To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector. Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the...

Read More »FX Daily, June 19: Still Patient?

Swiss Franc The Euro has fallen by 0.21% at 1.1169 EUR/CHF and USD/CHF, June 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk-taking was bolstered by the dramatic shift in Draghi’s rhetoric less than two weeks after the ECB meeting and a Trump’s tweet announcing that there was going to be an “extended” meeting between him and Xi at the G20 meeting and that...

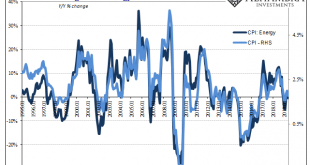

Read More »When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were). If you spend $1,000 a month on food for your family, and food prices rise 6% generally...

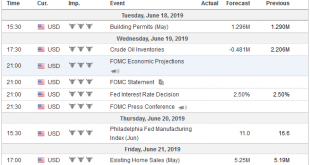

Read More »FX Weekly Preview: FOMC, EMU PMI, and Pre-G20 Positioning: Crossroads and Crosswinds

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last...

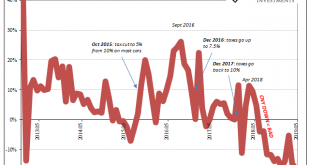

Read More »Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each. The US labor market is a foundation of non-inflationary sand, and China’s “stimulus” is...

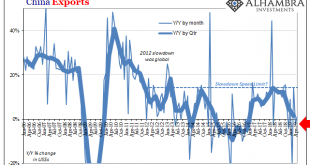

Read More »Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016. Base metal prices (excluding iron) also continue to register sharp reductions. Down 16% on average last month,...

Read More »FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Swiss Franc The Euro has risen by 0.08% at 1.125 EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng’s nearly 1.9% decline was...

Read More »Irredeemable Currency Is a Roach Motel, Report 9 June

In what has become a four-part series, we are looking at the monetary science of China’s potential strategy to nuke the Treasury bond market. In Part I, we gave a list of reasons why selling dollars would hurt China. In Part II we showed that interest rates, being that the dollar is irredeemable, are not subject to bond vigilantes. In Part III, we took on the Quantity Theory of Money head-on, and showed the...

Read More »All Of US Trade, Both Ways, And Much, Much More Than The Past Few Months

The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied. That’s not...

Read More »Janus Powell

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.” Now that the Fed is paused, it’s been these same markets increasingly projecting not just a rate cut or two...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org