We are leaving unchanged our euro area real GDP growth forecast of 1.5% for 2015 as a whole. In the euro area, industrial production (excluding construction) dropped by 0.5% m-o-m in August, in line with consensus expectations (0.5%). The July figure was revised marginally up by 0.2 percentage points to 0.8% m-o-m. However, despite August’s decrease, industry is still likely to have fared better in Q3 (+0.3% q-o-q for July-August as a whole) than it did in Q2, when production fell by 0.2% q-o-q. Mixed figures across countries In Germany, industrial production 1) fell by 1.1% m-o-m in August, much lower than consensus expectations (+0.2%) and completely reversing July’s increase. This echoed disappointing factory orders and trade data. However, August’s drop in production could have been magnified by calendar effects related to the timing of school holidays and might be corrected in September. Beyond monthly volatility, the latest German data (orders, manufacturing PMI and ifo manufacturing expectations) suggest that subdued external activity is having an impact on German industry. Despite the August drop, production remained broadly stable in July-August as a whole relative to the Q2 average. In France, by contrast, industrial production surprised on the upside, increasing by 1.6% m-o-m (expected: +0.6%).

Topics:

Nadia Gharbi considers the following as important: Macroview, Uncategorized

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

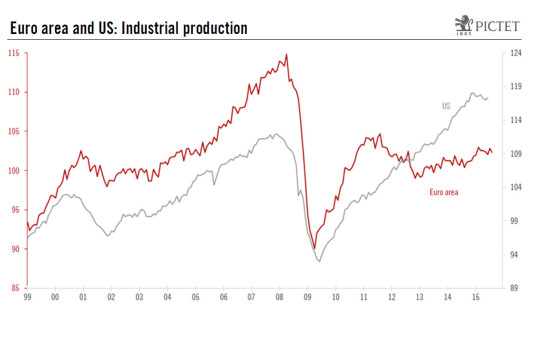

We are leaving unchanged our euro area real GDP growth forecast of 1.5% for 2015 as a whole.

In the euro area, industrial production (excluding construction) dropped by 0.5% m-o-m in August, in line with consensus expectations (0.5%). The July figure was revised marginally up by 0.2 percentage points to 0.8% m-o-m. However, despite August’s decrease, industry is still likely to have fared better in Q3 (+0.3% q-o-q for July-August as a whole) than it did in Q2, when production fell by 0.2% q-o-q.

Mixed figures across countries

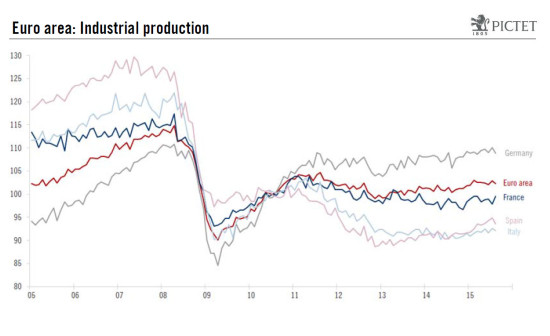

In Germany, industrial production 1) fell by 1.1% m-o-m in August, much lower than consensus expectations (+0.2%) and completely reversing July’s increase. This echoed disappointing factory orders and trade data. However, August’s drop in production could have been magnified by calendar effects related to the timing of school holidays and might be corrected in September.

Beyond monthly volatility, the latest German data (orders, manufacturing PMI and ifo manufacturing expectations) suggest that subdued external activity is having an impact on German industry.

Despite the August drop, production remained broadly stable in July-August as a whole relative to the Q2 average.

In France, by contrast, industrial production surprised on the upside, increasing by 1.6% m-o-m (expected: +0.6%). Looking at the quarterly dynamic, French industrial production accelerated in Q3 (taking July-August) compared with Q2 (from -0.6% q-o-q to 0.0% q-o-q). This is consistent with a rebound in real GDP growth in Q3 after stagnating in Q2.

In Italy, industrial production was down by 0.5% m-o-m in August (expected: -0.3%). The quarterly dynamic remained almost the same as in Q2, suggesting that the subdued recovery remains on track.

In Spain, industrial production dropped by 1.4% m-o-m (expected: -0.4%), the biggest decline since April 2013. Despite the August drop, on average (taking July and August) output production was up by 0.5% q-o-q compared with the Q2 average. This is lower than what was recorded in Q1 and Q2, in line with other economic indicators suggesting a slowdown in economic activity in Q3, after high real GDP growth in H1. Nevertheless, among the four biggest economies, Spain is likely to remain the outperformer for this year, with real GDP growth close to 3% for 2015 as a whole.

Domestic demand and the ECB should help

Despite monthly volatility and a weaker euro over past year or so, the industrial sector is still struggling to gain momentum and will likely not be a major driver of the euro area recovery.

Today’s industrial production data reflect a weaker external environment, in particular in Germany, where industry is highly exposed to external demand. Nevertheless, strong domestic demand fuelled by credit recovery, low inflation and improving labour market conditions, should help to compensate for any renewed weakness in emerging countries’ growth.

Moreover, further stimulus by the European Central Bank (ECB) could also prove supportive if it drives down the euro, making European goods more competitive. As a result, we have left unchanged our euro area real GDP growth forecast of 1.5% for 2015 as a whole.