[embedded content] Alhambra Investments CEO reviews economic charts from the past month and his opinion of what they mean. Related posts: Monthly Macro Monitor – March 2019 (VIDEO) Monthly Macro Monitor – February (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Chart Review – April 2019 (VIDEO) Monthly Macro Monitor – January...

Read More »FX Daily, June 05: Dollar Remains on Back Foot

Swiss Franc The Euro has fallen by 0.09% at 1.115 EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Federal Reserve’s patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has...

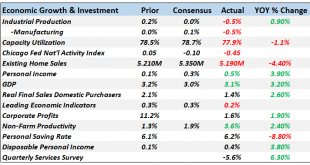

Read More »Monthly Macro Monitor: Economic Reports

Is recession coming? Well, yeah, of course, it is but whether it is now, six months from now or 2 years from now or even longer is impossible to say right now. Our Jeff Snider has been dutifully documenting all the negativity reflected in the bond and money markets and he is certainly right that things are not moving in the right direction. But moving in the wrong direction, even deeply, as we discovered in 2015/16,...

Read More »Dollar Supply Creates Dollar Demand, Report 2 June

We have been discussing the impossibility of China nuking the Treasury bond market. We covered a list of challenges China would face. Then last week we showed that there cannot be such a thing as a bond vigilante in an irredeemable currency. Now we want to explore a different path to the same conclusion that China cannot nuke the Treasury bond market. To review something we have said many times, the dollar is borrowed....

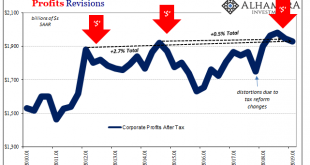

Read More »More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message. Accompanying this first revision was the first set of estimates for corporate profits. For the second straight...

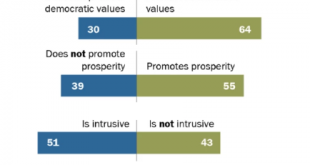

Read More »Europe Comes Apart, And That’s Before #4

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

Read More »The Crime of ‘33, Report 27 May

Last week, we wrote about the impossibility of China nuking the Treasury bond market. Really, this is not about China but mostly about the nature of the dollar and the structure of the monetary system. We showed that there are a whole host of problems with the idea of selling a trillion dollars of Treasurys: Yuan holders are selling yuan to buy dollars, PBOC can’t squander its dollar reserves If it doesn’t buy another...

Read More »FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces–trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies. ...

Read More »FX Daily, May 22: Sterling Can’t Get Out of Its Own Way

Swiss Franc The Euro has fallen by 0.24% at 1.1253 EUR/CHF and USD/CHF, May 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is a nervous calm in the capital markets. Yesterday’s rally in US shares failed to excite global investors. China, Hong Kong, and Taiwan markets fell, while Japan was mixed. Foreign investors continued to sell Korean shares, but the...

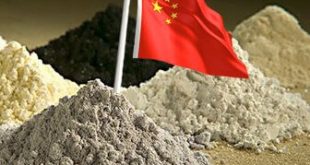

Read More »Rare Earths may Provide Leverage

Many American observers argue that the trade imbalance gives the US an advantage in a trade war with China. The US enjoys escalation dominance in tariffs because Chinese imports of US goods are so much less than the US imports of Chinese goods. However, the focus on quantities may be misleading. For example, the ability to find substitutes for the more expensive tariff imports could be a critical part of the evaluation....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org