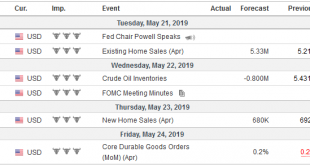

Swiss Franc The Euro has risen by 0.12% at 1.1275 EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped...

Read More »China’s Nuclear Option to Sell US Treasurys, Report 19 May

There is a drumbeat pounding on a monetary issue, which is now rising into a crescendo. The issue is: China might sell its holdings of Treasury bonds—well over $1 trillion—and crash the Treasury bond market. Since the interest rate is inverse to the bond price, a crash of the price would be a skyrocket of the rate. The US government would face spiraling costs of servicing its debt, and quickly collapse into bankruptcy....

Read More »Japan’s Surprise Positive Is A Huge Minus

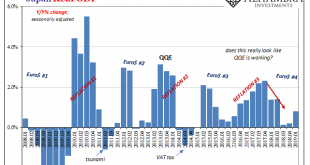

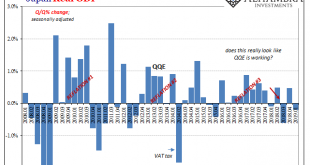

Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five. Japan Real GDP,...

Read More »FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China’s own willingness to flaunt the international rules are defeating the strategy. President Trump may suggest that China would prefer to negotiate with his main Democrat rival 18-months away from the election, by both Pelosi and...

Read More »Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough. After the market slide through Christmas Eve, everything...

Read More »Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so...

Read More »FX Weekly Preview: Trade, the Dollar, and the Week Ahead

China is isolated on trade. No one supports its trade practices. The idea that China was going to “naturally” evolve to be more like the US, or Europe for that matter, was always fanciful and naive. The emergence of China, as Napoleon warned two centuries ago, would make the world shake. US administrations adopted a multi-prong strategy of managing the rise of China. On economic issues, the focus was on working through...

Read More »Trade Wars Have Arrived, But It’s Trade Winter That Hurts

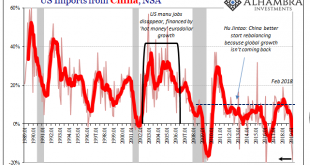

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year. In the entire series which goes back to 1988, there are only three...

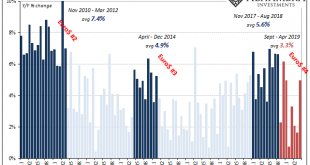

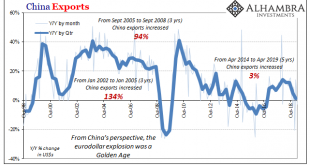

Read More »China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging. Even Japan was looking forward to a substantial QQE-based pickup – after the...

Read More »FX Daily, May 09: De-Risking as US-China Trade Talks Resume

Swiss Franc The Euro has fallen by 0.25% at 1.1389 EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org