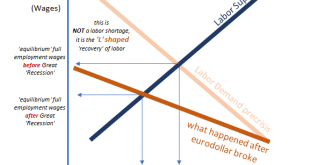

Now that the slowdown is being absorbed and even talked about openly, it will require a period of heavy CYA. This part is, or at least it has been at each of the past downturns, quite easy for its practitioners. It was all so “unexpected”, you see. Nobody could have seen it coming, therefore it just showed up out of nowhere unpredictably spoiling the heretofore unbreakable, incorruptible boom everyone was talking about...

Read More »Klarheit im Nachhaltigkeits-Dschungel

Bild: Unsplash Zahlreiche Anlagevehikel gelten heute als nachhaltig. Dies erschwert die Orientierung in diesem Dschungel der Definitionen. Sacha Bernasconi von Syz AM zeigt auf, welche Nachhaltigkeitsbereiche für Investoren interessant sind. Eine Antwort auf die Frage nach der Definition von Nachhaltigkeit liefert die Naturwissenschaft. Verantwortlich für den Klimawandel und den Temperaturanstieg...

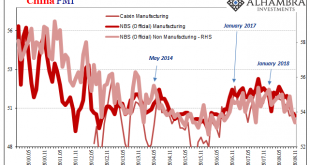

Read More »China’s Global Slump Draws Closer

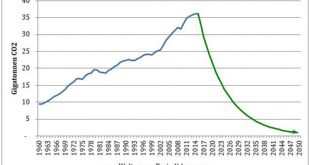

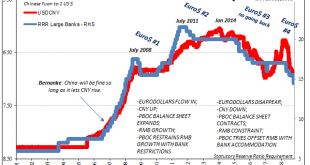

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity. Late 2015 was not a fun time in China. The idea of economic...

Read More »Cool Video: Santa Claus Rally and Trade

I was on Fox Business today. Stuart Varney introduced me by asking me about my forecast for a Santa Claus rally–a year-end recovery in equities. From a technical perspective, I liked the fact that the S&P 500 successfully retested last month’s lows last week. I liked that the price action made last Friday’s price action into an island bottom, with a gap lower opening followed by Monday’s gap higher opening. In terms...

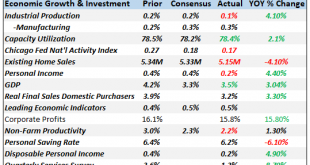

Read More »Monthly Macro Monitor – November 2018

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

Read More »FX Weekly Preview: Powell and Draghi, Xi and Trump

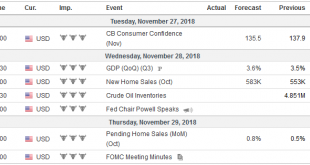

The investment climate will be shaped by three events next week. ECB President Draghi’s testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and...

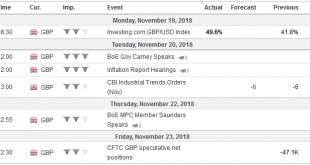

Read More »FX Weekly Preview: Unfinished Business

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but “what we know that just ain’t so.” Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC’s efforts to enforce the agreed-upon...

Read More »Der Ölpreis als Wirtschaftsseismograf

Im freien Fall: Zwei Händler beim Ölpreissturz an der Börse in New York. (Foto: Daniel Barry/Getty Images) Ein Fass Rohöl der Qualität Brent kostet heute 65 US-Dollar und damit fast gleich viel wie am ersten Handelstag 2018. Zwischen diesen beiden Terminen vollführte der Ölpreis allerdings eine wahre Berg-und-Tal-Fahrt. Kein anderer wirtschaftlicher Indikator spiegelt so unmittelbar die Hoffnungen und Ängste, welche dieses Jahr sowohl Anleger als auch Wirtschaftsakteure umtreiben. Auch...

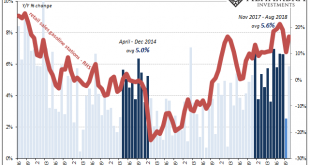

Read More »Retail Sales Marked By Revisions

Retail sales rebounded 0.8% in October 2018 from September 2018, but it’s the downward revisions to the prior months that are cause for attention. The estimates for particularly September were moved sharply lower. Total retail sales two months ago had been figured last month at $485.8 billion (unadjusted) originally, but are now believed to have been just $483.0 billion. The difference takes the growth rate underneath...

Read More »China’s Pooh Lesson

It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy. The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.Auto sales last month were off 12% from a year earlier to 2.38 million, the government-backed China Association of Automobile Manufacturers said...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org