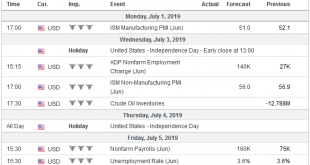

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing. United States The jobs report trumps the PMI/ISM data and suggests...

Read More »FX Daily, July 05: Dollar is Bid Ahead of Jobs Report

Swiss Franc The Euro has risen by 0.10% at 1.1126 EUR/CHF and USD/CHF, July 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dovish response to news that Lagarde was nominated to replace Draghi was extended by the dismal German factory order report that has pushed the euro to new two-week lows and kept bond yields near record lows. The focus ahead of the...

Read More »FX Weekly Preview: Macro Update: Melodrama Subsides but Capriciousness Remains

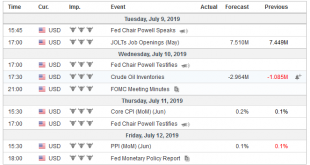

Since President Trump declared the end of the tariff truce with China in early May, an important focus for investors was the G20 meeting. It was only as it drew near was a meeting between the two heads of state confirmed. What was billed as an extraordinary meeting reportedly lasted less than 90 minutes, and the results were broadly as expected. The press quotes US officials confirming that the talks are “back on track”...

Read More »Gold is the secret knowledge of the financial universe

Interview with Chris Powell Every seasoned gold investor and every student of monetary history has likely stumbled upon various theories about institutional manipulation of the gold market. While it is true that rarely is there smoke without fire, it is still important to approach this matter rationally and form opinions based on sound evidence and solid research. This is why I have personally been following the work of...

Read More »Gold is the secret knowledge of the financial universe

Interview with Chris Powell Every seasoned gold investor and every student of monetary history has likely stumbled upon various theories about institutional manipulation of the gold market. While it is true that rarely is there smoke without fire, it is still important to approach this matter rationally and form opinions based on sound evidence and solid research. This is why I have personally been following the work of the Gold Anti-Trust Action Committee Inc (GATA) for quite some time....

Read More »FX Daily, June 26: Biggest Drop in the S&P 500 in June Weighs on Global Equities

Swiss Franc The Euro has risen by 0.06% at 1.109 EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 fell nearly one percent yesterday, its steepest fall this month and this was a weight on Asia Pacific and European activity. Most markets have eased, though not as much as the US did. Hong Kong, India, and Singapore were...

Read More »FX Daily, June 25: Heightened Political Risks Weigh on Sentiment

Swiss Franc The Euro has risen by 0.10% at 1.1088 EUR/CHF and USD/CHF, June 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is far from clear that the US sanctions against nine Iranian officials, with the foreign minister to be added later brings negotiations any closer. At the same time, US officials trying to keep expectations low for the weekend meeting...

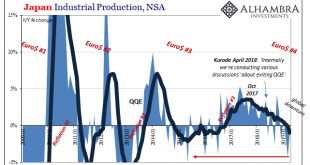

Read More »Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best. I wrote in April last year how Japanese Industrial...

Read More »FX Daily, June 24: Slow Start to Important Week

Swiss Franc The Euro has risen by 0.12% at 1.1099 EUR/CHF and USD/CHF, June 24(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Trump-Xi meeting at the G20 this coming weekend and heightened tensions in the Gulf, with the US set to impose new sanctions on Iran’s crippled economy are keeping investors on edge. News the opposition won the re-do of the...

Read More »FX Daily, June 21: Markets Pause Ahead of the Weekend

Swiss Franc The Euro has risen by 0.30% at 1.1115 EUR/CHF and USD/CHF, June 21(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are trading quietly ahead of the weekend. Equity markets are mostly narrowly mixed. Chinese shares extended their run, and the major benchmarks were up 4%+ on the week. Japan, Australia, South Korea, and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org