Bild: Pixabay Der Bundesrat hat einen Bericht zu den rechtlichen Rahmenbedingungen für Blockchain und Distributed-Ledger-Technologie im Finanzsektor verabschiedet. Demnach sei der bestehende Rechtsrahmen weitgehend gut geeignet für den Umgang mit neuen Technologien. Der Distributed- Ledger- und Blockchain-Technologie wird sowohl im Finanzsektor als auch in anderen Wirtschaftssektoren ein...

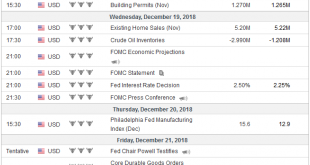

Read More »FX Weekly Preview: FOMC Dominates Week Ahead Calendar

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise. The famous dot plot of the Summary of Economic Projections has long shown that...

Read More »Sometimes Bad News Is Just Right

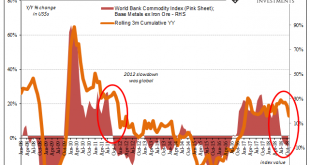

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019). We won’t know the full details...

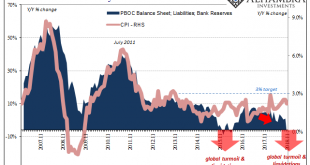

Read More »China Going Back To 2011

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of...

Read More »Positionierungskampf im Tokenbereich lanciert

Bild: Unsplash Die Mitwirkung von Swisscom im Bereich der Tokens rückt diese in den Fokus. Tokens ermöglichen zwar Chancen wie eine neue Handhabung von "non-bankable Assets", bedürfen laut Andreas Dietrich von der HSLU aber professioneller Marktteilnehmer. Unter Tokenisierung wird die Vertretung von Werten und Funktionen durch einen sogenannten digitalen Token verstanden. Die Transaktionen der...

Read More »Crypto Fund ernennt neuen Verwaltungsratspräsidenten und neuen COO

Dr. Philipp Cottier, neuer Präsident des Verwaltungsrats Crypto Fund, der erste von der FINMA nach dem schweizerischen Kollektivanlagengesetz zugelassene Vermögensverwalter für Crypto Assets, gibt eine Rochade in seiner Führung bekannt. Crypto Fund, eine Tochtergesellschaft von Crypto Finance, hat Philipp Cottier zum Präsidenten des Verwaltungsrates und Bernadette Leuzinger zum Chief Operating...

Read More »Die Heuchelei der G-20

Nicht nur die USA und China errichten Handelshindernisse: Treffen zwischen den Delegationen beider Länder am G-20-Gipfel in Buenos Aires (1. Dezember 2018). Foto: Pablo Martinez (Keystone) Erneut hat der Handelskrieg zwischen den USA und China in der letzten Woche die Weltpolitik und die Kapitalmärkte in Atem gehalten. Beim Treffen der G-20-Staaten wurde zwar ein vorübergehender Waffenstillstand vereinbart. Glaubwürdig erschien das nicht: Die Sorgen vor einer nächsten Eskalationsstufe...

Read More »Monthly Macro Monitor – December 2018 (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – August Monthly Macro Monitor – November 2018 Monthly Macro Monitor – October 2018 Monthly Macro Monitor – August 2018 Monthly Macro...

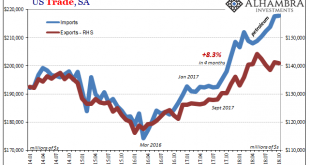

Read More »Converging Views Only Starts With Fed ‘Pause’

There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise. That’s how these things go. Global synchronized growth, decoupling,...

Read More »Neu lanciertes Fintech-Angebot will Vermögensverwaltung vereinfachen

Bild: Unsplash Contovista, ein Anbieter von Data-driven Banking, und True Wealth, ein digitaler Vermögensverwalter, schliessen eine strategische Partnerschaft ab, um das Potenzial einer Verbindung von Robo Advisors mit Machine Learning auszuschöpfen. Der kombinierte Einsatz der beiden Fintech-Bankangebote will darauf abzielen, das Verständnis von Bankkunden für die eigenen Finanzen zu schärfen...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org