% as per the official target. The recent appreciation in the trade-weighted euro will not help either.

Second, the longer the euro area faces such an environment of subdued inflation, the bigger the risk to inflation expectations. Market-based inflation expectations have been dragged down by the rout in commodity prices (a common pattern across developed countries), with the infamous 5y5y inflation swap rate down below 1.60%, close to levels not seen since the ECB announced its expanded asset purchase programme in January.

For those reasons, additional monetary easing by the ECB remains likely by year-end, probably in the form of an expansion in the duration of the QE programme (beyond September 2016), at least initially. To avoid such a decision, the ECB would need to see both a significant easing in euro area financial conditions (including a weaker euro and a rebound in equities) as well as an improvement in the outlook for global growth in the coming months (including in China).