The Federal Reserve’s confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would,...

Read More »The Future is Already Here–It is Just Not Evenly Distributed

When William Gibson would say that “the future is already here-it is just not evenly distributed,” he was referring to how wealth and location determine one’s access to technological advances (the future). Yet it equally can apply to the US-Chinese relationship. In a recent article in the Wall Street Journal, former Treasury Secretary Paulson seemed to express the views of many. If neither the US nor China changes its...

Read More »FX Weekly Preview: Stocks, Trade, and the Fed in the Week Ahead

Last month’s downdraft in equities spooked investors. The fear that is often expressed is that the end of the business cycle may coincide with the end of a credit cycle and a return to 2008-2009 crisis. It seems like an increasing number of economists agree with the sentiment expressed by President Trump that the Fed is too aggressive. Of course, they do not think the president should comment on Fed policy, but they...

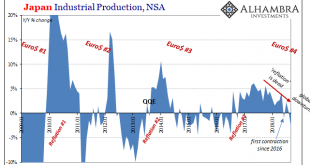

Read More »China Now Japan; China and Japan

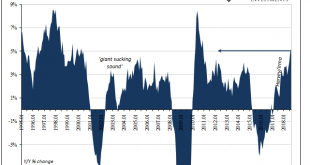

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc. It does seem as if someone flipped a switch...

Read More »Bloomberg Interview with Jeffrey Snider

Why Eurodollars Might Be Key to the Market Sell-Off (Podcast) There’s a huge market out there that doesn’t get much attention: Eurodollars. These have nothing to do with the euro-dollar exchange rate. Instead, eurodollars are U.S. dollar-denominated deposits at foreign banks and overseas branches of American banks. They’re effectively a source of dollars that operates outside the control of the U.S., and have at...

Read More »Another ‘Highest In Ten Years’

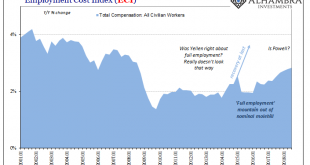

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers. Nowadays, the intent is reversed; businesses will try to keep core workers by keeping pay rates as steady as possible while instead shedding...

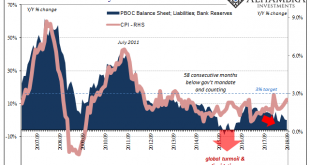

Read More »Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm. The Chinese had a pork problem in...

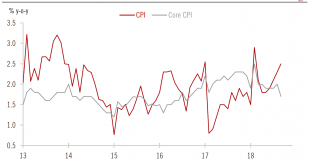

Read More »Inflation Environment remains Benign in China

Inflation is unlikely to be a constraint on central bank’s policy. The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August. Looking forward, we see some moderate upward...

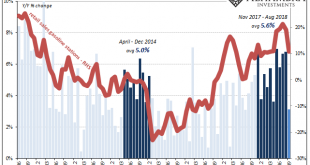

Read More »Just The One More Boom Month For IP

The calendar last month hadn’t yet run out on US Industrial Production as it had for US Retail Sales. The hurricane interruption of 2017 for industry unlike consumer spending extended into last September. Therefore, the base comparison for 2018 is against that artificial low. As such, US IP rose by 5.1% year-over-year last month. That’s the largest gain since 2010. While that may be, over the last five months American...

Read More »Now Back To Our Regularly Scheduled Economy

The clock really was ticking on this so-called economic boom. A product in many economic accounts of Keynesian-type fantasy, the destructive effects of last year’s hurricanes in sharp contrast to this year’s (which haven’t yet registered a direct hit on a major metropolitan area or areas, as was the case with Harvey and Irma) meant both a temporary rebound birthed by rebuilding as well as an expiration date for those...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org