The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike. The aftermath of that crisis, particularly the...

Read More »FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Swiss Franc The Euro has fallen by 0.17% at 1.0966 EUR/CHF and USD/CHF, July 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow’s ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and...

Read More »Monthly Macro Monitor: We’re Not There Yet

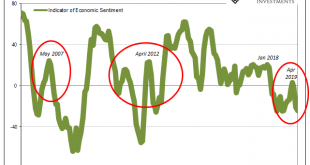

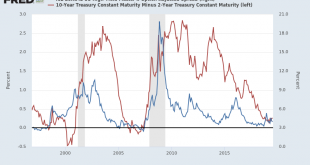

It’s been a slow turnin’ From the inside out A slow turnin’ But you come about Slow learnin’ But you learn to sway A slow turnin’ baby Not fade away Now I’m in my car I got the radio on I’m yellin’ at the kids in the back ‘Cause they’re bangin’ like Charlie Watts Slow Turning by John Hiatt “How did you go bankrupt?” Bill asked. “Two ways”, Mike said. “Gradually and then suddenly.” The Sun Also Rises, By Ernest...

Read More »Globally Synchronized, After All

For there to be a second half rebound, there has to be some established baseline growth. Whatever might have happened, if it was due to “transitory” factors temporarily interrupting the economic track then once those dissipate the economy easily gets back on track because the track itself was never bothered. More and more, though, it appears at least elsewhere that the track was bothered. Whether China, Singapore, or...

Read More »China: Q2 growth lowest in decades

Downward pressure on growth persists amid ongoing trade tensions. Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades. The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1. In comparison, growth in the secondary sector (mainly manufacturing) declined to 5.6% y-o-y, from...

Read More »FX Daily, July 15: Marking Time on Monday

Swiss Franc The Euro has fallen by 0.10% at 1.108 EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed...

Read More »FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell’s testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB’s move is more debatable, an adjustment at the July 25 meeting appears to have increased. While a...

Read More »As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens. Testifying before Congress today, in prepared...

Read More »FX Daily, July 12: Greenback Limps into the Weekend

Swiss Franc The Euro has fallen by 0.48% at 1.1086 EUR/CHF and USD/CHF, July 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in...

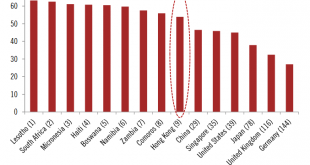

Read More »Hong Kong unrest

The extradition bill is ‘dead’ but political turmoil is not over yet. Since early June, a series of large-scale demonstrations took place in Hong Kong in protest of proposed legislation that would allow extradition of criminal suspects to certain jurisdictions, including mainland China. The proposed bill was triggered by the case of a Hong Kong man who allegedly murdered his girlfriend in Taiwan but could not be sent...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org